Our survey of the Spanish market reveals some similarities to the Italian market – as well as some differences.

In hindsight, perhaps we shouldn’t have carried out our survey of the Spanish installed AV market a month after our Italian one, as the two countries are showing similar results in many areas.

Firstly, as in Italy, nearly half our respondents thought general levels of confidence in the country’s industry were the same as they were six months ago; a slight majority of the others believed felt they were higher. There was a more optimistic picture, however, when we asked them how they felt their own companies were faring: just over half believed that their revenues would rise by more than 5% over the next 12 months, with the other answers – lesser growth, no change, and reduced revenue – covered roughly equally.

Asked to choose from a list of issues the one that was of most concern to their businesses, roughly two-thirds selected ‘clients going for lowest price rather than best value’. “In many cases, customers prefer to pay 20% less for a budget although in the short term they have problems in the installation – sad but true,” lamented one respondent. Another remarked: “Customers ask for a solution, ask for global [brands] and a report for the project. Then when they have the product list with brand and model references, then they look for the best price they can achieve instead of thinking about the value we provided finding the solution.”

Our survey then asked our respondents what they would change about the Spanish installation market if they could. “Competition,” said one. “Their strategy is to get contracts at any price and that damages the market.” Another felt that the most important thing would be “to recover respect for the distribution chain: manufacturer to distributor to dealer to client”.

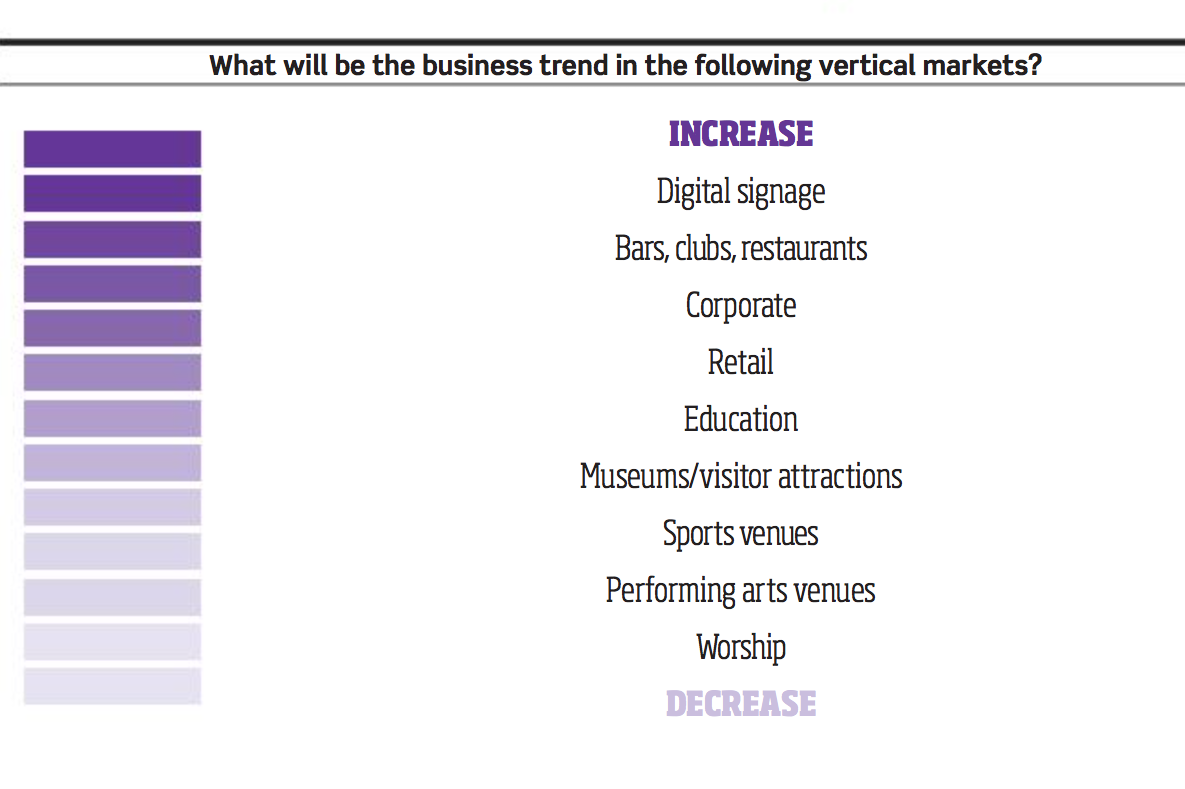

Turning to perceived vertical market trends: digital signage topped the poll as the sector most widely believed to be growing, as it often does; more unusually, bars, clubs and restaurants came in second place – just as it did in our Italian survey last month. The Mediterranean reputation for nightlife is clearly well deserved. At the other end of the list, houses of worship was the only sector where, on average, the trend was felt to be negative.

Finally, we asked about the number of players active in the market: the largest proportion felt this was not changing, with increasing attracting a slightly bigger response than decreasing. Two comments here sum up the mixed perceptions: both referred to closure of companies in the economic crisis, but while one thought that more, smaller companies opened in their place, while the other believed that the market was not ready for new entrants.