It would be difficult to think of a more problematic conflation of circumstances than that which has faced industry globally over the past two years – nor would you want to. From sudden staff shortages to coping with multiple lockdowns, these challenges have often been universal across sectors. But there is one particular issue that has made the continuing manufacture of electronics – including those destined for pro AV – especially troublesome.

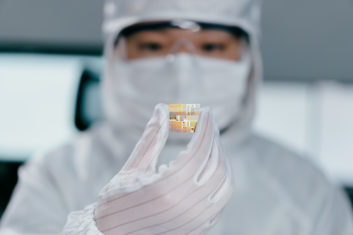

Installation refers, of course, to the global shortage of integrated circuits (ICs), commonly referred to as semiconductor chips. It was in spring 2020, as lockdowns really began to affect production levels, that the problem first received global media attention. And whilst output has risen again over the last year, no one expects the crisis to end before spring 2022 at the earliest. With the Omicron variant spreading at terrifying speed at the time of writing, even that forecast is beginning to seem rather optimistic.

Regarding the origins of the crisis, it’s not hard to perceive it as a perfect storm of factors. With China, Taiwan and other countries in the region being among the first to be badly affected by Covid-19, the combination of staff illness and factories having to either reduce or halt manufacturing altogether meant that production levels dipped dramatically over a fairly short period of time.

Regarding the origins of the crisis, it’s not hard to perceive it as a perfect storm of factors. With China, Taiwan and other countries in the region being among the first to be badly affected by Covid-19, the combination of staff illness and factories having to either reduce or halt manufacturing altogether meant that production levels dipped dramatically over a fairly short period of time.

DRIVING ISSUES

It was in the automotive sector that the implications of the shortage first became apparent. An especially chip-intensive area of manufacturing, cars tend to use around 1,500 chips per vehicle, although it can be as much as 3,000 in some models. So there was always going to be a major problem in this sector, but it was unfortunately magnified by the predictions of some firms that car sales would drop significantly, leading them to cancel chip orders.

These forecasts proved to be inaccurate, and the upshot is that the global automotive industry could have lost as much as US$210bn in revenue in 2021 (source: Statistain).

Simultaneously, the implications for electronics – which is generally thought to account for about half of global semiconductor demand – were starting to become clear. After a brief drop in demand last spring, sales rebounded significantly as the result of the sudden shift to home-based working. With 5G and accelerating cloud adoption also contributing to demand, discussion soon turned to the likelihood of extended wait times – up to 18 months – for new chip orders to be fulfilled.

If that wasn’t enough to be worried about, the initial device-focused nature of the shortage – including for use in display products, micro-controllers and power management systems – has gradually expanded to encompass multiple other aspects of the supply chain, among them substrates, wire bonding, passives and other critical parts of the production process. The end-result has been a veritable ‘obstacle course’ for manufacturers that is without recent parallel.

UNEVEN TIMELINE

As the producer of InfoComm and co-owner of Integrated Systems Europe, trade association AVIXA has played a major role in supporting the industry throughout this difficult period. Peter Hansen, economic analyst at AVIXA, confirms that “supply issues are much bigger than the chip shortage”, adding that “manufacturing, shipping and acquiring products is all happening on a much more uneven timeline. In some cases, margins are hurt. In others, extra revenue is foregone.”

However, Hansen does place this in the context of the spring 2020 period when demand for many products – albeit relatively briefly – went into decline. “That was extremely difficult and led to layoffs at almost 40% of pro AV businesses, as described in our 2021 second quarter Macroeconomic Trends Analysis (META) report. That’s a very serious and difficult problem. Current issues with supply and the chip shortage are lengthening lead times and causing some folks to turn down contracts, but overall businesses are managing the challenge.”

However, Hansen does place this in the context of the spring 2020 period when demand for many products – albeit relatively briefly – went into decline. “That was extremely difficult and led to layoffs at almost 40% of pro AV businesses, as described in our 2021 second quarter Macroeconomic Trends Analysis (META) report. That’s a very serious and difficult problem. Current issues with supply and the chip shortage are lengthening lead times and causing some folks to turn down contracts, but overall businesses are managing the challenge.”

In terms of AVIXA’s support of AV professionals, Hansen points to the provision of comprehensive market research – including the Q3 META report that was devoted entirely to supply issues – and the facilitation of conversations between AV buyers and sellers so they could identify solutions to specific shortages.

FUTURE IMPACT

As to the future, Hansen sounds cautiously optimistic while acknowledging the possible impact of various unpredictable factors. “We believe we’re near or perhaps just past the absolute worse of the crisis,” he says. “We do expect things to get better throughout 2022, with the second half of 2022 feeling relatively normal. But there are a lot of unknowns here. If Omicron or other variants disrupt the progress facilitated by vaccines, things could get worse. If Covid-19 fades and consumers return more fully to in-person than expected, spiking demand could also worsen supply issues.”

