In unpredictable and unsettling times, it feels reassuring to identify those markets where the underlying conditions seem the most robust. Moving out of the pandemic era, it’s clear that high-quality professional displays constitute one of those markets – an observation firmly underlined by recent research from Straits indicating that the global commercial display market will be worth USD 88.9 billion by 2030, on the back of compound annual growth of around 7%.

When you factor in the unique challenges of the last few years – and let’s not forget the whole issue of how the public should interact with displays in public spaces post-pandemic – these are even more impressive statistics. In explaining this growth, it’s not surprising that there are multiple factors at work, including ongoing digitalisation, a continuing improvement in quality and performance, the need for greater flexibility, and the rise of hybrid and remote working.

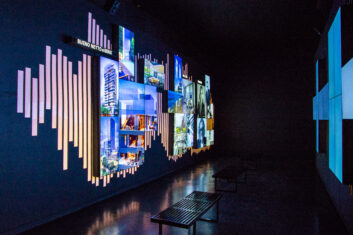

Chris Kee, executive director of product management at Christie, is not alone in pointing to display technology’s prominent presence at ISE 2023 as an indicator of the market’s current health. “We’re seeing strength and confidence in the pro AV industry,” he confirms, adding that this was “illustrated by the robust attendance at ISE 2023″, and a “pick-up in installations and purchases” of professional displays post-pandemic.

Chris Kee, executive director of product management at Christie, is not alone in pointing to display technology’s prominent presence at ISE 2023 as an indicator of the market’s current health. “We’re seeing strength and confidence in the pro AV industry,” he confirms, adding that this was “illustrated by the robust attendance at ISE 2023″, and a “pick-up in installations and purchases” of professional displays post-pandemic.

DEMOGRAPHIC SHIFT

Ross Noonan, technical sales & marketing manager at The LED Studio, does not appear surprised by the Straits prediction, and goes on to partly attribute the success of the market to an inevitable demographic shift. “It’s clear that the younger generation is very visually-led, which means that everything is being designed to be short, snappy, colourful and vibrant,” he says, adding that the ability of the latest screens to deliver content that bears all of these characteristics means that “we are likely to see a big increase [in sales] over a one to three year period”, providing the pandemic doesn’t come back.

In terms of retail and hospitality, the realities of the pandemic era may mean that those businesses that have survived are now more focused on the future than ever before. “Some struggled and folded, unfortunately, but those who survived have come back very strongly,” says Ben Phelps, retail industry director at Absen, who indicates that online retailers that have migrated to physical stores are among those who are most engaged when it comes to new display technology: “They are very aware that the displays form a large part of the customer experience.”

MVS Audio-Visual is a leading UK equipment supplier and installer whose current displays-related project mix comprises approximately 75% corporate customers, with the remaining 25% made up of hospitality, retail, and large venues such as stadiums. Along with continued innovation across applications, MVS head of workplace technology Alistair Maher indicates that the ability to satisfy a wide range of solutions, and at different price points, is a key element in keeping the display market healthy.

Despite the present economic uncertainty, notes Maher: “we are actually seeing more enquiries than ever. As a business, it’s important to offer cost-effective alternatives; not every customer will want a premium solution in every space. But if you acknowledge that, then you can move forward on that basis.”

Vestel’s head of sales B2B, Karen Langford, also acknowledges that economic factors may be having an increased impact on customer decisions at present. The company has worked on being “price-sensitive – offering solutions that involve the same technology,” not least in the education market, “where budgets are being cut”.

PIXEL PITCH

Whilst the operational context surrounding displays might have changed, many of the design trends that were shaping the market pre-pandemic – including increased flexibility of set-up, general future-proofing, and finer low pixel pitches for LED displays – remain entirely applicable.

This is confirmed by a brief look at some major recent launches, many of which were on show at ISE 2023. For instance, Christie showcased two new models in its MicroTiles LED series – which can be arranged in “near-limitless ways” with the company’s proprietary cabinet-free Click-n-Go tiles – in 0.75mm and 1.00mm pixel pitches.

“The finer pixel pitch results in better visual acuity, with brightness up to 2000 nits,” says Kee. “Our 1.0mm model features LED encapsulation, which improves optical performance for enhanced black-level performance and increased contrast. Encapsulation also provides a protective surface that protects the display from dirt, dust and scratches.”

“The finer pixel pitch results in better visual acuity, with brightness up to 2000 nits,” says Kee. “Our 1.0mm model features LED encapsulation, which improves optical performance for enhanced black-level performance and increased contrast. Encapsulation also provides a protective surface that protects the display from dirt, dust and scratches.”

