We have covered the global supply chain crisis on a number of occasions over the past couple of years, and on each occasion there has been a broad consensus around the view that things will see a marked improvement ‘next year’. Regrettably, that appears to be the case once again as a few days of speaking to vendors, distributors and consultants confirms that many of the shortages – especially around chip sets – are continuing to affect manufacturing and project delivery.

Toni Chalk is owner and managing director of StriveAV, a leading systems integrator working across the UK and internationally. Supply chain issues, she says, continue to represent “a massive issue”, especially in terms of project design and delivery. “For instance, you might design a project using X, Y and Z products, but when you go to the manufacturer you are likely to find that they either don’t have a lead time – a lot of people can’t give you dates now – or it could be 8 or 12 weeks, or even longer,” she says.

Inevitably, this has meant significant challenges with regard to project scheduling and delivery. “One of the results has been a trend towards ‘part delivery’ of projects, because we have had no choice,” says Chalk. “We recently worked on a university project that took nearly a year because we were waiting for various bits of kit. So it can be very frustrating.”

Inevitably, this has meant significant challenges with regard to project scheduling and delivery. “One of the results has been a trend towards ‘part delivery’ of projects, because we have had no choice,” says Chalk. “We recently worked on a university project that took nearly a year because we were waiting for various bits of kit. So it can be very frustrating.”

Before looking at some of the ways in which vendors and SIs have adapted to these circumstances, it’s important to note that there are some signs of improvement. In response to the most recent Installation piece about supply chains, Jennifer Chonillo from Automoblog got in touch to provide some insight from their recent coverage of component shortages in the automotive sector, which draws on data from the 2022 Global Semiconductor Industry Survey.

According to that survey, 45% of respondents believe that there will be a surplus of microprocessors in the period between 2024 and 2026 – indicating that “relief is coming” in this area. As well as overall supply problems lessening, the situation is also being assisted by some manufacturers deciding to remove features from their models, thereby reducing their reliance on microprocessors.

GEOPOLITICAL FACTORS

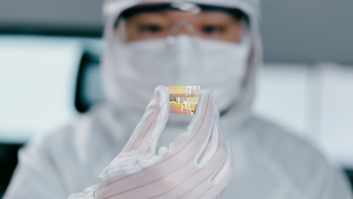

Nonetheless, there is little scope for complacency given that many of the geopolitical factors revealed to have had a big impact on the availability of microprocessors – including Russia’s invasion of Ukraine and escalating trade tensions between the US and China – are still very much in play. Looking ahead, you also don’t have to look far to find plenty of industry observers who are concerned about what impact any military action by China in Taiwan might have – Taiwan being one of the world’s most prolific manufacturers of semiconductors.

The impact of – and response to – the supply chain issues cited by Brad Hintze, executive vice-president of global marketing at Crestron, is not untypical. As he remarks, it has had an impact. “For instance, our relationship and partnership with our channel changed,” he says. “We’re now working together to design and order much earlier in the process, and this gives everybody better visibility on what’s to come. Our relationship with suppliers also evolved, and we continue to be in constant contact to discuss supply and demand – and urgency.”

Crestron is also engineering many of its products with alternative designs at a component level. As a result, says Hintze, the company now has the flexibility to choose which “layout” it uses when manufacturing, based on the availability of the components. “Of course, the quality and user experience remain very high,” he adds. “We’ve also built more burst capacity into our manufacturing process. Being able to produce more products in a short period of time, responding to short-term needs, gives us further resilience during spikes in interest.”

Crestron is also engineering many of its products with alternative designs at a component level. As a result, says Hintze, the company now has the flexibility to choose which “layout” it uses when manufacturing, based on the availability of the components. “Of course, the quality and user experience remain very high,” he adds. “We’ve also built more burst capacity into our manufacturing process. Being able to produce more products in a short period of time, responding to short-term needs, gives us further resilience during spikes in interest.”

In addition, the company has invested more in online tools to communicate with its channel and provide visibility on lead times. Examples include the Pro Portal, which was developed to give pros all the tools and information they need to self-service their accounts. Notes Hintze: “We accelerated development for those kinds of tools to give more proactive capabilities to our channel.”

