We get opinions from across the country’s installation market to find out levels of confidence and the sectors of growth to look out for in the next 12 months.

Depending on what measure you use, Italy’s position in the league table of eurozone economies varies: if you look at gross national income, it’s in third place, but on gross domestic product, it’s fifth. By any standard, it’s a major economy; and it’s one that, according to the Bank of Italy, shows business confidence levels returning to pre-2008 recession levels.

As far as the country’s installed AV market is concerned, our survey suggests that confidence is at reasonable levels; the majority of respondents claimed the same level of confidence in the installation sector now compared with six months ago; of the remainder, the majority were more confident rather than less.

It was a similar picture too with respondents’ projections of their own company’s revenue over the next 12 months: most felt that they would either rise modestly (up to 5%) or remain level. Only a small minority forecast a downturn in income.

To back up this picture of modest growth and confidence, the overall feeling of our survey was that the number of players in the Italian installed AV market is growing slowly – although no particular reasons were given for this.

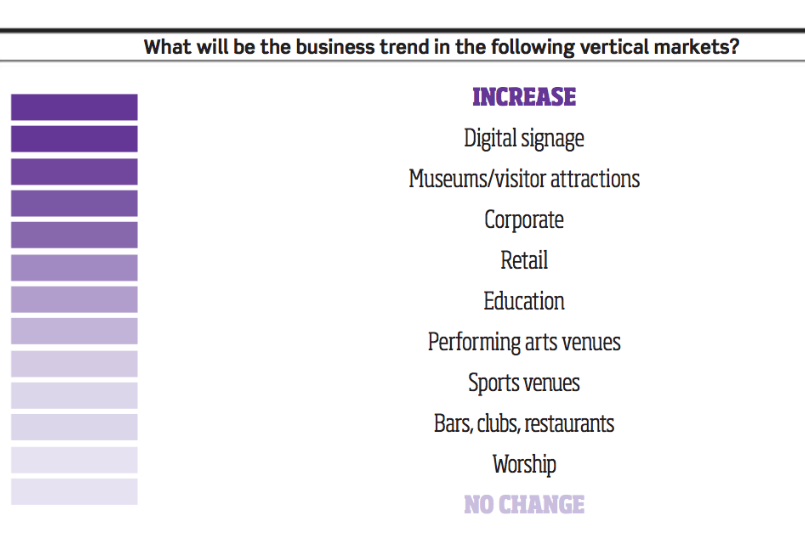

In terms of vertical markets, digital signage and, unusually for these surveys, museums and visitor attractions look to be showing the clearest signs of growth, whereas bars, clubs and restaurants, along with the worship sector, are showing no change.

When we asked what causes the most concern with regard to their own businesses, we received a very mixed picture, with four different choices from our list highlighted. ‘Poorly qualified newcomers distorting the market’ was the most popular selection; one manufacturer mentioned “a false promise from a new player regarding lower pricing was hard to clarify to end-users”. Other respondents cited credit terms, falling margins and our old favourite, clients going for lowest price rather than best value.

Lastly, respondents commented on what they would change about the way the installation market works in Italy. The majority of their comments were about training and qualifications throughout the industry. “Improve the training of technicians involved in design and installation,” said one. “There should be more consideration and skill at all levels – architects, owners, dealers, distributors,” said another. And a third expressed their wish in a very succinct, not to say abrupt manner: “Training mandatory”.