The Russian installation sector is at a significant crossroads: the struggling economy is a major headache for all concerned, but standards and requirements across the business are continuing to rise. David Davies finds out more about this sometimes contradictory market.

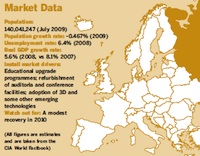

As anyone who has kept an eye on the twists and downturns of the global recession will know, Russia has been severely impacted by recent events. Exports have declined and levels of investment – both homegrown and foreign – have tailed off. The government is taking steps to help shore up the business community, but as yet it is too early to assess the success or otherwise of these measures.

As a result, IE undertook its survey of installers, manufacturers, distributors and other interested parties during a period of transition. This is arguably reflected in the results dissected below, which reveal occasional and striking contradictions.

Confidence levels

When asked to rate the general level of confidence in the Russian professional installation sector on a scale of 1 to 5 (1= very low, 5 = very high), the average score was a none-too-dispiriting 3.2.

Moreover, among those who declared a preference, 60% claimed that levels of confidence are currently on the rise.

This might well offer some cause for optimism; however, it is clear that when stakeholders in the Russian industry turn away from the wider landscape to their own backyards, so to speak, they are less upbeat. A clear majority of respondents who offered an opinion revealed that they expect their overall business in the installation sector to decrease this year in comparison to the last calendar year. From a particularly wide field of answers, the average prediction was for a decline of 29.7%.

If this makes for rather sober reading, at least stakeholders in the Russian installation business are, broadly speaking, united about the principal factors informing the current malaise. When invited to assess the relative impact that key issues are having on their installation sector interests on a scale of 1 to 8 (1 = least or of no importance, 8 = most important), two – national/international economic circumstances and government spending/taxation – were prioritised by the vast majority of contributors.

Indeed, a few participants declined to offer a full ranking: one said that only these two factors were important, while another claimed that after national/international economic circumstances, “all other factors are not significant”. (At the other end of the scale, green issues were ranked as a 1 by more than half of our contributors.) So, no getting around it, the economic situation is having a profound impact on both market and morale. At the time of writing in mid- October, the immediate outlook is by no means clear: a VTB Capital report indicated that Russia’s economy contracted in September at the slowest monthly pace in 2009, but the IMF forecasts that Russia might see a 7.5% fall in GDP this year, with only a modest recovery next year.

IE rounded off this section of the survey by asking participants to nominate other factors that they think are having an impact on the Russian installation business. A truly eclectic list collated from our many contributors includes competition from China, the availability of credit, consistency (or lack thereof) in governmental projects, import taxation policy, the emergence of 3D cinema and – alas – “corrupt practices”.

Future factors

Next, participants were asked to consider the likely relative importance of five key factors to their install customers in Russia during the next two or three years. On a scale of 1 to 5 (1 = least or of no importance, 5 = most important), keener pricing emerged as the most significant probable consideration with an average rating of 4.7. If this is a result that suggests the eye of Russian install customers is very much trained on the bottom line, it seems rather curious that total cost of ownership was judged to be the second least important factor. Meanwhile, in a finding that won’t exactly lift the hearts of the world’s protocol developers, networking was voted into bottom place with an average of 2.2.

The next area of questioning centred on emerging technologies and, specifically, those that participants feel will rise most rapidly over the next few years. From a choice of four technologies, 3D was expected to be the most popular, garnering 45.4% of the vote. Ultra-thin (OLED) displays and audio-video bridging over Ethernet tied on 27.3% apiece. Gesture-recognition technology did not score a single vote.

Defining projects

Despite the challenges, it is clear that many significant installation projects are continuing to take place. IE invited participants to nominate key installs – not necessarily ones in which they have been involved – during the past 12 months, and received a lengthy roll call traversing numerous areas of the market. The new Presidential Library in St Petersburg was nominated by more than one contributor, while there were several namechecks for projects attached to the 2014 Winter Olympics, which will take place in the resort of Sochi. General government-initiated upgrades to educational facilities were also highlighted, as was a raft of recent museum installations.

Shaping the market

Not surprisingly given the aforementioned results, the economic crisis was cited by several respondents in answer to a question about the key events that have shaped or defined the install market during the past 12 months. However, there were also references to the rise of 3D technology, the demand for conference facilities and – in an allusion that will cheer Mike Blackman and team – Integrated Systems Russia, which was described by Mitsubishi Electric Russia’s Michael Nevzorov as “one of the main driving forces that shapes the installation market”.

Finally, survey participants were asked to suggest which, if any, measures could be taken by installers, manufacturers and official bodies/government to ensure the future growth of the installation business in Russia. Once again, this question elicited an array of considered responses, with the need to boost training and background knowledge being widely highlighted. “Integrators will be able to realise more projects if they have well-trained staff with technical and product knowledge,” said Serge Philippo, sales manager Eastern Europe & Russia for Crestron International.

Dmitry Karikh, director of Corbel, observed that “international education programmes in pro-AV should come to Russia and educate and assess installers around the country. The business has to be clean from design to installation, although it seems like a fantastic dream right now!” “I believe the only measure that we can [take] is to increase customers’ knowledge about technology and futureproof features,” said Nevzorov.

“This will help to create the need for high-end products and solutions. In addition, it is desirable that the AV industry should become more integrated and powerful [in order] to raise its voice for utilising the latest technology in governmental projects.” Training was by no means the only theme, however. Powersoft’s audio division sales manager, Luca Giorgi, urged the adoption of “a different approach in evaluating technology from a system level point-of-view” in these financially pressurised times.

Christie regional director Adil Zerouali, meanwhile, had a cautionary word for outside investors: “It is essential that a company willing to develop its business in Russia understands the [realities of] long-term investment in the country.”

Summary

Sprawling, diverse and, yes, maybe just a little bit confused: this seems a reasonable description of the Russian installation business in late 2009. Still, with a host of major projects ongoing and signs that new technologies are coming into play, it is by no means stagnant. Moreover, with some contributors predicting a modest resurgence in 2010, it is likely that the situation will look rather more positive the next time IE checks in on the Russian market.