Meanwhile, the LED Studio has recently brought to market what it describes as the industry’s “first outdoor narrow pitch LED display”, the AEGIS Pro, which features pixel pitches as low as 1.2mm, high brightness and a fully waterproof exterior. Intended as a kiosk solution, AEGIS Pro provides a sustainable option for replacing existing LCD screens, including digital six sheets and bus stop signage, and is also said to deliver 40% less power consumption compared to traditional LED displays.

Considering current prospects, Noonan says that there are a lot of screens out there in the market “which are likely to be reaching the end of their lifetime over the next 18 months, so that [obviously leads to some] new opportunities”.

Meanwhile, ISE 2023 also saw the debut of a joint venture, between The LED Studio and VOD Visual: V1 Architecture. The proprietary LED display cabinet infrastructure permits the LED display to be constructed in SMD, Flip-Chip SMD or Flip-Chip SMD High Bright due to the engineered design that adjusts how the PCBs are manufactured.

Making it possible to utilise “three different technology manufacturing methods offers varying visual, economic and financial benefits for end-users, and presents options for upgrading the technology in the future,” notes Noonan.

TOUCH TOUCHY?

One question that we were especially keen to pose was how display specialists perceive the outlook for touch-based interaction in the wake of the pandemic. Whilst it might have been expected that this form of engagement would have been – at least for the foreseeable future – rather diminished, the reality is less clear-cut, although there is certainly evidence of vendors exploring alternative approaches.

For Christie, Kee observes: “I think we’ll continue to see touch as an optional feature on many displays, but we’ll also see the use of interactive solutions that don’t require touch. At ISE 2023, we demonstrated sensor-activated content using Pandoras Box Widget Designer with Christie AirScan and a laser projector. This allowed us to create a motion-controlled experience where attendees could manipulate the content via movement – no touch required. A solution like AirScan works on any surface, including LED video walls, as an alternative to touch displays.”

For Christie, Kee observes: “I think we’ll continue to see touch as an optional feature on many displays, but we’ll also see the use of interactive solutions that don’t require touch. At ISE 2023, we demonstrated sensor-activated content using Pandoras Box Widget Designer with Christie AirScan and a laser projector. This allowed us to create a motion-controlled experience where attendees could manipulate the content via movement – no touch required. A solution like AirScan works on any surface, including LED video walls, as an alternative to touch displays.”

Phelps points to the increase in “the use of mobile-based engagement with screens. QR codes that connect to the user’s own device is probably where thinsg are going”.

Nonetheless, there were still plenty of fresh touch-related products at ISE, including the new IFX range from Vestel that features touch/pen tools, including the latest 20-point IR Touch technology with faster response. Underlining the IFX range’s suitability for education, IR Touch allows multiple users to interact with the display simultaneously.

EFFICIENCY EMPHASIS

Similarly, the picture appears to be somewhat mixed in terms of how much concerns around energy consumption and sustainability are informing demand – although that certainly isn’t due to lack of effort on the part of vendors, whose increasing emphasis on efficiency were writ large at ISE 2023.

For example, the Christie MicroTiles LED in 0.75mm and 1.00mm pixel pitches are “designed with increased reliability and energy efficiency in mind,” says Kee. “The latest flip-chip technology increases the life of the new models by dissipating heat more efficiently, and new common cathode technology distributes power proportionately to each RGB module as needed, resulting in reduced energy consumption and a more energy efficient LED display,” he adds.

For Vestel, senior product manager TV & visual solutions Tim Matthews confirms that there are “a lot more requests [now] with regard to solutions that are eco-friendly, [echoing] a more general trend in society.” He think that this will receive a further boost “bearing in mind the whole situation with energy costs and the unpredictability there”.

On the other hand, MVS’ Maher remarks that concerns about energy costs have not been raised much by customers to date. “I have not [encountered] that myself personally, which is quite surprising, really,” he says. Nonetheless, there has been increased engagement with some elements pertaining to “efficiency and performance – for example, [customers] might want to know that the system can self-shut down and go into standby”.

Beyond the requirements and capabilities of the displays themselves, it’s apparent that another shift is taking place in the relationship that exists between them and customers across commercial verticals. Returning to the earlier point about younger generations being driven by visual stimuli, it’s apparent that the most successful engagements – in retail, hospitality and other applications – foreground the importance of having high-quality, visually-arresting content to show on high-end displays.

“The best responses occur when people have worked-out digital strategies, and I think a lot more are realising that now,” says Phelps for Absen, which exhibited a wide range of its LED solutions at ISE, including the new NX series of commercial displays. This trend, he indicates, is especially apparent among those retailers who started off in the online realm: “Their biggest asset is content creation and they understand that you need to put content that is made to measure on the screens [in the physical stores]. Ultimately, the screen is the canvas and the most important bit is the content.”

However the underlying technologies evolve over the next few years, it’s likely to be those display vendors who can most readily help customers to realise the full potential of their content who are best-positioned for continuing success.