There is also the fact that chip manufacturing is “an extremely long-term, capital-intensive process” that will likely require greater supply chain planning in the future to minimise the effect of any further shortages – more of which anon.

Installation contacted a broad cross-section of pro AV manufacturers for this report, and they reported varying degrees of impact. Brad Hintze, executive VP marketing at Crestron, says the chip shortage has brought “a lot of uncertainty” into production around the world. “Every day you hear of companies that have had to slow or halt production while they wait for chips. We face similar challenges. [So] we are working daily with our component suppliers to place orders very early, forecast needs for the next 18-24 months, and ensure we can receive the components as quickly as possible.”

In terms of new products, Hintze reveals that many of these are being engineered with “the ability to more easily swap out components – giving us flexibility to shift to different components if a particular manufacturer continues to see supply chain issues.” Indeed, he notes that the challenges of the last few years “push us to continue to innovate on our supply chain and the way we build products. [For example] we have built-in more burst capacity to quickly build products as soon as components become available.”

POWERING THROUGH

At Powersoft, orders for a major project made in early 2020 “along with our decision to maintain production” during the Covid crisis served to put the company in a strong position. Antonio Peruch, Powersoft’s production engineering director & co-founder (see interview on page 10), remarks: “Thanks to an effective financial management, we were able to invest in essential materials for production, thus minimising the impact on raw component shortage. Whilst our lead time has increased for obvious reasons, today we are able to supply our partners within 10–12 weeks.”

As of mid-December 2021, demand was “at least three times greater compared to pre-Covid”, and this is in part due to overbooking of components by some manufacturers. Fortunately, Powersoft had already placed all its orders for components for 2022 and is currently working on its 2023 schedule. There is no doubt that rigorous planning has served the company well. Peruch: “Without proper planning already done during the containment period, we would have found ourselves in an untenable situation due to the delays in the supply of components. Producing in Italy with a well-planned European distribution has allowed us, by having mixed purchases with international brokers, to satisfy our needs.”

Martin Audio’s experience of the chip shortage has not been dissimilar, with the company’s approach to stock standing it in good stead. As opposed to some industries where a ‘just in time’ ethos is prevalent, director of marketing James King says that Martin Audio “has always been a little more pragmatic, working with suppliers on longer-term commitments while trying to carry a level of stock holding”.

Martin Audio’s experience of the chip shortage has not been dissimilar, with the company’s approach to stock standing it in good stead. As opposed to some industries where a ‘just in time’ ethos is prevalent, director of marketing James King says that Martin Audio “has always been a little more pragmatic, working with suppliers on longer-term commitments while trying to carry a level of stock holding”.

Equally, through the pandemic, the company was, according to King, “always open for business, so we continued to provide such commitments to suppliers which helped them greatly and helped us provide some level of continuity”.

That’s not to say there hasn’t been a negative impact, though. “Despite these preparations, we have not been unscathed by the challenges,” says King. “Every day is a moving feast, managing suppliers, allocating incoming stock, and trying to provide sufficient visibility to customers so expectations of the sales channel can be managed. Increasingly, everyone understands that it’s a global issue affecting every industry, so they just want as much clarity as possible.”

The company’s early planning and ongoing proactivity will help to ensure that disruption is minimised, says King, although thought is being given to “our product roadmap and perhaps delaying any new electronics to avoid unnecessarily exasperating the situation”. But this will not impact their sales projections for business overall, which “continues

to look very healthy”.

Nonetheless, he predicts a longer timeframe for the resolution of the component issues than some others interviewed for this article: “We don’t see this chip situation getting anywhere back to normal for at least another two years, so we must be bold on occasion and work evermore closely with our suppliers.”

DIVERSITY DECISION

Aurora Multimedia Group’s product range includes AV-over-IP and HDBaseT solutions, among many others. According to CEO/CTO Paul Harris, the move to further diversify the product line-up to deal with difficult-to-source parts has been a key part of its approach to the component shortages, along with increasing lead times to ensure sufficient availability of stock. “Accommodating growth has been the bigger challenge as some ICs are 52 weeks out.,” he says. “That means depending on the product it could take over a year to increase production and there is a huge risk as by then the requirement may no longer exist. We have not had to halt production yet but we are limited to how much additional relative to the initial forecast we can produce.”

Pondering the industry impact more generally, Harris forecasts problems for those companies who do not have the capital to finance one-year’s worth of parts in advance. “It will also cost customer sales, but could be an opportunity for new customers as they search for alternatives,” he says. “An ‘I am a brand X house’ mentality will not work anymore for dealers or they could find themselves not delivering product to their customers to achieve the project objective.”

