It was in the late spring of 2020 that it became clear the world was about to confront its worst supply chain crisis for many years. Largely precipitated by the impact on labour and components of the Covid-19 pandemic and related lockdowns, the problem was soon compounded by multiple other factors ranging from the escalating trade war between China and the US, to the forced closure of several major semiconductor plants due to extreme weather or fire. It was, as they say, a ‘perfect storm’.

Of course, the implications for AV manufacturers and service companies were highly imperfect. With those businesses in turn affected by lockdowns and reductions in staffing levels due to illness, it was inevitable that project lead times would grow longer – in some cases, much longer. In a short period, order times of around 18 months became by no means uncommon. So even when the lockdowns did begin to ease first time around, it remained highly challenging for companies to schedule project delivery times.

When the world opened up for the first time in 2021, there were plenty of predictions that the supply chain issues could be largely resolved within a year or so. But the optimism did not last long: the arrival of the Omicron variant heightened the disruption in the short-term, whilst the impact of this year’s Russian invasion of Ukraine has had a profound impact on supply chains across numerous industries.

SOBERING READING

Issued in late May 2022, JP Morgan’s ‘What’s Behind the Global Supply Chain Crisis?’ report makes for sobering reading. In its introduction, the financial services group states: “The Russia-Ukraine conflict, wider geopolitical implications and renewed Covid-19 lockdowns in China have compounded an already bleak global supply chain situation. Existing restrictions imposed on Russia and the potential for further restrictions continue to impact fuel costs, contributing to the wider supply chain crisis. While freight markets have limited direct exposure to Russia and Ukraine, global logistics will have to contend with an increasing number of risk factors, including restrictions to airspace, uncertainty on the future path of consumer demand, and ongoing bottlenecks related to China’s Covid-19 response.”

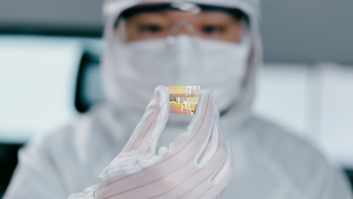

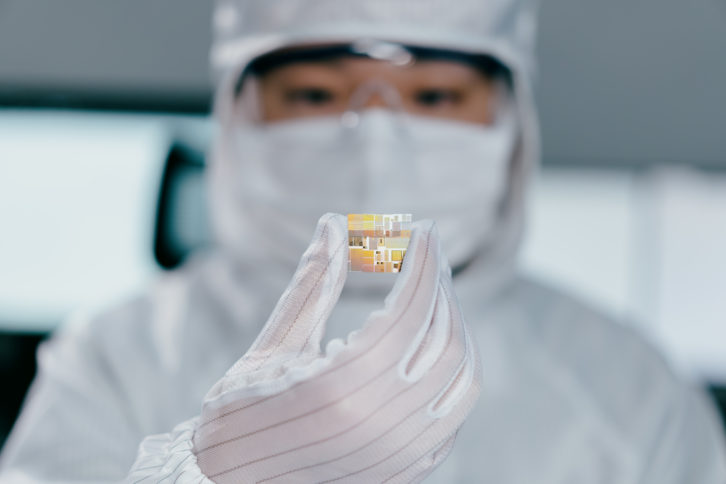

In the UK, the unfolding implications of Brexit constitute another issue that is going nowhere fast. Across Europe as a whole, the prospect of a further wave of Covid-19 is a somewhat unspoken fear as the winter approaches. Meanwhile, the war in Ukraine shows no signs of abating, and there are very justifiable fears of what impact any conflict involving China and Taiwan – one of the world’s most significant producers of semi-conductors – could have in the future.

In the UK, the unfolding implications of Brexit constitute another issue that is going nowhere fast. Across Europe as a whole, the prospect of a further wave of Covid-19 is a somewhat unspoken fear as the winter approaches. Meanwhile, the war in Ukraine shows no signs of abating, and there are very justifiable fears of what impact any conflict involving China and Taiwan – one of the world’s most significant producers of semi-conductors – could have in the future.

In which context it’s some relief to discover that AV companies are continuing to find new ways of operating and sourcing components in order to minimise the inconvenience to customers and the risk to their own businesses. It’s a process that is involving an increasing amount of ‘near-shoring’ – more of which anon – as well as more extensive collaboration.

EXPRESSLY UNANTICIPATED

Speaking earlier this year, Peter Hansen – economic analyst at AV trade organisation AVIXA – highlighted some of the major ongoing problems. “Here’s what we see: manufacturing, shipping and acquiring products is all happening on a much more uneven timeline,” he said. “In some cases, margins are hurt. In others, extra revenue is foregone.”

But Hansen indicated that a sudden increase in orders “compared to spring 2020 when demand for many products evaporated” is an important factor to remember, adding: “Current issues with supply and the chip shortage are lengthening lead times and causing some folks to turn down contracts, but overall businesses are managing the challenge.”

