After looking at the advantages of incorporating visual collaboration into workflows and the importance of high resolution displays when dealing with complex data, Ian McMurray concludes this feature by revealing some of the challenges unique to the oil and gas industry.

“The differences (with hardware) revolve around the challenges of the environment, such as remote access, secure networks and the ability to maintain and service equipment potentially within hazardous environments,” says Graham Kirkpatrick, technical sales manager at Reflex.

“Within energy companies there is a greater duty of care to address environmental factors,” adds his colleague and sales manager Bryan Edwards. “This leads to a demand for more intelligent AV solutions. Examples include global AV control platforms that seamlessly integrate with building management systems (BMS) and environmental monitoring system (EMS) platforms. We’ve also seen VC and displays with intelligent CO2 calculators included as part of an AV solution with the aim of reducing the organisation’s carbon footprint.”

“Oil and gas companies have many unique requirements,” says Bob Ehlers, VP, marketing and business development at RGB Spectrum. “They’re geographically dispersed; they have demanding operational requirements; their communications availability can be very variable; and they have an environment where very old and very new infrastructure needs to co-exist.

“And then,” he laughs, “there’s the highly volatile financial model.”

Ray McGroarty, global director for enterprise UC solutions at Polycom too notes the challenge posed by co-mingling infrastructures. “Legacy infrastructure is an important consideration for oil and gas customers,” he believes. “They don’t want to rip and replace what they have already invested in – and it can be even more impractical and expensive to do this on an oil rig than in an office building. For example, if they have already invested in Microsoft Lync from a technology and training perspective, then they don’t want to draw their end users out of this environment in order to use other elements of UC that have been added at a later date. RealConnect allows organisations to contact users via Lync through voice, video, chat or content collaboration without stepping outside of that familiar interface, regardless of the solution the contact is using. This makes it a popular solution for the sector.”

Overall, however, despite its many challenges, AV manufacturers and integrators operating in the oil and gas market find it a rewarding one, and one full of opportunity for companies prepared to invest in understanding the unique needs of the business.

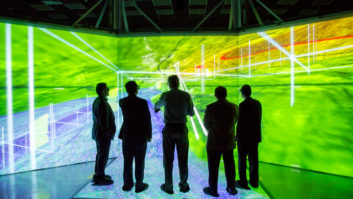

“It’s a good market to be in,” says David Griffiths, director, market development EMEA at Christie Digital Systems. “Not only is it vast, but it uses cutting-edge technologies such as high resolution and real-time data display.”

Exciting sector

“The oil and gas sector is an exciting one for AV manufacturers and integrators,” believes McGroarty. “The virtualisation of many of the design processes within oil and gas will naturally lead to more use of collaborative technologies as teams can be dispersed and collaborate on data within a common database. The use of virtual models of new exploration areas and new processes, combined with great communication technology, can be very powerful in helping teams to work through problems very quickly.”

“It’s a growing opportunity for AV manufacturers,” agrees Ehlers. “The slowdown in deployments of AV technology is a temporary situation. The sector is rapidly modernising, and we think that this will only continue.”

“The oil and gas market is definitely more value focused today than last year,” he goes on, “and AV technology really has to substantiate its value in order to be adopted. In the areas of remote monitoring, control rooms, abnormal situation management and the like – mostly related to production operations – we are seeing a fairly vibrant market. This would be expected, as operational efficiencies in production control remain a high priority and have a good payback. Solutions like display wall processors, video switchers, multiviewers and control room management systems are definitely players in this application space.”

“In exploration, we’re seeing slightly less activity as resources wait for higher oil prices. This affects systems like codecs, recorders, high-end video processors for simulation and so on. The adoption of new geophysical modelling systems is waiting for the market to bounce back – so investment in this application space is slower.”

“We view the entire sector as a long-term investment,” concludes Ehlers. “We just opened new demo centre showrooms in Houston and Dubai, and we exhibited for the first time at the Offshore Europe show in Aberdeen last month. We’re bullish on the opportunities in the oil sector for us.”

Equally bullish, but perhaps more philosophical, is Alexis Sakallis, business development manager, Dubai at integrator Pixel Projects. “Oil and gas companies have to keep investing in new technologies to improve prospecting, extraction and transportation of raw materials – and AV technologies are playing a vital role. Investment is a key factor for survival in this industry: it cannot stop. Global reserves are not infinite, and no economy can survive without oil and gas. We’re talking about the role AV technology can play in global population survival.”

AV manufacturers and integrators alike, then, still see the oil and gas industry as a good one in which to be. The clue, perhaps, lies in that £5.3 billion overspend in the UK. Times may be challenging for the oil and gas industry, but it knows it needs to continue to invest – whether that’s in exploration and infrastructure, or in the improved productivity and efficiency that is the natural outflow of today’s AV solutions.

Case study: RGB Spectrum helps ensure security in Mexico

Companies operating in high-risk geo-political locations that are violence-prone must take extra precautions to ensure the safety of their employees, assets and infrastructure. To this end, they often enlist the help of firms like the Risk Assistance Group, which provides turnkey security solutions for managing logistics and keeping the supply chain safe.

During a recent facilities upgrade at the headquarters of a high-profile client, one of the largest drilling companies in Mexico, the Risk Assistance Group chose to install RGB Spectrum’s MediaWall 4200 display processor with SinglePoint KvM control to add advanced display processing capabilities to the client’s expanded security system.

Located within the company’s Security Operations Center (SOC), the eight-monitor videowall is used to display video feeds from 30 IP-based CCTV cameras that monitor all areas of the facility. In addition, operators can display information from GPS systems tracking the movements of a fleet of 80 vehicles, as well as visualisations, live news feeds, web pages, and access control spreadsheets on the videowall.

Christie visual display solutions

Pixel Projects AV integration

Polycom videoconferencing solutions

Reflex AV systems design integration

RGB Spectrum display processing solutions