During the round of interviews conducted for Installation’s latest overview of the professional projector and display market, more than one participant alluded to an ‘arms race’ over resolution – and it’s not difficult to see why. The adoption of 4K and now 8K, and these technologies’ contribution to sharper and more detailed picture quality, has been a huge part of the narrative for the best part of a decade. But what also became clear during these calls is that this is now beginning to change as other features and functions come to the fore.

With the dawning of 8K, in particular, there is now a distinct sense that we are reaching the end of a particular avenue. Not only will further improvements in resolution be increasingly difficult to justify for many customers in both practical and economic terms, they will also offer a level of detail that is hard to discern with the human eye. So it follows that manufacturers have to shift focus (as it were) to other areas, such as versatility, ease of use, control and sustainability.

GREAT STRIDES

Encouragingly, it appears that many vendors are already making great strides in this area. Some of these innovations are discussed in this article, but they were also writ large in the halls of ISE 2024 – an event that also underlined the remarkable resilience of the broader AV industry after four often challenging years (see page 26 for our show report). As Mark Wadsworth, vice-president of global marketing at Digital Projection, reflects: “It was busy – insanely busy! It really felt like it was back to the good old days of Amsterdam where there was a constant flow of footfall non-stop. [Going into the 2024 event], we already had a lot of big projects signed off, but people were visiting us to talk about specific kit. So it really feels like there is a very upbeat mood [in this sector] at the moment.”

Leyard is a leading name in LED and LCD digital video wall and display solutions, providing its products to a wide range of applications in corporate, education, retail, broadcast and more. Cris Tanghe, VP product at Leyard Europe, is therefore well-placed to both chart the resolution trajectory, and identify why it may be approaching a plateau.

“There are different responses to [resolution], depending on the product itself, but [in general] if you look at projection solutions, which we [at Leyard] don’t do, there has really been a trend towards higher resolutions in the last decade,” he says, adding that a similar pattern has been observable in two areas which it very much does do: “So with LCD solutions, there was a transition from full HD screens towards 4K, and now you gradually see the 8K coming in. Then with LED walls – which is our main product that we are selling now – there has been a transition for lower pixels.”

“There are different responses to [resolution], depending on the product itself, but [in general] if you look at projection solutions, which we [at Leyard] don’t do, there has really been a trend towards higher resolutions in the last decade,” he says, adding that a similar pattern has been observable in two areas which it very much does do: “So with LCD solutions, there was a transition from full HD screens towards 4K, and now you gradually see the 8K coming in. Then with LED walls – which is our main product that we are selling now – there has been a transition for lower pixels.”

However, Tanghe implies that the limitations of going further are now increasingly apparent. “Achieving those 8K resolutions [tends to mean] massively big walls, so generally we have stopped at 4K, which depending on the pixel is already quite a big wall. [In addition] you don’t see that much effect by moving from 4K to 8K on an LED video wall because you’re already standing 4 or 2 metres away from the screen.”

Mark Wadsworth also implies that – both from technology and customer perspectives – more isn’t always more. “It has often seemed that there was almost an ‘arms race’ for higher brightness and more resolution, but that’s not always what the customer is asking for realistically. [Instead] what they may want more is a solid, reliable, predictable experience with the projectors, involving an easy and efficient process.”

These opinions are – to some extent, at least – contradicted by ViewSonic, whose portfolio encompasses projectors, LED displays, LCD monitors and more. On the display side, indicates monitor business unit GM Oscar Lin, higher-resolution remains a fundamental sales driver: “[In this product area] we are witnessing a remarkable surge in the demand for high-resolution displays across various industries… This surge has paved the way for substantial growth in the 4K, 5K, 6K and 8K monitors/displays market, bolstered by advancements in display technologies, notably OLED panels.”

But on the projector side, the nature of demand seems more complex. Dean Tsai, GM of the projector & LED display business, remarks: “For the projector market, as the pursuit of higher resolutions and better picture quality continues, we’re witnessing a concurrent shift towards an enhanced user experience. The current market increasingly favours projection solutions that not only deliver superior visual performance, but also boast a compact lightweight design. [For instance], nowadays compact projectors deliver higher brightness to offer a delicate visual experience even in ambient light conditions. The innovation allows the projector to be effortlessly transported and installed for a variety of leisure activities, [such as] decorating commercial spaces or setting up 360-degree immersive environments.”

Meeting the diverse demands of customers more effectively means that “seamless add-on features” are also important to solve the pain points, including high transportation costs and installation/maintenance difficulty, “especially for large-format displays,” adds Tsai.