Focusing in particular on the chip shortage, Hansen is not alone in identifying the impact of poor planning by industries such as automotive. “The chip shortage is actually in significant part a product of a lack of foresight,” he explained. “As the economy contracted at the start of the pandemic, car manufacturers – drawing on the experience of the great recession [in 2007-09] – said ‘we know how this goes’ and cut orders of chips in anticipation of reduced demand. But thanks to massive stimulus spending and demand moving away from experiences and towards physical goods, demand for cars actually spiked. Manufacturers ended up scrambling for lots of chips and clearing out the market. There are more contributing factors than just this story, but it illustrates how the chip shortage is something that was expressly unanticipated.”

Nonetheless, there are plenty of developments that could not really have been foreseen. In the US, severe storms in 2021 forced the temporary closure of chip plants owned by Samsung and NXP Semiconductor. In Taiwan, the impact of Covid-19 was compounded by the country’s worst drought in more than 50 years – spelling significant problems for manufacturers requiring large quantities of very pure water to clean their factories and wafers (which are ultimately turned into integrated circuits). Add in fires at two large semiconductor factories in Japan, along with increases in the prices of copper and other raw materials, and it’s not hard to see why the disruption has been so pronounced.

SEVERE IMPACT

Along with automotive, Goldman Sachs cited electronics as one of the most severely impacted industries. Not surprisingly, the dramatic increase in the amount of time people were spending at home was a big factor here, with orders for all kinds of entertainment products soaring. This also meant that some of the most eagerly anticipated consumer products – such as the latest generation of gaming consoles – were subject to delivery delays.

Whilst pro AV has always punched above its weight globally, the industry inevitably had to take its place in the queue as component producers continued to manage a mountain of challenges. And as another year draws to a close, the impact of shortages continues to be felt far and wide – albeit tempered by the resilience and forward-planning of many manufacturers and suppliers.

Whilst pro AV has always punched above its weight globally, the industry inevitably had to take its place in the queue as component producers continued to manage a mountain of challenges. And as another year draws to a close, the impact of shortages continues to be felt far and wide – albeit tempered by the resilience and forward-planning of many manufacturers and suppliers.

Joe Graziano, director of sales entertainment EMEA at Christie, puts the supply chain issues in a broader context. “The current global living cost escalation, component shortages and overhang from the pandemic are proving to be a challenge,” he says. “However, the market has proved extremely resilient and will no doubt take these new global issues within its stride. We’ve seen from the strong performances of AV trade shows – emerging from health measures imposed during the pandemic – that industry demand and interest has returned, perhaps more quickly than many originally feared.”

Lee Dennison, head of client relationships at live event technology solutions provider Creative Technology, points to continuing “delays across the board for technology [used in installations].” Where it might once have been possible to confirm a delivery time of three months, for instance, it’s not uncommon for “lead times to have tripled. But it can be seen as both a good and a bad thing; it is giving other manufacturers a chance to present themselves, and [from a UK perspective] it is hopefully allowing more British-based companies to adapt so they can supply products more easily and quickly. It is definitely the case that [other companies] are stepping up.”

MULTIPLE AREAS

South Africa-based technology supplier, manufacturer and distributor Stage Audio Works is well-placed to observe the shortages’ impact across multiple areas of activity. Nathan Ihlenfeldt, technical director, notes the ongoing rise “in requests for services and our manufacturing”, adding: “South Africa was later opening up [than some other countries], but things are really ramping-up now. That is difficult with the supply chain issues still occurring.”

With a volatile exchange rate also complicating things, Stage Audio Works has nonetheless reaped the benefits of its far-sighted sourcing strategy. “On our side has been the fact that we have a diverse portfolio with a diverse supply chain that allows us to be effective in multiple market sectors,” says Ihlenfeldt. Moreover, the company is continuing to add to its family of solutions, which range from flight cases and bags to loudspeakers: “This is something we are working on, especially with the supply chain issues [ongoing].”

Indeed, an emphasis on diversification – in terms of component sources, product offerings and service portfolios – is increasingly evident in many areas of pro AV. And in a world that seems to be spiralling into ever-greater chaos and uncertainty, it’s an approach that is only likely to become more fundamental to business continuity.

Andrew McKinlay, marketing director of lighting console and media control system manufacturer Avolites, remarks: “The unpredictability of supply, the exponential increase in micro-processor costs, and the discontinuing of product lines with little warning will continue to have a significant impact on technology manufacturing over the mid to long term. Non-reliance on single processor types or brands, multiple processor options for PCBs, and multiple relationships with component suppliers will all be outcomes and changes to the supply chain approach.”

