Futuresource Consulting says it expects the LED market to surpass 2019’s results, with sales of $6.5billion this year – despite the pandemic. Sales had dropped $750million to $5.6billion in 2020. The latest report from the market research agency reveals a strong market rebound, combined with an accelerated pace of LED adoption.

“Although global sales fell by 12% last year, the market performed better than the expectations of many,” explained Chris McIntyre-Brown, director, Futuresource Consulting. “That’s all down to China’s recovery, which rallied far faster and far stronger than expected, accounting for more than half of all global sales in 2020.

“North America gave some resilience to the LED market in the Americas. Overall, EMEA was the hardest hit region. Yet its fragmented nature and the variations in pandemic response mean there were vast differences in performance between constituent countries.”

Along with the rapid recovery in China, the global pandemic also saw many Chinese LED vendors call international staff home to focus on domestic opportunities, says Futuresource. This drove growth in China’s tier two through to four cities, but also created fierce competition for projects, which saw many smaller businesses fail.

At the same time as Chinese brands began to retreat, many major professional display brands in the LED space began ramping up their operations. This has radically altered the market landscape, and underlines the strength of these international brands, who are able to reach globally and support locally, maintaining excellent levels of support throughout 2020. The long-term future of many Chinese brands looks increasingly challenging, as Samsung, LG and others continue to flex their international muscle.

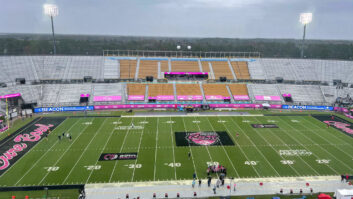

Focusing on the verticals, the majority were heavily affected last year, with retail, media and advertising, and stadiums and venues the hardest hit. However, Futuresource expects a full recovery for all three.

There have been some highlights on the landscape. Virtual production was an opportunity directly linked to the pandemic, offering numerous creative and financial benefits to end users. It’s been a particular lifeline for the LED industry, not only from a product point of view, but also because it allowed rental companies to utilise stock and warehouse space for studios and set builds.

The control rooms vertical has also seen a rapid uptick in demand for LED. Interest has been growing for some years, but 2020 was the tipping point, with mission-critical control rooms, particularly in the energy sector, beginning to adopt LED. Despite the pandemic, the control room vertical grew 2.7% year-on-year.

“Another challenge for the industry is the barrage of marketing terminology that’s currently in use,” said McIntyre-Brown. “Terms like SMD, IMD, Multipixel, COB, GOB, MiniLED, MicroLED and many more are being used by companies as they try to differentiate in an increasingly crowded marketplace. While this makes sense at a brand level, it is ultimately detrimental to the wider industry. We expect three technology types to coexist in the market for the foreseeable future, SMD, MiniLED and MicroLED, all underpinned by chiplets and Red, Blue Green (RGB) pixels.”

Narrow pixel pitch (NPP) still continues to perform strongly, decreasing by just 1% in 2020 against standard LED, which fell 24%. Much of this success was attributed to strong sales in China, but major western markets also showed a strong appetite for tighter pitches.

However, most of the NPP action took place above P1.2mm, though Futuresource expects this to be a temporary adjustment in a clear trend towards tighter pitch solutions for both indoor and outdoor segments, which is covered in more detail in Futuresource Consulting’s recent MicroLED report.

“As the market grows in maturity, the push towards all-in-one LED installations will shape the long-term future of the industry,” added McIntyre-Brown. “However, we are at a critical point, with some integrators attempting to install LED without the required skills. Comparisons have been made with the LCD video wall category ten years ago, with many vendors now launching accreditation programs in direct response.

“Despite the challenges, there’s a favourable future ahead for the industry. Our forecasts show a strong rebound next year, with year-on-year growth of 30% resulting in sales way beyond the $8billion mark. Looking further ahead, we expect to see MiniLED and MicroLED products propel the industry into a new phase of growth that powers through the $15billion barrier by 2025. Indeed, this is why Futuresource has also recently published an in-depth report focusing specifically on the MicroLED landscape.”