Meeting the diverse demands of customers more effectively means that “seamless add-on features” are also important to solve the pain points, including high transportation costs and installation/maintenance difficulty, “especially for large-format displays,” adds Tsai.

Inevitably, these issues will be more acute in those sectors, such as retail, that are having a more challenging time, although a worsening economic outlook in many countries – the UK and Japan being among those who formally tipped into recession as this article was being finalised – is likely to be mean a more pervasive focus across sectors on operational costs like transportation, installation and maintenance.

To which one might reasonably add ‘energy consumption’, which also resonates with another increasing emphasis across the projector & display business: sustainability.

Along with boosting versatility and general ease of use, improving the environmental footprint of projectors and displays – not least as a fundamental component of helping customers to achieve their own sustainability goals – was the most frequently recurring theme of the interviews for this piece.

The overriding impression is that awareness of climate change and the need to decarbonise has increased significantly in the past five years, in particular, with customers across applications increasingly defining (and publicising) their Net Zero roadmaps. And whilst this is clearly the correct direction to be taking by any meaningful metric, it’s also worth noting that corporate sustainability reporting requirements are now being tightened up in many territories. Once a concern primarily among the biggest national and international corporations, it’s going to become a requirement for more and more SMEs in the next decade. Inevitably, then, sustainability is rising up the ranking of factors informing both purchasing and R&D decisions.

KEENLY AWARE

Tsai strikes a widely-shared note when he remarks that ViewSonic is “keenly aware of the importance of environmental considerations like energy efficiency, lifecycle management and recyclability”. In line with ViewSonic’s ESG commitments to reduce emissions and enhance product sustainability, initiatives include designing products for longevity, repairability, and achieving high reuse/recyclable rates, with a focus on reducing greenhouse gas emissions and supporting responsible consumption.

In terms of specific product design progress, Tsai cites the use of LS Series Lamp-Free Projectors with LED and laser technology “for better energy efficiency and a longer lifespan than traditional lamp-based projectors”, while Clifford Chen – GM of the Presentation Group at ViewSonic – alludes to the inclusion of recycled materials as well as energy-saving control and scheduling features “to enhance resource efficiency and reduce energy consumption”.

Among a roll-call of customer questions, Leyard’s Tanghe cites ‘How green is this? and ‘What is the power consumption?’ as being among the most frequently-occurring these days. Along with climate concerns, “the fact that we have skyrocketing gas and oil prices means that it’s more and more on top of people’s minds”, he says. “It maybe started with people thinking about their [home environment] and what they needed to do to be ecological there, but then it became clear that [the same type of conversations] about our professional environments were needed.”

Among a roll-call of customer questions, Leyard’s Tanghe cites ‘How green is this? and ‘What is the power consumption?’ as being among the most frequently-occurring these days. Along with climate concerns, “the fact that we have skyrocketing gas and oil prices means that it’s more and more on top of people’s minds”, he says. “It maybe started with people thinking about their [home environment] and what they needed to do to be ecological there, but then it became clear that [the same type of conversations] about our professional environments were needed.”

From that tipping point onwards – which Tanghe suggests was around three years ago for quite a lot of organisations – there were “more and more requests coming in to be carbon neutral or [enable] carbon reduction.” In terms of Leyard’s own products, the adoption of more efficient processing chips and built-in power standby in LED cabinets – “meaning you can send a command and it will shut down down to less than 3W” – are among the most significant developments, while plans are also afoot to further advance the carbon neutrality of the European factory, which is located in Slovakia. “We also have a yearly evaluation by an external company that checks how we can further improve our efficiency,” adds Tanghe.

Sony Group, meanwhile, was among several manufacturers to draw attention to the latest developments in its environmental progress at ISE 2024. The company’s Road to Zero plan aims to reduce environmental footprint to zero by 2050, and as part of this Sony has established medium-term targets, referred to as Green Management 2025, that concern FY2021 through FY2025.

As a consequence, Sony says it is “accelerating efforts” such as the reduction of product power consumption, the elimination of plastic from the packaging of newly-designed small products, and the introduction of renewable energy.

In terms of specific visual solutions, Sony’s own recycled plastic, SORPLAS, has been integrated into the BRAVIA BZ-L professional display series since last summer. Indeed, all 15 models incorporate sustainable elements – from the use of SORPLAS recycled plastic and less ink usage on the cartons, to an optional stand for less waste and an Eco Dashboard for better understanding of power consumption based on settings configuration.

In terms of specific visual solutions, Sony’s own recycled plastic, SORPLAS, has been integrated into the BRAVIA BZ-L professional display series since last summer. Indeed, all 15 models incorporate sustainable elements – from the use of SORPLAS recycled plastic and less ink usage on the cartons, to an optional stand for less waste and an Eco Dashboard for better understanding of power consumption based on settings configuration.