While it might be said that manufacturers are on the frontline of this particular crisis, there has obviously been a knock-on effect for integrators, distributors and other industry stakeholders. For Pure Audio Visual, an integrator specialising in professional communication and collaboration systems, the impact started to be felt in August 2020 when some category 1 suppliers started running out of stock of key products such as control processors and DSPs.

Adapting system designs and sourcing alternative products has helped to mitigate the situation. Tony Crossley, Pure AV’s special projects director, recalls a complex AV meeting room project. “Between finalising the design and receiving the order, the control system, AV-over-IP transcoders and DSP were no longer readily available from our supplier, who was now quoting lead times that our client wouldn’t find acceptable.,” he says. “To meet the client’s deadlines, we needed to find alternative products and revise our design accordingly. We spoke to several manufacturers and, through a combination of product substitution and creative programming, ultimately provided a system that maintained functionality, was just as intuitive, and delivered at the equivalent cost. The installation was then able to go ahead as scheduled.”

Adapting system designs and sourcing alternative products has helped to mitigate the situation. Tony Crossley, Pure AV’s special projects director, recalls a complex AV meeting room project. “Between finalising the design and receiving the order, the control system, AV-over-IP transcoders and DSP were no longer readily available from our supplier, who was now quoting lead times that our client wouldn’t find acceptable.,” he says. “To meet the client’s deadlines, we needed to find alternative products and revise our design accordingly. We spoke to several manufacturers and, through a combination of product substitution and creative programming, ultimately provided a system that maintained functionality, was just as intuitive, and delivered at the equivalent cost. The installation was then able to go ahead as scheduled.”

With shortages set to last a while yet, Crossley says the firm will take a “multifaceted approach” that entails working closely with category 1 and 2 suppliers to ascertain their stock levels and roadmaps for deliveries into the UK. He adds: “We will forward order and hold stock of a more extensive range of products, and we will be working closely with our customers to keep them informed and, where necessary, manage expectations. We are also evaluating solutions from an extended range of manufacturers with a view to expanding the breadth of products that we consider in the development of our system designs.”

Supply chain evolution

Once the present challenges have receded into the rear-view, it’s inevitable that thoughts will turn to evolving supply chains so the impact of any future shortages is more muted. Crossley is not alone in indicating that suppliers are likely to hold more stock

at any one time than has been the case in recent years.

“Over the last 20 years, many of our suppliers moved stock away from individual countries to central European warehouses,” he says. “I suspect the smarter ones will now be looking to hold inventory in the UK, giving them a clear commercial advantage in the UK marketplace.” In addition, whilst there had been overall deflation in the value of AV products for some time, there now seems to be “inflation” creeping into the AV market. “Many of our suppliers have either increased prices or notified us of imminent increases. Also, we are seeing a flattening of the technology curve in some of our product lines. Add all-time low interest rates into the equation and suddenly there is a compelling business case to hold stock.”

For AVIXA, Hansen envisages more of a local or regional focus through near-shoring – outsourcing processes to a nearby country. “Manufacturers will want to move production not necessarily in-country, but to a more local, low-cost country. For chip manufacturing, in particular, countries see this as a borderline national security issue. They don’t want to have to rely on a single foreign country for a certain type of chip. As a result, many countries are supporting massive investments in chip capacity. The long-term legacy of that will be a much more robust chip manufacturing supply network, with options to source similar products from many more locations.”

There also seems to be a willingness to explore opportunities for manufacturers to act together in a more coordinated way – possibly through collective ordering of components in larger quantities.

As King remarks: “There may be avenues that could be explored in terms of the emergence of ‘buying groups’ where manufacturers band together with suppliers to provide greater visibility and volume commitments that could potentially mitigate to a degree. However, that is also a fraught exercise to engineer and maintain.”

As King remarks: “There may be avenues that could be explored in terms of the emergence of ‘buying groups’ where manufacturers band together with suppliers to provide greater visibility and volume commitments that could potentially mitigate to a degree. However, that is also a fraught exercise to engineer and maintain.”

EMERGING FACTORS

Of course, even when the Covid-19 pandemic does finally recede, there will be other emerging factors to concern everyone – not least the ever-growing threat to manufacturing facilities and supply chains from climate change-related extreme weather patterns. So, ultimately, strengthening the lines of dialogue with customers and between industry stakeholders is going to become even more critical as we progress through 2022 and beyond.

Mulling the likely legacy of the shortages, Crestron’s Hintze observes: “Planning ahead and transparent communication are super-important. Our channel needs to work closely with customers to plan for their product needs as early in the project lifecycle as possible, then place orders so manufacturers know the real demand and can build to meet those needs.

“Transparently communicating with customers about the timing for delivery and expectations for lead times is also a crucial need for our industry to navigate this together.”

The second part of this special report is available here. Click here to read our exclusive Q&A with Powersoft’s Antonio Peruch.