With the digital signage industry continuing to grow at a rapid rate, predicting its trajectory is far from straightforward. Ian McMurray enlists the help of the industry in trying to determine where it’s heading

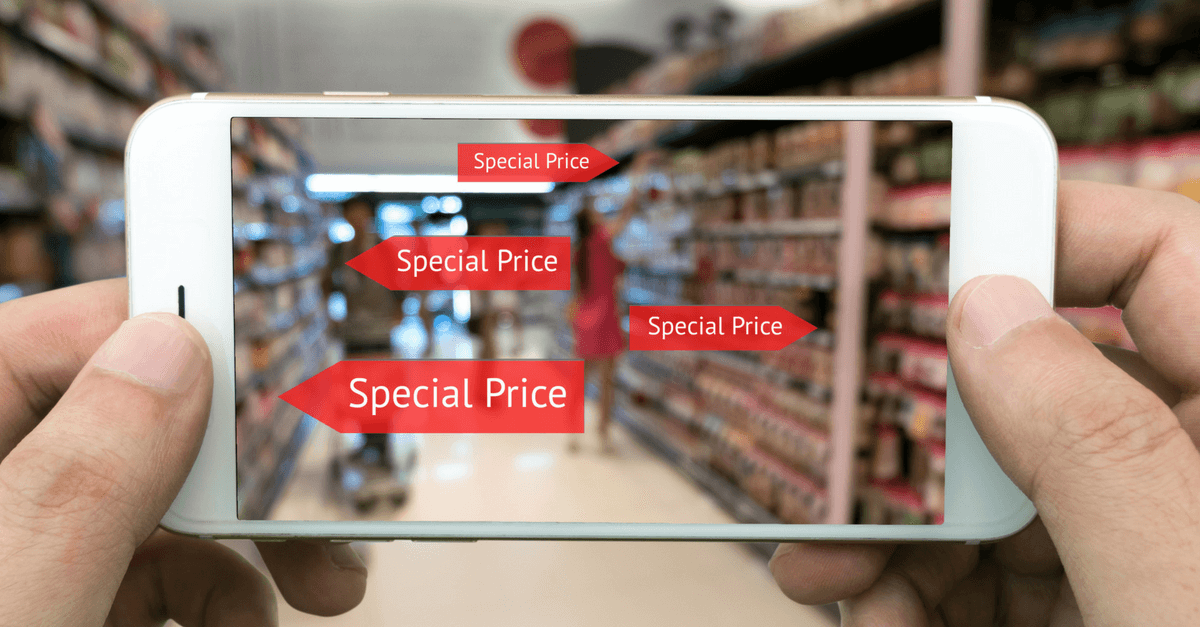

Have you heard of “Just Walk Out” technology? Maybe not – but you’ve almost certainly heard of Amazon Go, the internet behemoth’s concept bricks and mortar store – now approaching prime (sic) time. Just Walk Out technology includes cameras, sensor fusion, AI and deep learning to make possible a shopping experience where you never have to queue. It’s no exaggeration to say that, if successful, the idea could revolutionise the retail industry.

Digital signage will continue to become smarter, more connected and an integral part of the customer journey

Here’s the thing. Today, there are digital signage deployments out there that leverage those exact same technologies to create experiences that are personal, that are targeted at the individual. Digital signage could, in the years to come, be at the heart of that revolution.

But perhaps we’re getting ahead of ourselves. What will 2018 bring? Florian Rotberg, managing director of digital signage research company invidis consulting (pictured, right), provides an overview.

“We don’t expect any super-duper new technology revolutionising the market,” he says, “but digital signage will continue to become smarter, more connected and an integral part of the customer journey.”

How will that play out? It perhaps makes sense to start with screens.

UltraHD goes mainstream

“For large format displays, the most popular medium for digital signage, we expect to see UltraHD/4K resolution becoming mainstream for screen sizes above 55 inches,” notes Thomas Walter, section manager, strategic product marketing at NEC Display Solutions Europe. “Interactive displays will become more prevalent as brands seek more proactive customer engagement. Higher resolutions will facilitate this increased interaction, giving users a pixel-free viewing experience even at close proximity.”

Will those screens be based on the LCD technology that has been the mainstay not only of digital signage, but of the entire displays industry? Walter sees a popular growing alternative.

“Digital signage operators will seek ever larger and brighter ways to attract attention and narrow pixel pitch LED video walls will become increasingly popular for retail advertising, passenger information, out of home infotainment, large venue/arena signage and many more scenarios – especially where viewers might be at a greater distance,” he believes. “LED modules offer excellent benefits for seamless integration.

“As LED becomes more widespread, prices will reduce and current fine pixel pitches will become even narrower to achieve higher resolutions and more detail at shorter viewing distances – the viewing experience will be exceptional,” he goes on.

“We don’t expect that OLED will play a major role. Leading industry experts still don’t see any development in overcoming the reliability issues inherent in OLED. Although image quality is good, image retention continues to be an issue which reduces its usage in digital signage where content elements aren’t changing every few seconds as they might on TV.”

Leading industry experts still don’t see any development in overcoming the reliability issues inherent in OLED

The vast majority of digital signage doesn’t even need 4k currently

Jury out

Rotberg agrees – somewhat. “OLED and QLED will gain traction,” he asserts. “Neither technology is brand new, but it’s taken a while to get them ready for professional displays.

