High levels of growth in experiential location-based virtual reality (LBVR) is expected, according to the latest VR Tracker Report from Futuresource Consulting. Consumer spend is expected to reach $809 million by 2022 due to the spread of LBVR in shopping centres, theme parks and cinemas.

“Q1 2018 saw significant growth and rising consumer spend, which is expected to lead to full year spend of $299 million in 2018 across the four types of LBVR categorised as arcades, multi-player experiences, VR cinemas and VR theme parks,” commented Carl Hibbert, Associate Director of Consumer Media & Technology at Futuresource Consulting. “Of all four categories, ‘VRcades’ has seen the fastest take off. The category was estimated at $79 million consumer spend in 2017, accounting for 40% of all LBVR revenues.”

The VRcade category has the highest number of locations, with an estimated 4,000 worldwide, of which those in China account for 75-80%. However, the VRcades, particularly those in China, offer low-cost and consequently limited quality experiences, according to the Futuresource Consulting Global Virtual Reality Tracker Report.

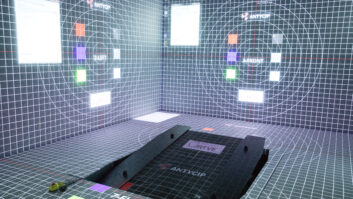

However, at the other end of the spectrum are high-end, free-roam, and interactive multi-player ‘location-based’ VR experiences. By 2022, multiplayer VR experiences will account for 41% of Global LBVR consumer spend.

Hibbert added: “Multi-player LBVR allows players to roam free, untethered and with others in a VR environment. This category is expected to have the highest CAGR rate across the forecast period, despite a lower number of installations. This is due to consumer desire to pay for sociable experiences with friends, especially in more developed markets. Furthermore, the majority of multi-player installations offer original content restricted to franchise partners, thus remaining exclusive and adding to the attractiveness.”

The report also states that notable players in the market such as The Void and IMAX are banking on using well-known franchises to support their roll-out of LBVR and support consumers’ appeal of this new tech medium. But with the cost of popular franchises restrictive for many, start-ups including Zero Latency are building their own content and experience portfolio.

LBVR is seeing popularity as the entry point for mass consumer adoption of VR, as it serves well to increase consumer awareness and engagement with the technology. The at-home market has seen slower than expected uptake, whereas LBVR allows consumers to experience VR without the large investment costs involved in purchasing hardware.