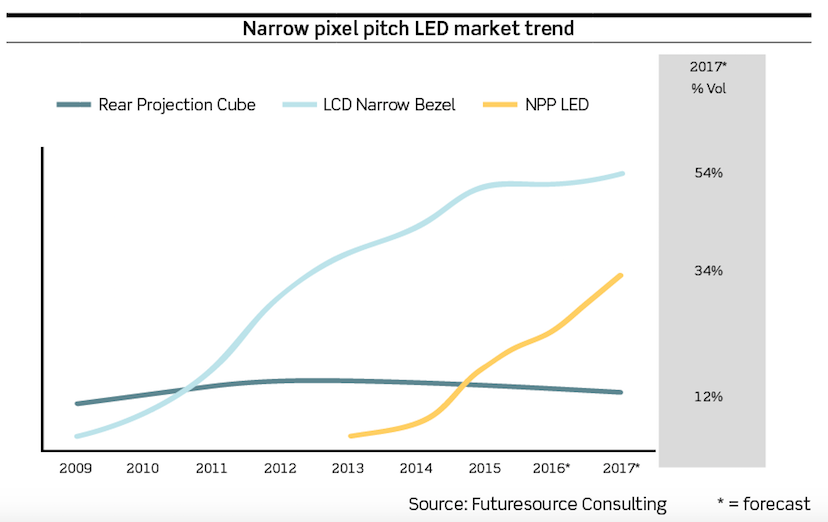

Despite only being launched in 2012, narrow pixel pitch LED displays are performing well in the market, says Qian Du

Narrow pixel pitch (NPP) LED had a strong year in 2015, with total value reaching $678 million, representing an increase of 201% year-on-year. The market has now entered a steady but strong growth phase in 2016. Futuresource expects that the NPP LED market will account for 34% of total value in the videowall market – highly impressive for a technology that was only launched in 2012.

In 2016, as Futuresource expected, P1.9mm has started its transition to the mainstream pixel pitch, and P0.9mm is becoming the premium option. Average end-user prices have been falling, due to the increase in surface-mounted device (SMD) LED package production and tier 2 Chinese LED manufacturers significantly expanding the local market with relatively low price SKUs.

Chip-on-board (COB) LED continues to receive more attention, and is often considered to be the next production technology for NPP LED. COB LED offers low energy consumption and water/dust/break-proof features. Compared with SMD LED, COB LED has higher production yields and lower production costs. However, COB LED is currently unable to match the picture quality of SMD LED and the repair process is challenging.

Instead of racing for ever-tighter pixel pitches, vendors have focused on improving products and developing better solutions. Futuresource has seen the approach from vendors change, with the creation of solutions or specific products designed for specific applications. Furthermore, many vendors have moved towards a more standardised 27.5in diagonal cabinet design, with 16:9 aspect ratios seemingly the preferred size.

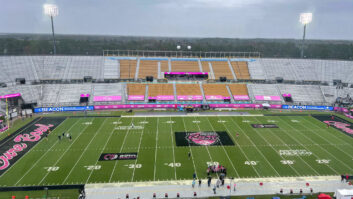

The competitive landscape of the market changed in the past 18 months, with international brands such as Samsung, NEC, Panasonic, Planar (Leyard), Christie, Delta and eyevis all entering the market. These brands are expected to stimulate the market, especially with Sony unveiling its Crystal LED Integrated Structure (CLEDIS) at InfoComm (pictured), which redefines high-end display solutions.

Qian Du is market analyst, professional displays at Futuresource Consulting.