Despite a significant global decline in front projector shipments during the second quarter of 2025, emerging pockets of growth in installation, large venues, and specialised applications signal ongoing opportunities for vendors willing to adapt.

The latest report from Futuresource Consulting reveals that the worldwide front projection market experienced a sharp 24.5 percent year-on-year volume decline in Q2 2025, with market value falling 20.5 percent to US$913m. However, the picture is far from uniform: niche segments like installation and large venue (I&LV) projectors, education, projection mapping, and high-end home cinema continue to grow steadily.

David Thompson, lead market analyst at Futuresource Consulting, said: “Make no mistake, the projector market is under intense pressure from flat panels, LEDs and shifting buyer behaviour. But this story isn’t one of uniform decline. We’re seeing a sector in transition, where mainstream categories are contracting, but niche segments continue to deliver growth. Installation and large venue projectors are bucking the trend, and there’s a clear runway for vendors who focus in on the right markets.”

The I&LV segment posted nearly 11 percent volume growth in Q2, buoyed by demand for high-resolution displays in education and pre-tariff buying in the US. Regional strength was evident in France, the UK, Saudi Arabia, Turkey, and South Africa, while the Americas saw a 12.5 percent rise in this category.

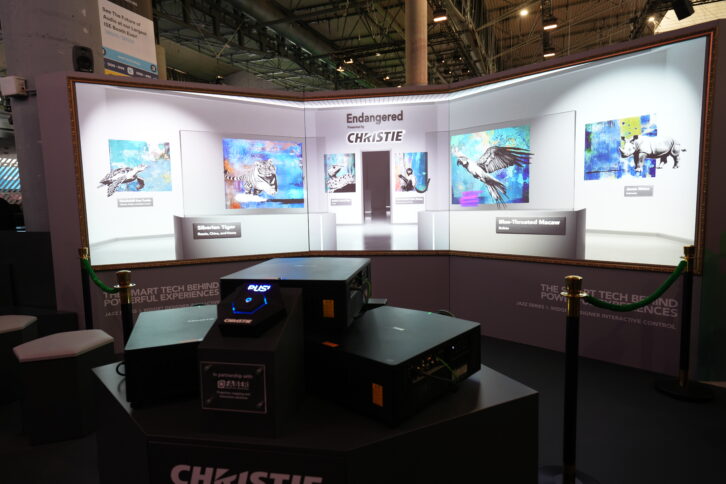

Specialised applications such as golf simulation, projection mapping, and premium home cinema continue to sustain demand, underscoring projection’s unique value where scale, flexibility, and visual impact are paramount.

In contrast, mainstream business projectors saw a steep 26.7 percent drop in volume, with significant declines in key markets such as China (-39 percent) and the US (-15.5 percent). Dedicated home projectors also fell nearly 26 percent, though India showed growth in the high-end segment, indicating pockets of premium resilience. Ultra-mobile projectors suffered the sharpest decline, down 58.8 percent year-on-year.

Looking ahead, Futuresource projects that while overall front projector volumes will continue to decline long-term, the total market value for 2025 is expected to surpass 2024, driven by the higher-value I&LV segment.

But regulatory risks loom, particularly in Europe, where the potential end of the EU mercury lamp exemption after 2027 could abruptly eliminate lamp-based projectors from the market.

Thompson added: “The future of front projection is narrower, but it’s sharper. We’re seeing a shift away from broad corporate adoption and towards specific verticals and geographies where projection still has an edge. Vendors that hone in on those niches and embrace laser, high-brightness and creative form factors will continue to find growth opportunities and financial success.”

To learn more about Futuresource Consulting’s Front Projection Market Report or to make a purchase, contact [email protected] or visit here.