Installation readers recently took part in a major survey investigating use of, and attitudes towards, audio networking. The results provide a clear insight into the thinking behind audio professionals’ choices, and the future of audio networking. Roland Hemming reports

During May and June, Installation, its US sister title SCN, and publications in the Middle East and Asia, asked their readers to complete an online survey on audio networking. The results of this comprehensive and truly worldwide survey are now in.

The survey was open to all. In particular we wanted to hear from people who don’t use audio networking technology, and there was a good response from this section of the Installation readership. Inevitably, though, the majority of responses came from people who already use this technology, so that needs to be taken in consideration when reading some of the answers.

The purpose of the survey was to try and find out how much audio networking is going on and what choices people are making.

In general we were looking at the ‘big five’ industry protocols, as well as seeing how much use there was of proprietary ones.

(Click on charts to enlarge)

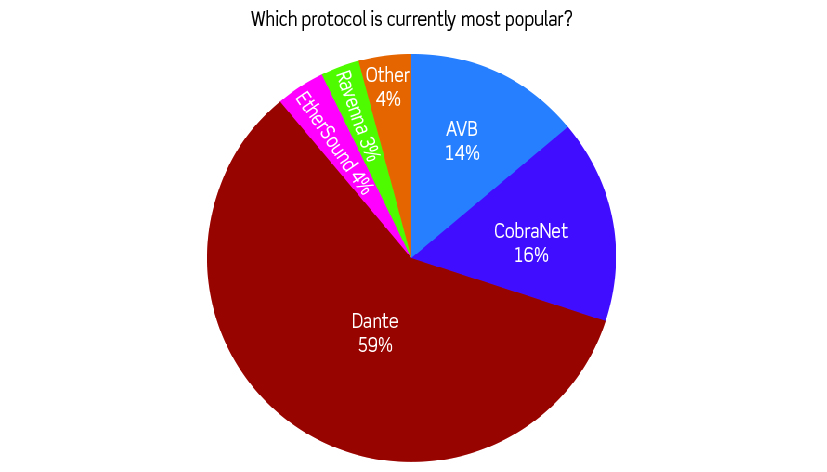

When asking which protocol they thought was the most popular there was a clear leader in Dante (59% of respondents), with CobraNet in a distant second place (16%). Anecdotally it’s still probably likely that there are more CobraNet installations out there, simply because it is the oldest, but you will read that newer protocols are now used more often.

Trends in networking

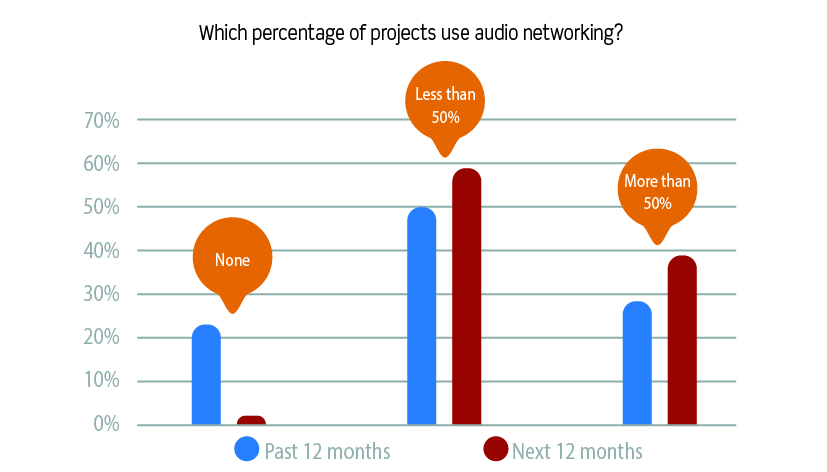

We asked how much of people’s work involved networking in the past 12 months and how much would use it in the next 12. Our survey shows a significant rise in its use. Notably 23% had not used networking in the past year but that drops to less than 2% in the next 12 months. What’s more, nearly 40% think that networking will be used in more than half of their work.

