The market for visualisers has grown at a steady rate in recent years and looks set to take off in the near future. The education sector in particular is leading the charge, as Steve Montgomery finds.

With the demise of the overhead projector in favour of whiteboards, flat-panel displays and projectors, a slot was recently created for the visualiser. This device, also known as a document camera, is capable of projecting an image onto a screen or through a video port directly into a projector or panel to show papers, photos and small objects for education, training and general presentation applications.

Many large AV manufacturers now produce visualisers. They are accompanied by specialist manufacturers such as Genee Vision, Lumens and Elmo. A new report from Futuresource Consulting evaluates market size and areas of focus throughout Europe. It includes areas of interest for business development within the AV installation industry. The report concentrates on the education market, which is currently the leading early adopter.

Colin Messenger, Futuresource analyst and report author, explains: “Visualisers are not a new product: many current manufacturers had products available when Futuresource first researched the market in 2002, though total sales were very low.” The report indicates that visualisers are often ‘follow-on’ products as schools that already have interactive whiteboards adopt them as a complementary device. In 2002 there were only 50,000 whiteboards installed in schools in the UK and fewer than 10,000 in the rest of Europe. Now there are over 1 million installed across Europe, indicating a sizeable market which is likely to ‘pull’ products such as visualisers into schools as they become more technically literate.

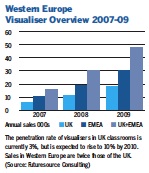

Rates of growth, in terms of number of units and total value, are expected to be large over the next five years, rising from 11,000 units in 2008 to 30,000 annually by 2010. Currently just one in 30 UK school classrooms has a visualiser. That will increase to one in 10 by 2010. Sales across Western Europe are twice the size of the UK, with 50,000 visualiser sales forecast in 2009. The UK market is valued at £12 million in 2009, and a 53% increase is forecast in 2010 bringing the value to £18 million, with the average price at £700.

Messenger adds: “Considering the normal bell-shaped penetration rate of high-tech products, in which the maturity level of 40% deployment will correspond roughly with the peak rate of sales, we are well below that at roughly 3%. That is a tiny figure and we consider the market to be at the ‘tipping point’ of a rapid rise. Once countries get started they leap very fast. These are fast-track products that penetrate the market very quickly, which is why we expect such rapid growth. In terms of global markets, the UK and Europe are some way behind the US where the growth is already being experienced.” The implications for the AV industry lie in the opportunities for follow-on sales. New products with greater functionality will open additional applications and market sectors, allowing higher-value sales to be made.

www.futuresource-consulting.com