During the past year or so, Installation has regularly viewed sectors of the AV industry through the prism of the pandemic era. Along with the supply chain crisis, they have irrevocably changed pro AV in both visible (remote and hybrid working) and less visible (mental processes and attitudes to work) ways. But whilst no sector has emerged unscathed, it’s no surprise that visitor attractions and live events – where pandemic conditions caused an almost total shutdown in early 2020 – were among those most severely affected.

Over two years later and, with admittedly not inconsiderable variations and inconsistencies, both sectors are much brighter. Throughout 2022, the live events calendar in music, theatre and beyond has looked comparatively normal, albeit prone to cancellations due not only to Covid – but also to strikes, travel issues, etc. Visitor attractions from museums and galleries to theme parks and project-specific installations have also returned to life, with immersive AV technologies being a particular driver.

Lee Dennison has more than 25 years’ experience of live events, working at companies including White Light and Autograph Sound before joining Creative Technology – live events arm of the NEP Group – as head of client relationships in 2021. Acknowledging that some areas of the industry “turned off quicker than a tap” when Covid struck, he says that over the past two years “everyone has had the chance to find out that there were very good bits of virtual – and some really bad bits, too. And what’s come out of that is that we like being around people having shared experiences – it’s what we’re built to do. It’s still where memories are made. So [it’s clear that why once circumstances changed] there was a huge upsurge in live events and visitor attractions.”

Lee Dennison has more than 25 years’ experience of live events, working at companies including White Light and Autograph Sound before joining Creative Technology – live events arm of the NEP Group – as head of client relationships in 2021. Acknowledging that some areas of the industry “turned off quicker than a tap” when Covid struck, he says that over the past two years “everyone has had the chance to find out that there were very good bits of virtual – and some really bad bits, too. And what’s come out of that is that we like being around people having shared experiences – it’s what we’re built to do. It’s still where memories are made. So [it’s clear that why once circumstances changed] there was a huge upsurge in live events and visitor attractions.”

Some particularly headline-making events – such as ABBA Voyage and the Van Gogh Exhibition: The Immersive Experience – have helped raise the public profile of the sectors coming out of the pandemic. But in this era it’s no surprise to discover that there are caveats, and in this case there are plenty of pending issues to be concerned about.

Growing fears of electricity blackouts during the coming months are bound to have a major impact on these highly energy-intensive sectors. They are also going to be particularly susceptible to the worsening economic conditions and cost of living crises affecting many countries (although Government action on fuel costs – for businesses and consumers – should help, assuming inflation is kept in check). Last – but certainly not least – is the ebbing away of talent during the pandemic, which is only aggravating an already profound skills shortage. In which case it’s heartening to hear that so many companies in these spaces are now ramping-up their outreach and educational efforts to ensure that more people are drawn into what remains an extremely exciting line of work.

BACK TO LIFE

Joe Graziano – who is director of sales, entertainment EMEA at audio visual solutions supplier Christie – is not alone in observing one of the principal new realities of the post-pandemic era: reduced capacities at events and attractions.

“The market definitely seems to be coming back to life,” he says. “However, although capacity is improving, there seems to be a re-balancing of what is considered an acceptable and satisfactory capacity, with 70-80% of the pre-pandemic capacity becoming the norm. This certainly gives the impression of a less hectic environment and has decreased waiting times as a result, so perhaps the overall user experience has been positively impacted and is attracting new visitors.”

Hans Christian Stucken, global marketing advisor at media & control systems company AV Stumpfl, says that for a long while during the pandemic period all parts of the supply chain were “not scared, but very wary of investing because they weren’t sure what the ground rules were going to be [when things began to open up again]. But it has definitely bounced back now in the sense that [after] a long period of consumers working from home, there seems to be a growing hunger for shared experiences in the physical world. So after what you could say has been a hibernation-like period where it was next to impossible to experience these things, there has been [renewed activity around new attractions], with immersive being a buzzword that is used a lot.”

There is also plentiful evidence that companies who have recently diversified – before and/or during the pandemic – have been well-positioned to benefit as the world opened up once more. South Africa-based international supplier, distributor and manufacturer of events technology solutions Stage Audio Works is a case in point. Its manufacturing business, in particular, has expanded in recent years, with one of its latest ranges – the Plus Audio family of loudspeakers targeted at touring and fixed installation applications – launching in 2021.

There is also plentiful evidence that companies who have recently diversified – before and/or during the pandemic – have been well-positioned to benefit as the world opened up once more. South Africa-based international supplier, distributor and manufacturer of events technology solutions Stage Audio Works is a case in point. Its manufacturing business, in particular, has expanded in recent years, with one of its latest ranges – the Plus Audio family of loudspeakers targeted at touring and fixed installation applications – launching in 2021.