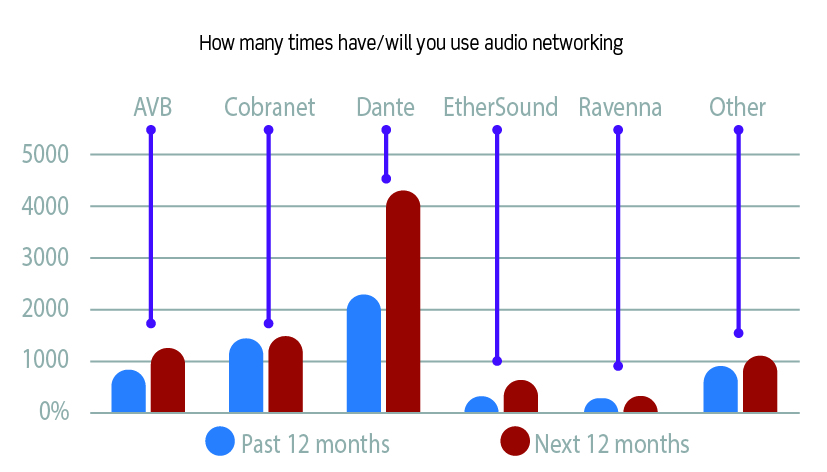

In order to find out what protocols people have used and will use, we asked about previous and future use of protocols.

Our respondents had completed over 6,000 networked projects in the last year but expect to do over 9,000 in the next – a significant leap and increase. All protocols benefit from this growth but of the 2,900 additional projects, about 2,000 expect to use Dante.

Asking why

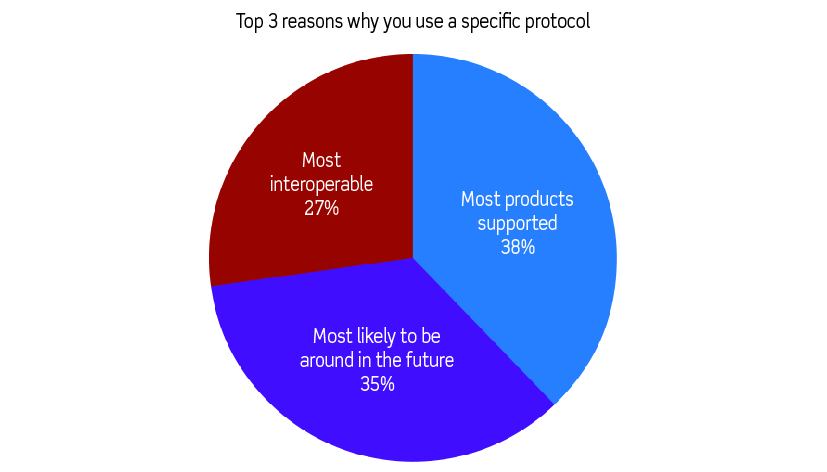

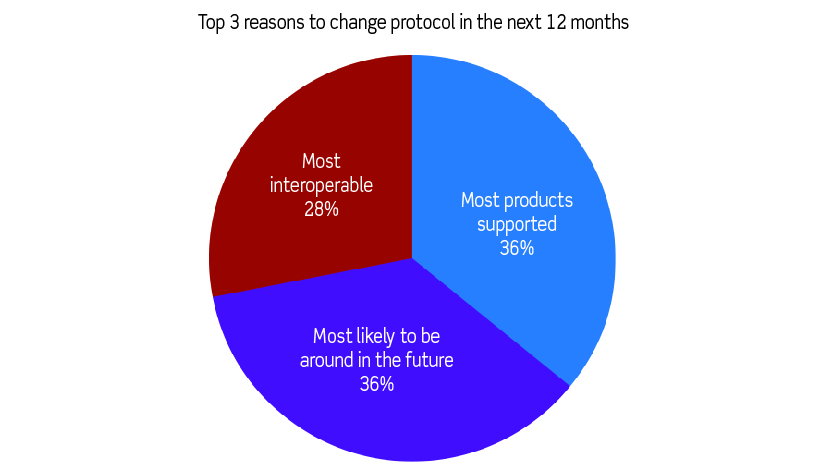

We wanted to know what thought process people went through when choosing what protocol to use, and also would make then switch from one protocol to another. The top three reasons for choosing a specific protocol are wanting a wide selection of products (cited by 38%, if one looks at just the top three answers), the confidence that the chosen protocol will be around for a good few years (35%) and interoperability (27%).

When it came to reasons for switching protocols, the same three answers came top, with a very similar distribution.