The jury is still out,” he adds, on how OLED/QLED will perform in daily commercial operations.

“Fine pitch LED will increasingly replace videowall display installations,” he adds, going on to note that, in the mid-term, higher resolutions – 8K – will begin to appear.

“The vast majority of digital signage doesn’t even need 4k currently,” Rotberg says, “but screen resolution is factory driven and smart phones and consumer TV market are continuously pushing the envelope to even higher resolutions.”

It’s not all about flat panel displays, however. Walter notes that projection offers an excellent alternative solution for digital signage now that large venue laser projection can deliver not only high and consistent brightness, but also maintenance-free and low cost of ownership.

“It’s a compelling solution for special and unique signage applications on 3D surfaces and other dynamic scenarios where video walls are unsuitable,” he believes.

Stephanie Gutnik, vice president, business development at Broadsign, also sees the importance of what’s on the screen.

“Dynamic content continues to catch on as a way of ensuring messaging is fresh and relevant to the viewer,” she notes. “Beyond that, security – in terms of who can access the network and modify content – will also turn into a necessary component of any RFP. Finally, ad-based digital signage networks will be focused on yield optimisation via automated workflows and data-driven decisioning.”

Intelligent tools

Walter picks up on Rotberg’s point about signage becoming increasingly smarter.

“We’re seeing the advent of intelligent signage tools which provide context-aware signage and analytics,” he says. “Instead of simply delivering standard content, it is tailor-made and directly addresses the needs of the audience. Through interaction, the engagement of the audience increases, viewing times are extended, buying rates see significant uplift and the investment into the displays quickly pays off.”

He goes on to explain that NEC leafengine is a middleware that integrates more than 30 different sensors to provide context-aware signage experiences for customers, while NEC Field Analyst enables these engagements to be measured and analysed to increase the potency of marketing.

To achieve this, content management systems will need to evolve to deliver sophisticated functionality.

“Content management systems will become complete tech stacks that not only manage a network’s back-end operations but front-facing requirements, such as sales,” believes Gutnik. “This type of platform enables efficiencies that reduce operating expenses and, when advertising is involved, ensure the sales pipeline is set for success.”

Rotberg envisions a future that sees the CMS market fracturing into two.

“The basic digital poster projects – non-interactive – which probably make up 80 per cent of all screens currently, will commoditise,” he says. “License fees will drop dramatically. This digital poster market will be dominated by players like Google, Adobe, or software add-ons from the display manufacturers.”

This digital poster market will be dominated by players like Google, Adobe, or software add-ons from the display manufacturers

Bells and whistles

“At the top end – which comprises around 20 per cent of all projects – very sophisticated, omni-channel and IoT/retail experience solutions will be the Champions League of digital signage,” he continues. “These solutions will manage hundreds of APIs, communicate with complex media asset management systems and provide users with all the bells and whistles imaginable in digital signage.”

“We believe these market trends will be very challenging for most existing digital signage software suppliers,” he adds. “The pressure is huge to join forces or to consolidate in order to offer a large installed base of users.”

Whether it’s screens, players or content management systems, the future of digital signage will, first and foremost, be about creating engagement. Already, we’re light years ahead of where we were only a year or two ago. The question is: have we gone as far as we can go?

“We’re just scratching the surface,” exclaims Gutnik. “As we continue to experiment with dynamic content and mobile interaction, we will have a better understanding of the means by which viewers wish to engage with content conveyed through digital signage.

“The easier and more enticing we make it for consumers to follow through with a call to action, the better we will be at planning, delivering and measuring campaign success.”

Cultural acceptance

Rotberg sees the same situation – and uses the same phrase to describe it. He does, however, sound a note of caution.

“We have indeed just scratched the surface,” he says, “but the challenge of customer engagement is mostly not about technology, but about cultural acceptance. Even today, it would be easy to put hundreds of sensors into a store – but consumers are very reluctant to identify themselves and their purchase history to retailers.”

“The concepts and business cases are still missing key benefits for consumers, and the IT infrastructure is often still very silo-ed,” he continues. “Once these issues have been resolved, seamless omni-channel customer engagements should gain traction fast.”

Walter thinks the burgeoning Internet of Things is key – a position with which Rotberg agrees.

“We’re making excellent progress, and the IoT is supporting the industry on that journey,” Walter believes. “But we’re at the very beginning of the IoT age, and there is still a lot to come. It’s important to be involved now, as it’s still relatively easy to create competitive advantage out of context-aware signage applications.”

Digital signage is leveraging the same technologies that Facebook, Google and Amazon have turned to such advantage. Those businesses rely on collecting as much personal data – so-called ‘big data’ – about you as possible so that it can target you with messages it not only believes, but knows, are relevant to you. Rotberg is surely correct – that some consumer resistance is inevitable – but expect to hear much more about the role of artificial intelligence in digital signage in making sense of that data, as well as in delivering even more individually customised experiences.

It’s ironic, surely, that the same technologies that many believe have made a substantial contribution to the ascent of online shopping and the decline in bricks and mortar retailing show the greatest promise for reviving it – and that the company who pretty much invented click-to-buy is at the forefront of that revival.