Sean Wargo, senior director of market intelligence at AVIXA is a busy man this week as he will be highlighting the future business opportunities and trends for the audiovisual industry at several Conferences and Seminars every day at ISE. Here he gives us a sneak peek into his findings….

No one knows the AV industry better than we do and AVIXA market intelligence can help businesses gain a competitive edge and stay abreast of industry trends. We work with leading global research firms to collect, analyse, and report on emerging markets, current and future product sales, end-user buying habits, and the macro-trends impacting the pro-AV industry. Below are some highlights from AVIXA’s latest research.

Overall AV industry forecast

The pro-AV industry will grow from $186 billion in 2018 to $230 billion by 2023, according to AVIXA’s 2018 AV Industry Outlook and Trends Analysis (IOTA). We’re expecting compound annual growth to be 4.3 percent from 2018 to 2023, which is in-line with our previous estimates and is consistent with GDP growth estimates. Regions around the world are growing, with Asia poised to take the lead as the largest market, capturing 36 percent of the pro-AV market by 2023. We’re estimating 2.6 percent CAGR for Europe. (avixa.org/IOTA)

Macroeconomic factors

While industries and economies are generally flourishing, trade policies and protectionist views are acting somewhat as headwinds, according to the IOTA. Uncertainties related to Brexit, Brazil’s recent election, low oil revenues, and fiscal deficit put downward pressure on the pro-AV industry. Factors leading to growth include Europe’s real GDP increasing from 1.9 percent in 2016 to 4 percent in 2017, new manufacturing hubs emerging in Southeast Asia and South Asia, and improvement in the U.S. economy from fiscal stimulus and strengthening business investments.

Trending technologies

According to the IOTA report, there are five key technology trends driving growth in pro-AV:

- Advances in audio are being fuelled by voice assistant integration, IP connectivity, and artificial intelligence.

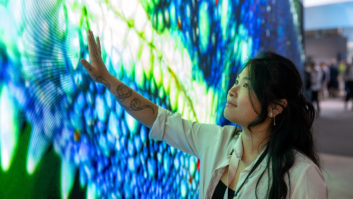

- Display technologies, which include direct-view LED video, LCD, OLED, and Micro LED, are poised to impact different markets. For example, the cinema pro-AV market, which is projected to grow 8.6 percent over the next five years, is ready for a technology upgrade. For cinema, direct-view LED technology offers a disruptive alternative to traditional projection, with several notable advantages, though at a currently high cost.

- IT and cloud investments are increasing as buyers outsource infrastructure to take advantage of greater flexibility, agility, and potential cost savings of cloud deployments. Cloud videoconferencing service revenue grew from $351 million in 2016 to $422 million in 2017.

- Smart buildings are expanding opportunities for the pro-AV industry to provide efficiency and cost savings by integrating multiple networked devices, from lighting to video surveillance.

- Artificial intelligence is increasingly being implemented into pro-AV solutions to connect users and their environments. AI may be most applicable to conferencing and collaboration for initiating meetings, making video calls, and sharing real-time data through intuitive voice commands.

The importance of solutions

The integration of technologies is what differentiates the pro-AV industry from others. Many of the technologies, products, and services for audio and video capture, processing, storage, and displays are similar across different applications, but combined, they meet different needs and business outcomes. According to the IOTA report, the top solutions include conferencing and collaboration, learning, live events, digital signage, security and surveillance, and performance and entertainment.

Conferencing and collaboration lead the pro-AV industry, generating $30.8 billion in global revenue in 2018, while learning follows closely behind ($25.8 billion) as digital and connected learning is widely implemented. Video displays continue to drive learning solutions.

To learn more about AVIXA’s market intelligence, visit avixa.org/MarketIntel, or take advantage of a free Main Stage (Stand 12-N110) session with AVIXA’s Sean Wargo on Friday morning at 11:00-11:30 – don’t miss your exclusive chance to get specific insights about how you can interpret and leverage the details of AVIXA’s IOTA and MOAR reports for maximum benefit!