We asked people for comments and only one person mentioned that they would not use a proprietary protocol.

User satisfaction

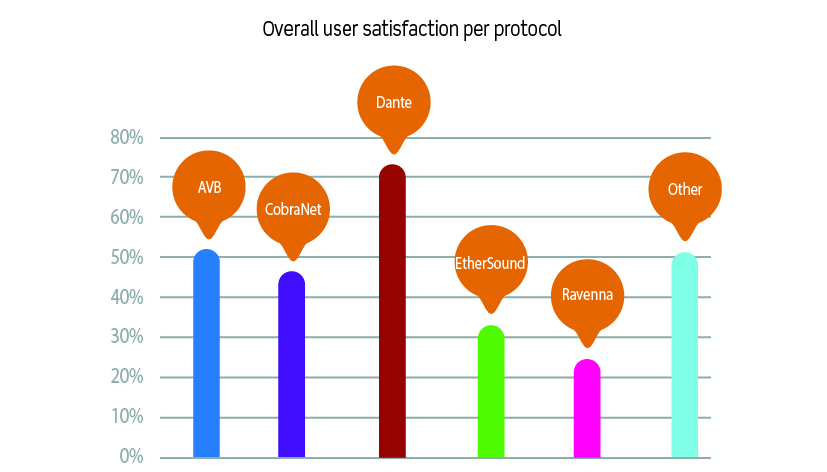

From their use of different protocols, we asked how satisfied they were with their experience. Dante was the clear leader (72% declared themselves satisfied or very satisfied); proprietary protocols and AVB were neck and neck in second place (51%).

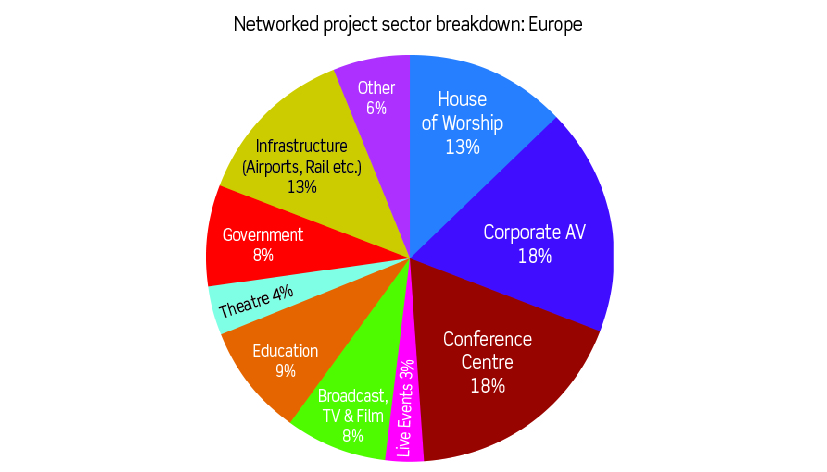

Where is networking being used?

It seems that audio networking is used everywhere, but over one-third of all networked projects in Europe are in conferencing or corporate applications (both 18% of respondents’ projects). Other sectors making use of the technology are houses of worship (13%), transport infrastructure (air, rail etc – 13%), education (9%), government (8%) and broadcast, TV and film (also 8%).

