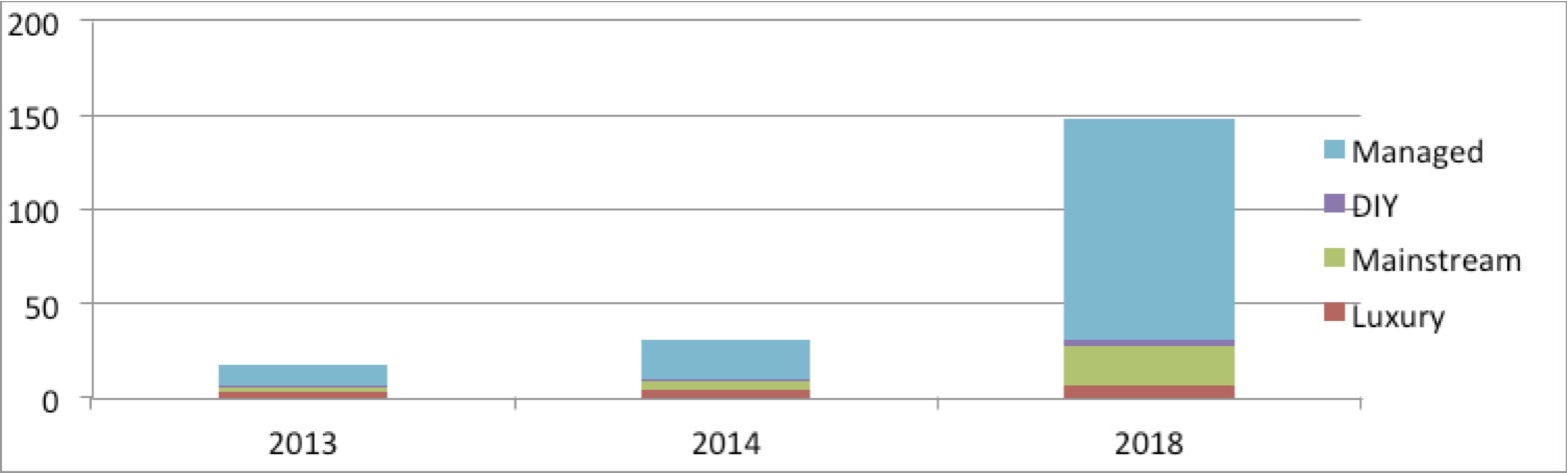

Interest in smart home technology is growing rapidly, resulting in increased demand for wireless sensing and control devices. In 2013, sales of wireless embedded smart home monitoring devices, including contact and motion sensors, smart thermostats and smart plugs, grew to 17.23 million, almost double shipments in 2012. Continuing momentum will ensure that by 2018, more than half-a-billion wireless smart home monitoring devices will be deployed around the world.

A study by ABI Research investigates the home control market along with home security and monitoring with its crossover into home energy management applications. The market can be broken down into five sub-segments, namely: entertainment control, home security and monitoring, healthcare and elderly monitoring, home control, and energy management systems.

Contact sensors for detecting whether windows and doors are closed were the most popular smart home monitoring device shipped last year, with motion sensors in second place. Both devices support smart home monitoring functionality but can also be used for additional applications such as energy management. “Combined, over 84 million contact and motion sensors will ship annually by 2018; however, it is smart plugs, smart door locks and connected smoke and carbon monoxide detectors that will see the greatest shipment growth,” comments ABI senior analyst Adarsh Krishnan.

Wireless options

Large vendors including Honeywell, GE, Nest (now Google), Bosch and UTC are increasingly adding wireless connectivity to their home devices, bringing network connectivity and remote management to their offerings to appeal to growing numbers of consumers. New entrants such as Netatmo, Dado, Sen.se and Lowe’s are bringing innovative devices to market that will have great effect on market development.

As the market for wireless smart home devices grows, so does competition between wireless protocols to capture market share. Currently it is dominated by proprietary wireless protocols but that is challenged by standards such as Wi-Fi, Bluetooth Smart and ZigBee. Each protocol has its advantages and disadvantages and some will play more to the smart appliance rather than smart device space. For example, Wi-Fi support for residential home-area networks and mobile devices facilitates easy network set-up without additional gateways or bridges but power demands will push adoption into appliances and devices with a fixed power supply. For its part, Bluetooth Smart support in mobile devices will also drive adoption in smart home devices.

“The market in Europe differs radically from the North American,” says Krishnan. “In the US, the security, telcos and cable companies lead the initiative, whereas in Europe it is the utility companies. So the emphasis is different: America focuses more on home automation and smart homes; Europe leads with energy management resulting in the initially greater penetration of smart metering, which is more focused on grid stability and energy supply balancing than providing smart dwellings, which will come later.”