MANUFACTURING CAPACITY

Ross Noonan, technical sales & marketing manager at LED display solutions provider The LED Studio, indicates that the company’s self-reliant manufacturing capacity in China has been a major asset during the last few years. “Our ability to do everything on-site means we are in control of the materials and can be more flexible in terms of looking for alternatives when there are shortages in the market,” he says. “We have also looked at reducing the number of components in our products; for example with our latest display cabinet design [the V1 Architecture for LED displays debuted at ISE 2023] there is only a need for one power supply when historically there would have been four.”

Significantly, the company is also taking steps to minimise the impact of possible geopolitical developments impacting its China base by creating a second factory that is now “almost open to manufacturing.” Whilst he was not in a position to confirm the location at the time of interview, Noonan notes that the relationship between Taiwan and China has “raised concerns across the globe, really, so as a manufacturer we have to look at alternative ways of fulfilling [our requirements]. So we are exploring manufacturing outside of China”.

Although the supply chain crisis has undoubtedly presented its fair share of challenges, Noonan indicates that – along with “volatile energy costs” and Covid-19 – it has also precipitated a welcome wave of creativity throughout the industry. “I do think all these issues have got the tech industry to look inwardly as to how it can be greener and more sustainable,” he says.“In the same way that the car industry has thought carefully about how to make cars more efficient and less polluting.”

MORE ACCEPTING

Supply-related delays are inevitably frustrating to various stakeholders in a given project. But one saving grace of the last few years seems to be an increased awareness of the difficulties that individual organisations may be confronting at any one time. In particular, Chalk feels that the pandemic served to bring about a change of mindset.

“Covid massively affected the world and I think that customers are aware of how this has impacted technology and supply chains,” she says. “As a result, customers seem to be more accepting of some delays due to supply chain issues, to a point. [Previously] if I had told a college or university that I couldn’t give them a delivery date, they would have been very frustrated! But today, they understand that it is just how the world is at the moment.”

“Covid massively affected the world and I think that customers are aware of how this has impacted technology and supply chains,” she says. “As a result, customers seem to be more accepting of some delays due to supply chain issues, to a point. [Previously] if I had told a college or university that I couldn’t give them a delivery date, they would have been very frustrated! But today, they understand that it is just how the world is at the moment.”

Keeping the lines of communication open between all parties is evidently vital in a period when deadlines are so subject to change. But what of the longer-term outlook for lead times: are more stretched timescales here to stay?

“Yes and no,” responds Hintze. “We have immediate availability for key products, but the business reality is also that in big projects, companies don’t decide which products they want today to have installed tomorrow. They plan ahead, and it’s okay if our dealers and we do the same. In fact, it’s better for our industry if everyone has visibility for future needs – not just for us to manufacture, but also for dealers to give them a better view on their calendar, or to get involved earlier in the project, allowing them to suggest optimisations in the building or design process.”

This systematic approach to visibility can also indicate at an early stage whether an extra supplier is likely to be required. Hintze adds: “It even allows us to come up with alternatives for, say, a shipment of components that is stuck because the Suez Canal is dried out. That being said, the disruptions that we saw over the last two years couldn’t have been avoided by having multiple suppliers as the components disruption happened across the entire industry and had a multitude of reasons.”

DIVERSE SUPPLY

Longer-term, there is a good chance that the diversification of component manufacturing currently taking place around the globe will circumvent another crisis of comparable magnitude. In particular, semiconductor production is set to receive a major boost with a number of facility projects now under construction.

“Traditionally, a lot of component manufacturing was happening in Taiwan and China, and what we’re seeing now is that companies are investing in factories outside,” says Hintze. “Texas Instruments, for example, is building expanded manufacturing facilities in Texas and Utah. The Taiwan Semiconductor Manufacturing Company is also investing in new factories in the US. The European Union is mobilising over €43 billion to make itself more self-sufficient in semiconductors this decade.”

As troublesome as they might have been, the events of the last few years will ultimately usher in a more geo-dispersed component production map – one that had arguably been required for some time.

Last word to Hintze: “Political and environmental factors have always been a consideration, not just for us, but for everyone involved. Experts have been warning about the risks for ages, but this perfect storm of Covid-related restrictions, transportation challenges with the Suez Canal, and geopolitical changes accelerated the need for diversification.”