Powersoft was founded more than a quarter of a century ago and even today the three founders – Luca Lastrucci (CEO), Claudio Lastrucci (R&D Director) and Antonio Peruch, as well as president Carlo Lastrucci – are still deeply involved in the operational side of the business.

Powersoft was founded more than a quarter of a century ago and even today the three founders – Luca Lastrucci (CEO), Claudio Lastrucci (R&D Director) and Antonio Peruch, as well as president Carlo Lastrucci – are still deeply involved in the operational side of the business.

“We have different functions but with the same objective: to innovate through products that are design-driven,” explains Peruch. “This requires being present, guiding and stimulating our employees through our corporate mission statement. Our president is constantly present and is regularly meeting (physically) with the different departments (R&D, purchasing, marketing, sales, etc) to involve and stimulate all employees, from the creative people in the lab to the marketing and sales people. This is one of the key points of Powersoft’s success.”

Because of the different positions the main players hold, they are able to make collegial decisions quickly and efficiently. Peruch is personally responsible for three teams: production engineering, test engineering, and the documentation of all products. This responsibility and a “360-degree view” also allows Powersoft to align objectives and define profitable joint investments.

His role also includes the upstream part of prototyping, which, according to Peruch, is an important first phase of industrialisation, reducing lead times, before moving on to design, for which the laboratory is responsible.

“All these parts of industrialisation are plannable and predictable,” he says. “Then there are the imponderables, accidents and incidents – such as Covid – which divert attention and product effort and which must be remedied quickly in order to continue to support the production, yield and growth of the company. Constantly questioning our processes and goals is how we grow as a company.”

Peruch was kind enough to respond to further questions on Covid and, in particular, the global chip shortage.

What processes were in place before Covid for the supply of chips?

Pre-Covid, and following our budgets and commercial objectives, we were already well supported by our EMS (Electronics Manufacturing Services – ie third party electronic components manufacturers), both internally for the manufacture of our products and externally for the production of electronic boards in order to satisfy our commercial demand.

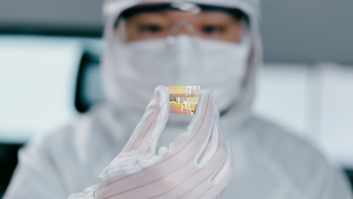

The principle is based on the lead time of the components, which is the ‘key’ to being able to support production and which is always a variable. The lead time therefore drives everything and the demand also depends on the cost of the components. If demand increases so that the number of parts required exceeds production capacity, delivery dates are extended by manufacturers and industrialists (silicon, windings, capacitors, PCB boards, mechanics, etc) and following the confinements, the balances have changed: we have seen a shortage of bank silicon and raw wafers, production of which fell during the first phase of the pandemic.

Production and demand also varied according to the different situations experienced by the countries that gradually emerged from containment.

Balances therefore shifted and once demand returned, the industry was facing an unprecedented shortage which, even today, can’t seem to be able to balance or to sustain a demand that is greater than pre-Covid needs. This increased demand is partially due to overbooking by manufacturers desperate for electronic components. The return to equilibrium will take time, especially as other sectors that have slowed down significantly this year, such as the automotive industry, will also have to be served.

Is there anything that gives Powersoft a competitive edge?

We have been investing in components for several years. Thanks to good management of our working capital, we are able to allocate large sums of money to these materials which are essential for production. This is the reason why we are able to go through much longer difficult periods being less impacted than our competitors.

We are facing shortage problems but our laboratory is able to adapt and redesign parts of the project with versioning, our electronic boards, partly smoothing this effect. Powersoft has total control of its technologies, and reaction times for decision making are very short, as everything is managed in-house.

We are facing shortage problems but our laboratory is able to adapt and redesign parts of the project with versioning, our electronic boards, partly smoothing this effect. Powersoft has total control of its technologies, and reaction times for decision making are very short, as everything is managed in-house.

All the orders for components for 2022 have been placed; we are already working on 2023. All this was already decided in the first half of 2021 when we realised that the situation was not improving and was taking a new ramp which we define as ‘manual allocation’.

This daily work is done in harmony with our EMS in order to join the common cause of Powersoft, and to continue to deliver our customers during this Covid crisis. The process of making an amplifier is even longer when it comes to custom components where the subcontractors themselves have suppliers who allow them to build their own components/chassis, and this already sets up processes for allocating raw materials before they can even make those parts whether they are mechanical or electrical devices. So we have full visibility and control of our production line.

In recent years, we have also made significant investments to relocate the integration of the electronics in the mechanical part of our amplifier racks to our factory, following a lean production technique and strategy in the assembly and testing of all our products.

How did you respond to the initial stage of the pandemic?

I think there is always a bit of luck in life. Our success in the last 25 years is due to people and innovation, but also a bit of luck. It is the same for this period of Covid. We were ready to face the crisis, but luck also gave us a boost: in 2020, we received a large project and we made sure that the whole production chain could follow with investments to guarantee this commitment. We also decided not to stop producing during the Covid crisis, where many others stopped, including manufacturers and factories.