Value of networking

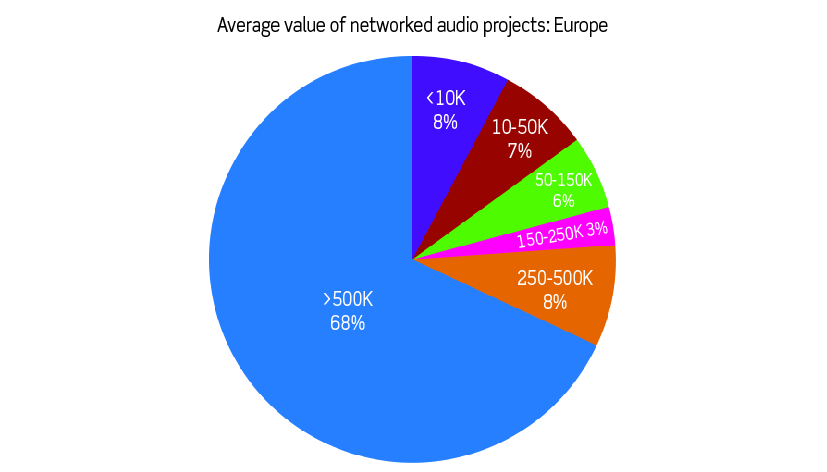

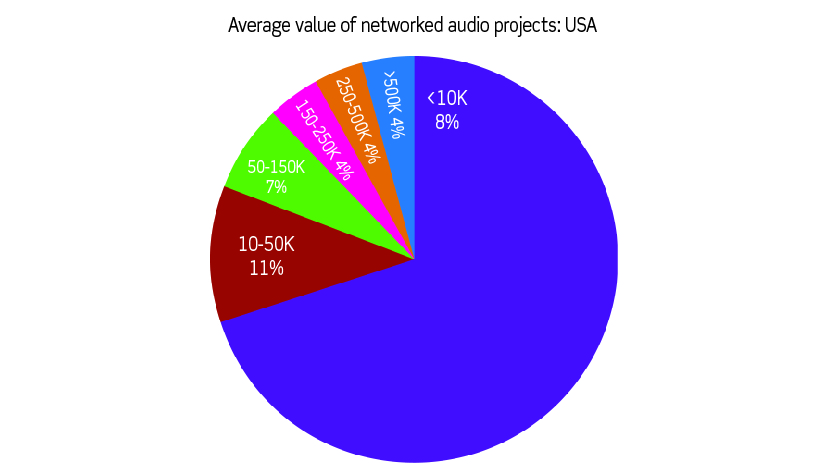

One area where there was a stark difference was in the difference in value between networked audio projects in Europe and the USA.

In Europe most of the networked projects are large ones – above €500K, whereas in the USA the majority were below €10K. Many high-value projects by necessity have to use networking as they will tend to be large sites and have large channel counts, so its not really a question of choice – networking has to be used. It could be argued therefore that the USA is a more mature networked audio market because it is choosing to use it on smaller projects, rather than just those where you have to use it.

And those non-networkers?

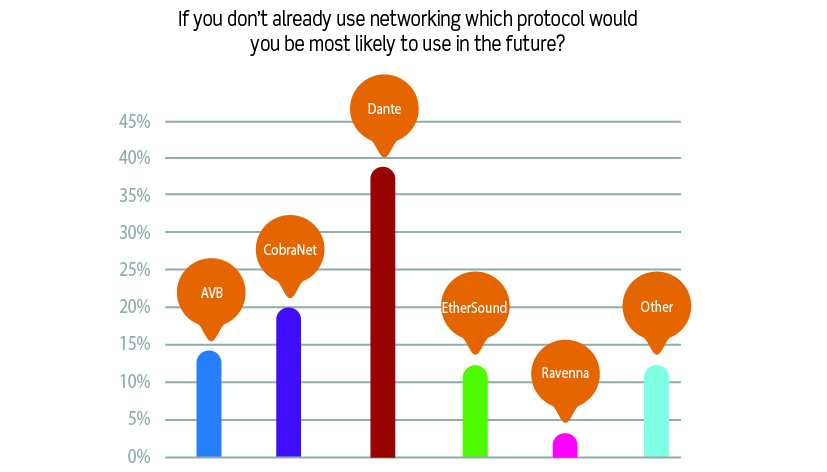

We stated in the beginning that we wanted to hear from people who were not currently using this technology. If they were to use networking on a project, what protocol would they most likely use? More would choose Dante (38%), followed by CobraNet (20%) then AVB (14%).