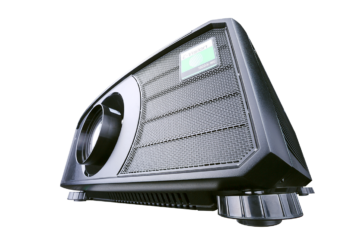

For Digital Projection, Wadsworth immediately points to the long-running green philosophy of its parent company, Taiwan-based Delta Electronics. “Every single R&D decision they make is taken [with regard] to how can they do better for the planet, how can they be more efficient, how can waste be reduced, and so on,” he says. So for example, at the high-end of our new projectors, the new TITAN [Laser 47000 WU] is 15% more efficient when measuring the lumens-per-watt output [than the previous model].”

Among a host of other developments showcased in Barcelona, Digital Projection introduced new Satellite MLS (Modular Light Sources) responding to “a huge demand for even more brightness and efficiency”, with 20,000 and 30,000 lumen MLS now complementing the original 10,000 lumen light source.

Echoing a widely-voiced opinion, Wadsworth suggests that improving power efficiency will remain a top R&D priority, arguably providing not just welcome benefits to environmental impact now, but also an historical corrective for an industry that has traditionally been distinctly energy-intensive.

“Let’s face it: as an industry we have had a pretty big footprint when it comes to electricity use,” says Wadsworth. “So with every new projector we create, a big part of it is how we can be more efficient [in energy consumption].”

UNEXPECTED CIRCUMSTANCES

Whilst the technological direction of travel for key markets such as corporate and education, was increasingly clear pre-Covid, it’s certainly become much more so in the aftermath of the pandemic. So to pick up on those two markets, working, meeting and learning patterns are now often more variable – not least in their inclusion of more remote participants and technically-demanding visuals – than they were ten years ago. No wonder, then, that versatility and an ability to adapt to new and/or unexpected circumstances is now a big design driver.

For ViewSonic, Chen cites the ViewBoard 100G Series as an example of its “significant strides in versatility”, adding: “It’s a 110in 4K interactive display, designed with a 16:9 aspect ratio and [including] a built-in whiteboard tool that elevates classroom interactivity and supports multitasking through features like split-screen and floating windows”.

As for the future of professional displays, Tsai points to the growing importance of “customisability”.

“The demand for solutions tailored to specific user needs and industry requirements is on the rise. This includes the desire for configurable hardware and software options that cater to varied requirements,” he says, pointing to recent developments such as the new LDC series LED displays – which afford flexibility in size and aspect ratio “while preserving the All-in-One design” – and the availability in its product range of different brightness levels and projector light-sources.

“The demand for solutions tailored to specific user needs and industry requirements is on the rise. This includes the desire for configurable hardware and software options that cater to varied requirements,” he says, pointing to recent developments such as the new LDC series LED displays – which afford flexibility in size and aspect ratio “while preserving the All-in-One design” – and the availability in its product range of different brightness levels and projector light-sources.

Focusing firmly on displays, there is also an evident willingness to help customers integrate solutions into a wider range of environments, which for example may be impacted by space considerations.

For Leyard, Tanghe points to the development of a solution that allows components “to be offloaded to a rack which is typically in a controlled and secured environment”.

For example, moving the power rack away from the display lowers the heat dissipation and supports broader deployment of the solution, especially in complex environments like control rooms. The resulting slimmer form-factor is also useful in broadcast: “It allows you to be very creative in broadcast studios, such as in the way that [a background display] is provided.”

Not surprisingly given the trend towards increased remote working – and the need to be able to manage estates over potentially large distances – there is also a discernible demand for visual solutions to be supported with cloud-based management platforms. As well as allowing for effective control of day-to-day requirements, such platforms also tend to gather significant data that allows potential problems to be identified and addressed early on.

For example, ViewSonic has introduced myViewBoard Manager. “This cloud-based platform empowers IT administrators with the ability to efficiently monitor device information, optimise tool usage, and conduct firmware updates across all ViewSonic displays via a singular web dashboard,” says Chen. “This tool not only simplifies the management and communication process within organisations and campuses, but also enhances resource efficiency and reduces energy consumption, paving the way for more sustainable operational practices.”

Samsung is another manufacturer to have recently highlighted new innovations around system management and control. Hence at ISE 2024, its ‘SmartThings for Business Exhibition’ highlighted how the use of IoT (Internet of Things technology), among other innovations, will help business owners to leverage their displays to connect and gain more control of their smart devices across different business environments.

