Specialised and high-resolution displays are fuelling an expanding demand in the medical sector across a range of applications, writes Steve Montgomery.

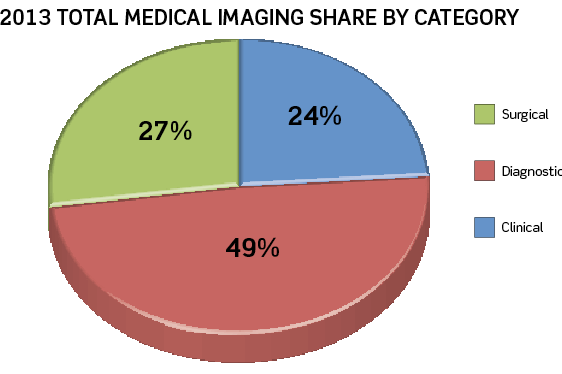

The worldwide market demand for medical imaging displays used in clinical review, medical diagnostics and surgical procedures, is showing strong growth, according to the new NPD DisplaySearch Specialty Displays Report. Between 2013 and 2017, global revenues for the displays used in surgical procedures and clinical review are each expected to grow at a compound average rate of 9%. Growth in diagnostic displays is forecast to increase 5% per year.

Several key trends in the flatpanel display market, including the shift to LED backlighting, colour displays that accurately show both colour and grayscale images, large high-resolution 4MP and 6MP displays that can be split to emulate two side-by-side displays, together with the wide availability of 4K UHD displays, will have a significant impact on the various segments of the medical imaging market.

“Technology continues to advance at a rapid pace, creating new medical imaging procedures that require sophisticated high-resolution and larger display solutions,” says Todd Fender, senior analyst of professional and commercial displays at NPD DisplaySearch. “It is this continued advancement of technology and increased demand due to an aging baby-boomer population that are the largest contributing factors to forecast growth.”

Varying requirements

In the surgical display market, larger screens with higher resolutions are becoming more common and affordable, and many are already being installed in surgical rooms as collaboration among medical professionals, both on-site and virtual, becomes more popular. The fastest area of growth is expected from screens that are 60in and larger. Resolutions of 2MP currently provide 74% of revenue in the surgical display category. However, 8MP displays are forecast to grow 83% by 2017. According to Fender: “A larger high-resolution screen makes it much easier for more than one person to view it at the same time, and many of these screens are used for live teaching.”

Unlike surgical displays, the clinical-review display market does not require displays with resolutions greater than 2MP and screen sizes larger than 22in. Demand for the most popular screen sizes (19in and 22in) with preferred aspect ratio of 4:3 and 5:4 will be affected by lack of supply as manufacturers change to larger, widescreen displays. “The limited supply of smaller screens, and their higher prices, may entice some clinical display buyers to transition to larger displays, higher resolutions, and wider aspect ratios in order to reduce acquisition costs,” Fender said.

The number of radiology investigations continues to increase annually, spurring growth in the diagnostic display market. The 21.3in display, now comprising 67% of the market, will continue to dominate this category. However, due to specialised panel and backlight requirements, few manufacturers participate in this niche market. Those that do participate have limited capabilities and some run on older, less-efficient production lines. Therefore, the costs to produce these panels are higher than the more commoditised displays, which results in relatively stable ASPs.