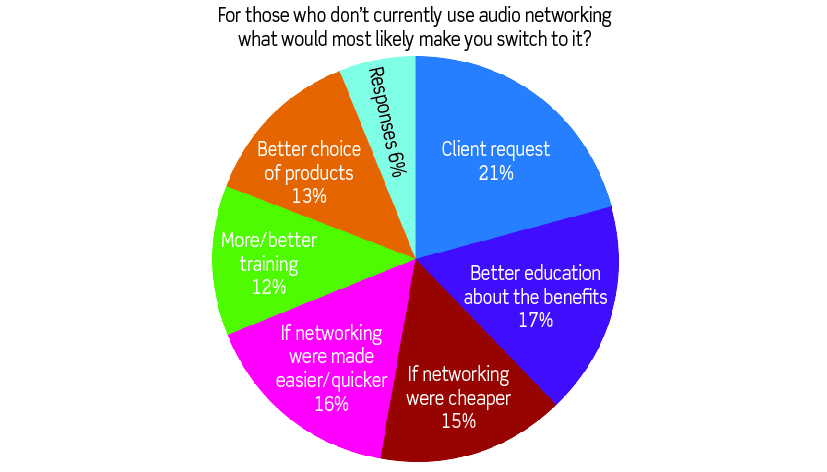

We also wanted to know what would make them switch from analogue to networked audio. Client request would be the primary driver (21%) but there seems to be a slight fear of networking from potential users, with requests for education on benefits (from 17%), for it to be easier or quicker (16%), and for training (from 12%).

Looking to the future

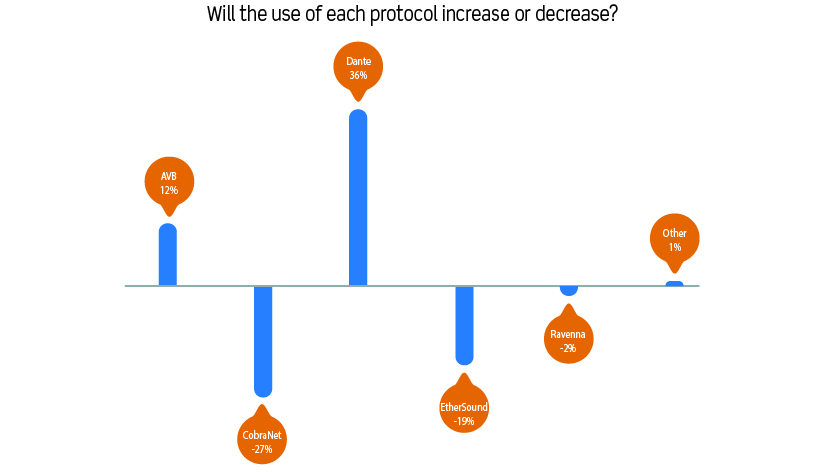

Finally we asked people to peer into their crystal balls and to predict the future for each protocol. There were only two protocols where the number of respondents expecting an increase outweighed those who thought the opposite: AVB (+12%) and Dante (+36%). The use of proprietary protocols was expected to be about the same.

Conclusions

We were impressed with the number of responses – over 600. What was also clear from reading the comments was that almost all the responses were from normal working professionals. Few people appeared to have an axe to grind on the subject, or unwavering loyalty to a particular way of doing things; most were simply trying to get the job done with the equipment the industry provides.

AVB had a mixed response and from the comments it appeared that the majority of AVB users were Biamp users. This raises the question as to whether people are using AVB because they want to use Biamp, or whether Biamp’s use of AVB helps make their product work better.

Dante leads by every metric and again supports our research data on number of products.

Users want a large variety of products available to choose from and the fact that there are many more Dante products available than anything else means that they are the most popular choice.

Dante user satisfaction is higher and this is something that is often forgotten when discussing this subject: Audinate have invested more in this area of technology than anyone else, so it’s clear that this investment has paid off in them releasing more functional and easier-to-use solutions; they are not just masters of marketing.

The data shows that users of Dante use networking technology more often than other protocol users, once people have used it they seem more confident to use it again.

The data bodes well for the future of audio networking, with a massive predicted increase in use. With 50% growth in use in 12 months, this is a lot of extra products being sold. We wonder if non-networked product manufacturers will feel a pinch, or simply that people are moving to the networked model version within their favourite brand’s offering.

What we don’t know yet is the rate of growth – linear or exponential. If it is the latter then it won’t be long before a significant minority of projects are networked – then it really is mainstream.

After sustained growth in networked product use we expect to see an increase in the number of products that don’t support analogue connections at all. This changes the paradigm, as then it gets to the point where you won’t have a decision to make between digital and analogue: the choice will be gone from some product categories as analogue won’t exist.

What is clear is that this technology is the fastest-changing thing in the audio industry and we will certainly be keeping a close eye on how it pans out.

Roland Hemming is a consultant with RH Consulting.

Our thanks to Audinate for sponsoring this survey.