Our latest country survey reveals some similarities with the corresponding exercise just over a year ago – as well as some interesting differences.

With ISE around the corner, we thought it would be fitting for our latest survey to look at the installed AV market in the show’s host country, the Netherlands – and to compare the results with the last time we ran this poll, which was in our November-December 2016 issue.

We began by asking about general levels of confidence in the Dutch installation sector. The majority felt that confidence was higher than it was six months ago; the next most popular answer was that they had not changed. This is a very similar result to our 2016 survey.

We went on to ask our respondents how they thought their company’s revenues over the next 12 months would compare with the previous 12. ‘Grow by up to 5%’ was the most popular answer, with ‘grow by more than 5%’ in a fairly close second place. Again, this is broadly similar to last time, except that the top two positions were reversed.

Our next question related to business issues: specifically, we asked our respondents to pick, from a list of six, the issue that caused most concern in the context of their businesses. ‘Credit terms or other cashflow issues’ was the most popular issue, with ‘falling margins in second place’. This was in contrast to our 2016 survey, when ‘clients going for lowest price rather than best value’ was the top choice, followed by ‘poorly qualified newcomers distorting the market’. One possible explanation for this is that the response base has altered since the previous survey: because of a change in our research methodology, there is a greater representation of manufacturers in our current survey.

To gauge market activity and consolidation, we always have a question in these surveys about whether the total number of companies active in the installation market – including manufacturers, distributors, integrators, resellers and consultants, among others – was increasing or decreasing. The majority felt that this number was not changing, although more respondents thought it was increasing rather than the opposite. By contrast, ‘increasing’ was the favoured response in 2016.

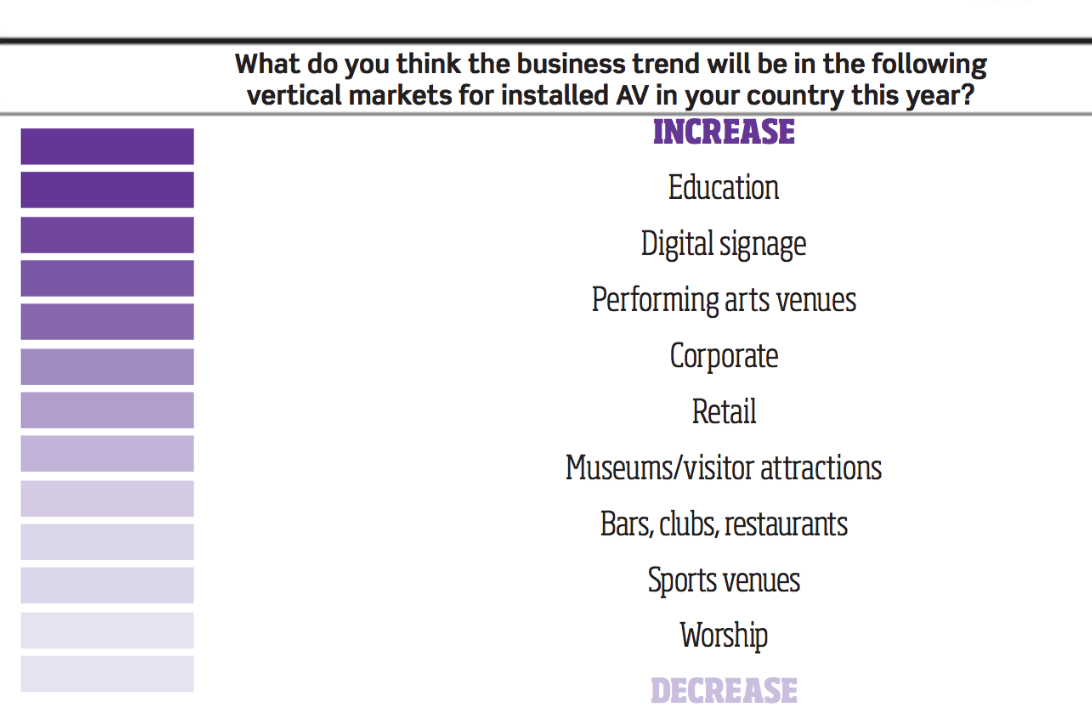

We also asked our respondents what they thought the business trend would be in various vertical sectors. It’s here where the differences from our last survey are shown most strongly. Retail, which came in last place in 2016, rose to a mid-table fifth place; conversely, corporate, which came in second place last time, finished in fourth place this time around.