Samsung is another manufacturer to have recently highlighted new innovations around system management and control. Hence at ISE 2024, its ‘SmartThings for Business Exhibition’ highlighted how the use of IoT (Internet of Things technology), among other innovations, will help business owners to leverage their displays to connect and gain more control of their smart devices across different business environments.

Underlining the importance of powerful connectivity, SW Yong – president and head of the visual display business at Samsung Electronics – observes: “In a commercial display sector where operational efficiency is key, Samsung digital signage is leveraging SmartThings to deliver next-gen connectivity and features to organisations of all sizes. This further expansion of the SmartThings ecosystem will serve to elevate experiences for customers and partners from a wide variety of industries.”

AMBITIOUS RETAILERS

Whilst the period after early 2020 was undoubtedly challenging – and, in terms of the recent past, unprecedented in its sheer unpredictability – a mood of optimism was discernible in all of the interviews conducted for this piece. In particular, the latest edition of ISE has resulted in many vendors feeling that the industry is now regaining its pre-Covid energy. Not untypically, Tanghe notes: “ISE was really buzzing – the atmosphere was really good and the amount of visitors we had was excellent… Everyone we spoke to was very enthusiastic.”

Indeed, this enthusiasm is even discernible when addressing markets one might reasonably expect to be more muted at present – retail being an obvious example. Whilst the high-street is incontrovertibly having a tough time in many countries, the growing tendency of retailers to focus their investment on a select number of stores and create impactful experiences heralds obvious opportunities for visual solution providers.

“It might be the case that the retailers [don’t expect to sell so much through their physical stores], but are more about creating an experience that enables people to connect to the brand and then maybe buy [a product] somewhere else [eg. such as online],” says Tanghe. “So you see a lot of LED walls being installed into new ‘experience’-type stores.”

IMMERSIVE MAPPING

Meanwhile, building projection-mapping as part of large-scale immersive experiences remains in the ascendant for many vendors – Digital Projection among them. “Especially in the Middle East, there seems to be a massive appetite to create huge impact [in this way],” says Wadsworth, adding that demand currently tilts more towards corporations – who might want to use projection-mapping to announce new products or initiatives – than sports or other live events.

But its not just corporations getting in on the act. ISE saw the official launch of a partnership between INFiLED and Alex Maltsev, an award-wining artist renowned for his 3D and design projects. The collaboration will “extend across content creation for screens”, showcasing the integration of Maltsev’s artistry with INFiLED’s latest display technology. ISE also marked a collaboration between INFiLED and Barcelona-based creative studio Tigre Lab, entitled ‘Living the Art Experience’.

But its not just corporations getting in on the act. ISE saw the official launch of a partnership between INFiLED and Alex Maltsev, an award-wining artist renowned for his 3D and design projects. The collaboration will “extend across content creation for screens”, showcasing the integration of Maltsev’s artistry with INFiLED’s latest display technology. ISE also marked a collaboration between INFiLED and Barcelona-based creative studio Tigre Lab, entitled ‘Living the Art Experience’.

With Leyard among other companies engaged in immersive artistic projects – its recent supply of an LED tunnel to the Axel de Beaufort and Guillaume Verdier-designed museum-boat ARTEXPLORER being a prominent example – it’s clearer than ever that visual solutions is an area in which art and commerce can be perfectly intertwined.

ISE also drew attention to another encouraging trend for the long-term prosperity of the visual solutions sector – the announcement of new partnerships or expansion of partner networks. It’s not hard to see why these are appealing in an era of shifting expectations, not least as software and integration requirements continue to evolve rapidly.

For example, Sony announced the addition of 26 members and industry leaders to its AV Alliance and Technology Partner Network, joining the existing 40+ members from across Europe and other parts of the world. The resulting strategic alliances enable the provision of “compatible software and hardware solutions that deliver enhanced value, compatibility and creative freedom” to its BRAVIA pro displays.

Returning to an earlier theme, Rik Willemse – head of professional displays & solutions at Sony Europe – remarks: “Our partner network is not only important for delivering the highest-quality solutions to more end-users, but is also key in our mission towards a more sustainable AV industry. It’s important to us that our partners share our mission on advancing environmental and social initiatives.”

Putting together market overviews hasn’t always been the cheeriest of tasks in the last few years, with Covid and other world events impacting industry progress. But with ISE 2024 confirming that pro AV is in robust health once again, this feeling of uncertainty is dissipating – not least in visual solutions. So, while even higher resolutions might not be so important in the future, it’s clear that there will be plenty of other features and functions – from ease of control and integration to sustainable operation – to ensure that this remains an ongoing success story.