Technical director Nathan Ihlenfeldt observes that “from our perspective we have a reasonably diverse business across market sectors. So that means we did not suffer the same level of activity [downturn] as some other companies out there.” In particular, the company puts a lot of emphasis into products that support “direct pandemic-related business” such as live streaming.

SLOWER RETURN

In terms of in-person events, it’s been a more measured climb back to normality than in some other regions. “In South Africa, compared to Europe and the US, it’s been a slower return to live events [because] there were still lots of restrictions up to about 8 weeks ago,” notes Ihlenfeldt, speaking to Installation in early September.

“But now live events are coming back and there have been a lot of manufacturing and service-related enquiries over the last few months.”

Indicating that one huge aspect of live events – musical performance – has recovered more quickly than some others, Dennison reveals that the schedule for 2023 is already looking very robust. “We are probably 80% booked for concert touring and festivals next summer,” he says. Pointing to supply chain issues and reduced availability across the industry of skilled freelancers post-pandemic, he adds: “The reality is that if you haven’t yet booked the technical part of your tour across audio, video and lighting, then you’re going to struggle for next year.”

BOUNCE BACK

Looking at data for two key areas of the UK live events market – theatre and music – confirms that the bounce back has been more rapid than many would have expected. At the end of June, it was reported that YouGov had found theatre attendance was almost back to pre-pandemic levels, with 18% of people UK-wide and 28% of Londoners having attended a play or musical in the previous three months – compared to 20% and 29% respectively, in March 2020. Events like June’s West End LIVE – Europe’s biggest free one-day festival featuring performers from more than 50 London shows – and the aforementioned ABBA Voyage symbolised the resurgence of the sector.

Issued just as the Glastonbury Festival was about to begin, data from Mintel revealed that UK sales of music festivals and concerts has recovered sharply in 2022, with the value of the market likely to surpass pre-Covid levels in 2023. Specifically, sales are forecast to reach nearly £2.79 billion next year – rising from £2.77 billion in 2019. Unfulfilled demand for live events during the ‘fallow years’ is among the factors cited by Mintel, which also predicts that the market will reach a record high of more than £3.22billion by 2026.

But there are causes for concern – the most pressing of which is a drop in the number of technicians and other staff that will only become more worryingly apparent as the events calendar becomes more crowded. Dennison says they lost probably 25% of freelancers over the Covid period, “who went and retrained, and are now lost to the industry completely”.

He believes that the broadcast industry has been a particular beneficiary of the live events talent drain. If you’ve become used to “a 9 to 5 in broadcast” at increased salary, then the appeal of a “load-out from a field at 3am” is likely to be rather limited.

Reduced lead-times in one specific area are also becoming a challenge. “A lot of music-based work [tends to be] diarised about 18 months in advance,” says Dennison, “so probably the only ‘rollercoaster’ now is in the conferencing area where some of the lead times are becoming ridiculously short for whatever reason – hesitancy over sign-off, general nervousness. Where you used to get about 8 weeks’ notice”. Now it’s more like 4 or 5 weeks.

Reduced lead-times in one specific area are also becoming a challenge. “A lot of music-based work [tends to be] diarised about 18 months in advance,” says Dennison, “so probably the only ‘rollercoaster’ now is in the conferencing area where some of the lead times are becoming ridiculously short for whatever reason – hesitancy over sign-off, general nervousness. Where you used to get about 8 weeks’ notice”. Now it’s more like 4 or 5 weeks.

With crew shortages and supply chain issues (“there’s only a finite amount of equipment out there”) in the mix, it’s inevitable that delivering events is often going to be a fraught endeavour for the foreseeable future. One upside is that any pressure that might have come from customers to lower costs has been largely resisted in the industry so far.

“There has been a push back from the freelance community, and quite rightly so,” adds Dennison. In fact, there has recently “been a rate increase that was a long time coming, with [freelancer agencies] being able to lift their rates from a starting point of view” in many cases.

TELLING STORIES

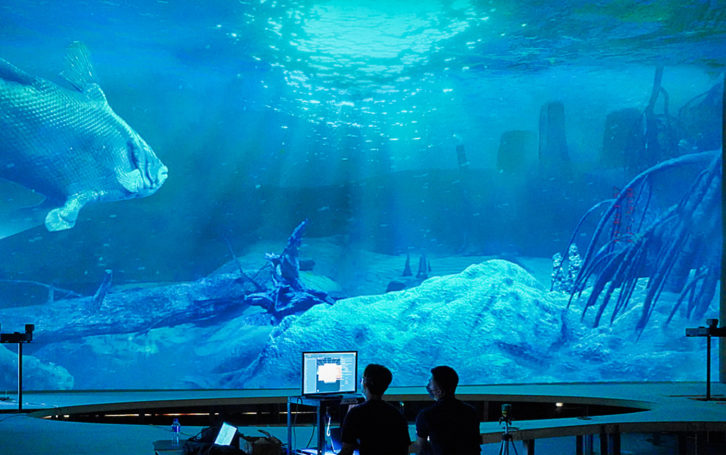

If the current narrative around live events is more of a business-oriented tale, then the story around visitor attractions could be regarded as more technologically-driven. Specifically, a process of transformation enabled by new immersive technologies and increasingly indistinct lines between on- and off-line experiences has continued to accelerate – helped in no small part by more service companies and technicians having the time to study and familiarise themselves with mixed reality, virtual production, immersive audio, and so on.

