Graham Cooke of Futuresource Consulting looks at why system-on-chip is becoming a key feature for many smart display vendors.

The smart displays market has evolved and changed in the last year, with further developments expected this year. Of course, smart displays incorporating system-on-chip (SoC) are not new, with Samsung having had ‘Smart Signage’ screens for almost five years. However, now is the time when there is the most availability and choice to the user, with ever more vendors offering this solution.

Why is SoC becoming a key feature for many vendors? End-users are in some cases demanding a simplified solution for basic signage, and do not require dedicated external media players and networks when a basic system fulfils the signage needs they have. This is especially true when the content being shown is often not much more than a rotation of images, basic graphics, video and free broadcast channels.

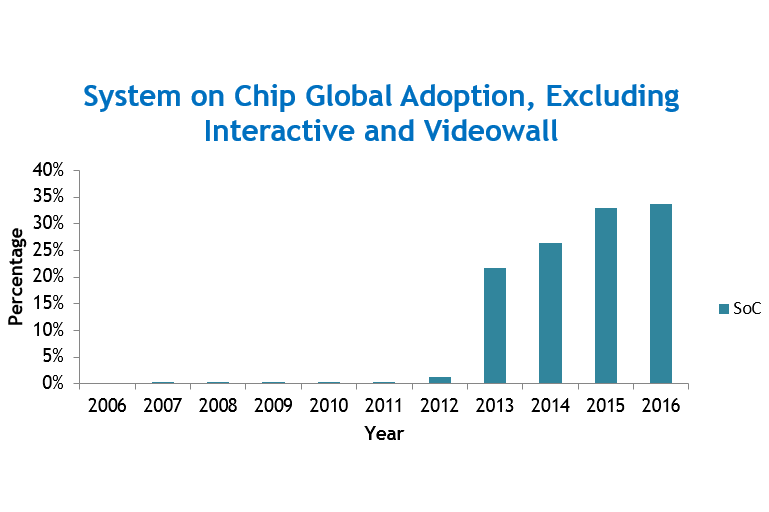

Highlighting the importance of this category, roughly a third of all displays (excluding videowall and interactive) have SoC integrated into them. Vendors have taken different approaches to this segment, with various choices around SoC, OS, range inclusion, integration level and so on all driving complicated development decisions.

Major players

Samsung is by far the largest proponent of SoC, with well over two-thirds of its display range (excluding videowall and interactive products) coming with on-board intelligence. Samsung has been less discerning than some other vendors about which model ranges should carry SoC, integrating it into virtually all of its mid-range and some high-end SKUs. 2016 saw the introduction of the Tizen-based solution, utilising the successful platform cultivated in the smart TV sector. The processors used have also developed significantly, providing more power with which to run increasingly complex signage platforms.

LG has the next largest offering of SoC, with the WebOS platform. It has been far more selective around range inclusion, opting to focus more keenly on entry-level ranges where the benefits to the end-user are perhaps more obvious.

Last year also saw new SoC market offerings from other vendors. Some of the more interesting developments have been Android-based solutions from Panasonic and Philips, with Viewsonic expected to follow in the near future. This is an interesting direction to take, as Android has a strong base of mobile and tablet users, and a wide network of developers to produce compelling, easy-to-use signage applications. The Google Play Store is a strong selling point for these displays, with a large content bank readily available.

The final announcement of 2016 came from NEC with its Raspberry Pi solution. This solution is not integrated into the display; Raspberry Pi signage computers are offered via an optional slot into the new Open Modular Interface (OMI). This provides flexibility in pre-sales along with the ability for fast swap-out should the player fail.

Utilisation rates

But what of the actual usage of SoC solutions beyond the hard sales numbers outlined above? Discussions across the industry suggest utilisation rates are as low as 10%. One reason for this is that the technology is perceived as being very lightweight and only suitable for small networks showing basic content, for example in a small retail environment. Integrators and distributors have told us that if an SoC display is selected (the only option for some brands), they will always encourage the use of a dedicated media player. Of course, an integrator will make more margin on an additional player, but there are also concerns that if the SoC fails it is a very costly and time-consuming process to have the display replaced, whereas a new dedicated media player could be sent out very quickly and instantly swapped out.

With the evolution of the smart displays from new and existing vendors, Futuresource expects to see the segment continue to grow and utilisation rates increase, helping to drive the signage market forward.

Graham Cooke is a market analyst in the professional displays team at Futuresource.