We were coming off a very productive first quarter in line with our very ambitious budget for 2020, and this new order further strengthens our commitment to purchasing components, with almost six months of stock ahead of us and re-launching a new purchasing campaign for 2021.

While demand was virtually at a standstill, we went full steam ahead in the second quarter and purchased a lot of components to meet our sales forecasts for the year. Thanks to these purchases and forecasting capabilities, we ended 2020 with stocks available for the first half of 2021 for our fixed installation amplifiers.

In my opinion, one of the reasons why the crisis worsened in the following months from an industrial point of view, is that companies started ordering even more components to meet demand and to try to catch up, in addition to a major incident that occurred at a semiconductor factory which shook up the audio market.

Second, silicon is also a factor in the overall shortage. Silicon smelters are predominantly in Taiwan and Malaysia and the prices of the world’s leading integrated circuit manufacturer (TSMC with a 56% market share) has increased by 12%.

The transport problems linked to the shortage of containers blocked in ports also contributed to the crisis and prices have increased up to seven times. Sea freight rates are also a major component of commercial costs and the blockade of the Suez Canal for nearly a week in March, by the mega-ship Ever Given, triggered a further surge in charters that had just begun to stabilize after all-time highs reached during the Covid pandemic.

Why are manufacturers struggling?

Delivery times have reached several weeks for some components, in some cases more than a year and a half. This makes the situation extremely difficult for producers. We have supported our EMS with proper long-term planning to mitigate the risk of long component procurement times. Producing in Italy with a well-planned European distribution has allowed us, having mixed purchases between different and international suppliers, to satisfy a large part of our needs.

In recent times it has become increasingly necessary to turn to brokers in Asia rather than in Europe and America. This has favoured the development of this grey market through new brokers that are multiplying and causing component prices to rise up to 15 times!

Lead time: As demand increases, lead time increases. The more lead time increases, the more component costs increase if new investments are required from manufacturers to meet these latest demands.

Dealers are overwhelmed and now face at least three times the number of orders compared to the pre-Covid period. This demand is not the result of a real need but due to the industry’s need to track down this component in order to reproduce it as quickly as possible.

Have any positive things come out of this crisis?

We were in a predefined lead time system, but now we are in a lead time situation with manual allocation. About 30% of the effort in our R&D lab is focused on redesigning our boards so that we can guarantee production.

My role as an industrialisation manager is to find solutions quickly. This ability and organisation will remain a wealth of experience for the future as well.

It has inspired us to continue to automate and improve internal and external processes. We are constantly looking for new solutions and tools to improve our efficiency.

Almost 8% of our turnover is dedicated to research and development. Part of this investment is also dedicated to the research and development of these new solutions. This period has made us more flexible, more responsive and more agile.

Almost 8% of our turnover is dedicated to research and development. Part of this investment is also dedicated to the research and development of these new solutions. This period has made us more flexible, more responsive and more agile.

Producing in Italy allows us to have greater quality control and direct visibility of costs on a daily basis as well as reducing decision-making times.

Thanks to Powersoft’s leadership, negotiation and purchase is increasingly directly with primary suppliers. We are also improving our processes for an increasingly correct estimation of the needs and demands of the market and the relative planning to satisfy them.

Have you had to rethink your business strategy because of Covid?

The crisis has shown that our business strategy was the right one with a complete product management capacity and production in Italy totally under control. Investments in R&D allow us to have products that are increasingly in demand, and the knowledge of the market allows us to understand the needs of the future.

It’s still important to constantly question yourself and try to improve.

How has Powersoft been able to increase its sales volumes and gain new customers?

We have a good reputation for quality and reliability and the market demands our products. From a production point of view, we have no limits to the ability to grow and we are able to add operational personnel in a very short time, guaranteeing flexibility.

Has the increase in energy costs had an impact?

No, the increase in our energy consumption due to our increased production capacity does not impact our finances much and therefore the cost of the product, especially since our subcontractor factories in Italy that produce the electronic boards for our amplifiers and amplifier modules also use solar energy to power their production.

Have you been able to “recycle” components dedicated to rental staging amplifiers for fixed installation ones?

As we continuously release new, innovative products at the state of the art technology, the products over time are different from each other and do not have much in common from an electronic component point of view. This also applies to products for installation applications and products for live events.

How does Powersoft position itself in relation to customers having to bear the costs increase?

Our policy since the start of Covid has been to try not to pass the cost increase on to our customers. Unfortunately, this pandemic period does not seem to be coming to an end and the increases will persist. On some products we were therefore forced to apply increases to guarantee margins.

Have you been able to “recycle” components dedicated to rental staging amplifiers for fixed installation ones?

As we continuously release new, innovative products at the state of the art technology, the products over time are different from each other and do not have much in common from an electronic component point of view. This also applies to products for installation applications and products for live events.

How does Powersoft position itself in relation to customers having to bear the costs increase?

Our policy since the start of Covid has been to try not to pass the cost increase on to our customers. Unfortunately, this pandemic period does not seem to be coming to an end and the increases will persist. On some products we were therefore forced to apply increases to guarantee margins.

For more on the chip crisis, see part 1 of our special investigation.