Andrew McKinlay, marketing director of lighting console and media control system manufacturer Avolites, remarks: “The unpredictability of supply, the exponential increase in micro-processor costs, and the discontinuing of product lines with little warning will continue to have a significant impact on technology manufacturing over the mid to long term. Non-reliance on single processor types or brands, multiple processor options for PCBs, and multiple relationships with component suppliers will all be outcomes and changes to the supply chain approach.”

Paul Harris, CEO/CTO of IP product innovator Aurora Multimedia Corp, indicates that greater universality could help minimise the impact of any future global events of this magnitude. “More standards and diversifying product brand offerings will [be best protection],” he says. “Standards are the most important as [they] create interoperability, and proprietary systems do not accommodate for that.”

NEAR-SHORING

In broader terms – and this applies to many other areas of manufacturing – it’s likely that there will be a growing emphasis on ‘near-shoring’, in which organisations transfer work to companies that are geographically closer and potentially less expensive. It’s a development that AVIXA has highlighted in its own annual Macro-Economic Trends Analysis (META) reports.

“Manufacturers will want to move production not necessarily in-country, but to a more local, low-cost country,” says Hansen. “For chip manufacturing in particular, countries see this as a borderline national security issue. They don’t want to have to rely on a single foreign country for a certain type of chip. As a result, many countries are supporting massive investments in chip capacity.”

A parallel can be drawn here with the issue of energy security and resilience. Russia’s invasion of Ukraine has left no one in any doubt about the necessity of not being overly reliant on one or two sources of energy. ‘Diversified’ energy policies that include a far greater emphasis on renewables and local sources are now the order of the day. Similarly, ‘supply chain security’ has emerged as a popular industry buzzword, entailing all its associations with proactivity and ensuring that risk is minimised at every stage of the chain.

Country-level chip initiatives will also be beneficial, and Rene Haas – CEO of computer processing giant Arm – is among those to have stressed the urgent need for the UK to develop a microchip strategy. Fortunately, it seems that plenty of other nations have made progress in this area.

Hansen notes: “Many countries are supporting massive investments in chip capacity. The long-term legacy of that will be a much more robust chip manufacturing supply network, with options to source similar products from many more locations.”

Of course, those companies with larger existing reserves of components will have been in a strong position during the past two years – leading to the suggestion that we might see a persistent drift away from the ‘just in time’ manufacturing that has become more prevalent in the last decade. But returning to larger stockpiles heralds its own challenges – not only are customer requirements continuing to change more rapidly, so are the technologies that underpin them, including semiconductors.

Allowing the possibility of some “some bigger trends” away from just-in-time, Hansen points out that “having a big inventory can also cost you. Many companies were burned by inventories in the great recession [of 2007-09]. If you had a big inventory of high-end concert speakers in March 2020, you would have been wasting a lot of scarce funds on storage. As a result, we see shortened and diversified supply chains as likely, but a return to significant warehousing of supplies less so.”

CLOSER COLLABORATION

More rigorous collaboration all along the project chain – from instigation through ordering to delivery and installation – can also help to mitigate the impact of supply problems. Fortunately, there is plentiful evidence that companies in all areas are taking steps to enhance their planning and optimise their communications.

Shaun Marklew, CTO of classroom and office technology company Boxlight, observes: “The key thing is planning and expectations. It is very difficult in an industry where customers who have been used to placing orders and receiving goods in days to expect them to plan and forecast months ahead. The best we can do is communicate with our partners and end-users to expect longer lead times and plan for this by placing orders in advance or forecasting what is required. As manufacturers we can plan for supply issues and longer lead times if we know what will be required.”

Brad Hintze, executive VP marketing at Crestron, comments: “Planning ahead and transparent communication is super-important. Our channel needs to work closely with customers to plan for their product needs as early in the project lifecycle as possible, then place orders so manufacturers know the real demand and can build to meet those needs. Transparently communicating with customers about the timing for delivery […] is also a crucial need for our industry to navigate this together.”

Brad Hintze, executive VP marketing at Crestron, comments: “Planning ahead and transparent communication is super-important. Our channel needs to work closely with customers to plan for their product needs as early in the project lifecycle as possible, then place orders so manufacturers know the real demand and can build to meet those needs. Transparently communicating with customers about the timing for delivery […] is also a crucial need for our industry to navigate this together.”

James King, director of marketing at Martin Audio, suggests: “There may be avenues that could be explored in terms of the emergence of ‘buying groups’ where manufacturers band together with suppliers to provide greater visibility and volume commitments that could potentially mitigate to a degree. However, that is also a fraught exercise to engineer and maintain.”

Whatever happens, the supply chain crisis still has a long way to run and could easily be extended by factors beyond the control of pro AV – or any other industry for that matter. In particular, the need for the industry to safeguard itself against climate change – both in terms of its effects on the industry, and the industry’s effects on climate – has to be at the forefront of manufacturing and supply policy from now on.

With such a heady combination of concerns, the ongoing steps towards building business continuity through diversification, as well as more rigorous planning and risk assessment, are to be applauded.