“With the latest AV technologies there is [more likely] to be an overlapping of categories, and I think that is a good thing for visitors,” says Stucken. Hence the blossoming interest in “the whole field of immersive experience technologies, such as the latest generation of laser projectors and LED walls. Increasingly these are being seen as [standard requirements], which is obviously good news for us as if you need high-resolution video content to be displayed professionally, and you are going to invest a lot of money in displays and projectors, you will also need very high quality media servers and control systems that tie everything together such as our [PIXERA systems].”

Graziano highlights the increased emphasis on visual impact: “With the onset of a maturing marketplace and the increase in user expectations, at Christie we’ve found the visitor’s realism of the experience has become paramount. Users are all too familiar with clarity, resolution and accuracy of colours – now they want to be fully immersed in the experience. Christie’s 3DLP RGB pure laser technology pushes the boundaries of colour reproduction, brightness, image uniformity and operational lifetime, representing the pinnacle of projector illumination technology.”

Dennison also points to the increased emphasis on high-quality visuals in all manner of visitor attractions, including museums and galleries where you might encounter “huge works of art digitally displayed as elements of visitor attractions.” Like many others, he also indicates that there will be growing crossover with virtual production, covered in greater depth recently in our September edition. Indeed, June 2021 saw Creative Technology open a new 3D tracked LED stage in partnership with ARRI and based at ARRI Rental’s HQ in Uxbridge, London.

FUTURE DEVELOPMENT

There will be more – much more – of this kind of development in the future, driven by a recognition that the relationship between people and technology is in the throes of a profound change. As Stucken notes, this has particular implications for the way that museums and other visitor attractions “use technology to tell stories”.

Many attractions, he adds, “are now facing the fact that there has been a generational shift in which a lot of people have grown up with digital devices and are used to non-linear storytelling and interactivity. So if they don’t want to lose a substantial percentage of future visitors, they have to adjust the storytelling – and that doesn’t mean there has to be ‘dumbing down’. [Instead it’s that] there has to be an acknowledgement that the way media is being consumed has changed drastically over the last 20 years.”

Many attractions, he adds, “are now facing the fact that there has been a generational shift in which a lot of people have grown up with digital devices and are used to non-linear storytelling and interactivity. So if they don’t want to lose a substantial percentage of future visitors, they have to adjust the storytelling – and that doesn’t mean there has to be ‘dumbing down’. [Instead it’s that] there has to be an acknowledgement that the way media is being consumed has changed drastically over the last 20 years.”

Ultimately, it’s in the hands of operators and their collaborators to think carefully and rigorously about the use of technology, look at the available options, and ensure their selections are always in the service of the stories they want to tell. In short, its ideas and concepts that must be in the forefront, with tech acting as the facilitator of this heightened creativity.

Stucken invokes the famous mantra of BBC founder Sir John Reith to “inform, educate, entertain – and if you want to do that, you need to take account of the new possibilities and be aware of the importance of being engaging.”

LOOMING STORM

All of which would bring us to a relatively contented conclusion if it weren’t for the looming storm clouds on the horizon. One is the prospect of the supply chain crisis continuing long into 2023 (see page 44), helped in no small part by massively unstable geopolitics. As Stucken remarks: “What’s happening now is unprecedented in the last 60 to 100 years, so anything to do with supply chains and logistics is way less predictable that it was before.”

Another is the worsening economic picture, and the prospect of severe cost of living crises in many countries. In the UK, predictions vary as to whether it will be the worst domestic cash squeeze for 50 or 70 years. Whatever the case, it’s going to mean huge pressure on disposable income and an inevitable impact on sectors that have always been vulnerable to the vagaries of the economy.

“People will still want to be entertained, but they will be more selective,” says Dennison, “which means that [there will need to be an emphasis] on providing the right content in terms of what people want to get out of it.”

For Graziano, where a user chooses to commit money to being entertained, “they seek incredible experiences and value in the whole process”. Where lacking, he expects visitor attractions to improve in areas that ensure users find reason to revisit.

Stucken agrees that a “more volatile period” is pending, but draws comfort from the recent pace of technological change. “Demand for next generation visitor attractions has been such that a lot of new technologies have risen and become mature in the last ten years,” he says. “So I am hopeful that might mean that if a general recession does occur, it might not be quite as daunting as it might have been.”