Industry growth is being driven by new markets, reports Tim Frost.

The InfoComm Outlook and Trends Analysis (IOTA) project was recently conducted by the industry body, in collaboration with information, analytics and solutions organisation IHS Markit. The results will be published in four reports: the European report is available now, with Asia-Pacific, Americas and Global reports to follow.

To compile the report, IHS collected detailed data from a sample of key vendors, and collated buyer-side data across a range of market segments including broadcast and media, command and control, corporate conferencing and collaboration, digital signage, military and governmental, retail, education and hospitality, and security surveillance. Data from within existing research programmes was augmented by additional primary and secondary research and detailed macroeconomic forecasts.

Positive outlook

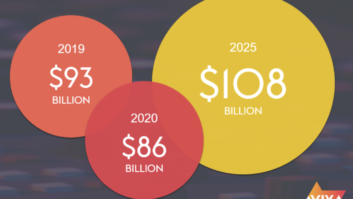

Looking globally, IOTA has a positive view of the market trends for the industry. Despite global GDP growth being expected to continue to fall marginally over the next two years (from 6.7% down to 6.1% in 2019), the report predicts pro AV revenues will continue to rise. They are expected to increase from $178.4 billion in 2016 to $198.7 billion in 2019, and on to $231 billion in 2022 – a rise of over 29%.

The ranking by value of the largest three pro AV market sectors globally remains unchanged. Streaming media/storage/distribution (SMSD) remains the largest sector, followed by services and then capture and production equipment. The video display sector will go up one position to become the fourth largest sector by 2022; environmental will move up from the ninth largest sector last year to fifth position in 2022.

Conversely video projection, the fourth largest market by value in 2016, is expected to show the most dramatic decline, slipping to eighth position in 2022. In value terms, the figures for projectors are stark: revenue that stood at around $28.3 billion in 2014 is expected to decline by almost two thirds to $10.8 billion in 2022.

Europe on the rise

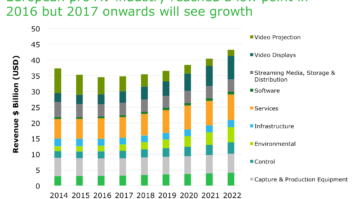

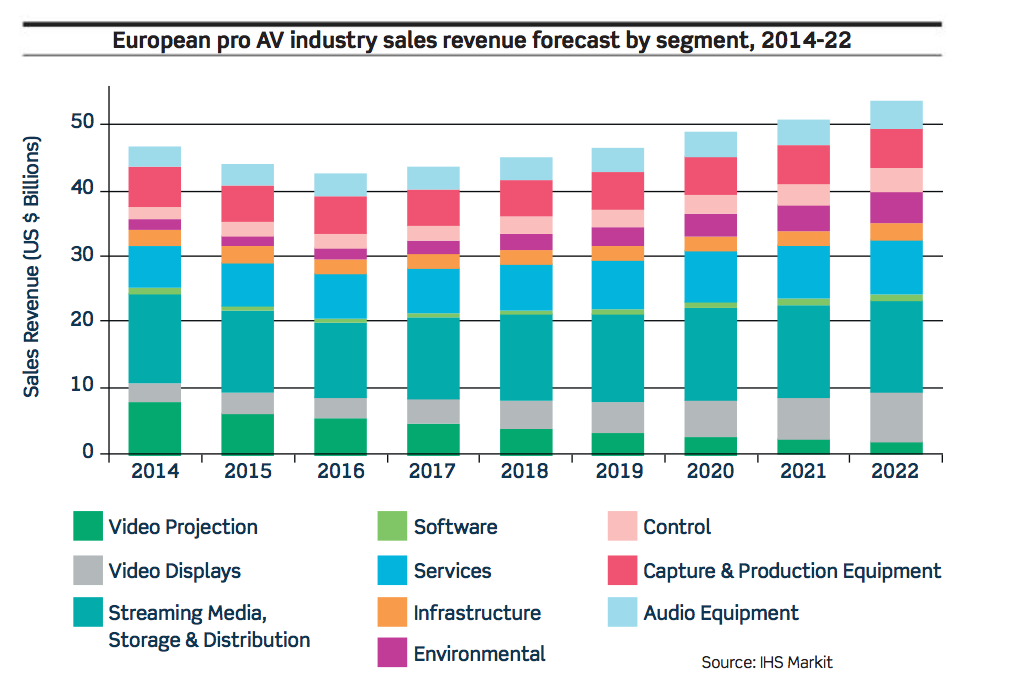

According to the European report’s introduction, the region’s general economy has taken an upward path: “Europe has finally shed the mantle of anaemic growth and can look forward to a period of broad economic expansion.” The European pro AV industry’s compound annual growth rate (CAGR) seems to have bottomed out in 2016, with a market value of $42.31 billion.

The report splits Europe into four sectors, Eastern, Central and Western Europe and Scandinavia, with Western Europe accounting for around 70% of the region’s total pro AV revenues. With its economic maturity, Western Europe’s pro AV market, like Scandinavia’s, is likely to grow by a modest CAGR of 3%. This contrasts with the Central and Eastern European sectors where the markets are still developing; here CAGR will be 6% and 9% respectively to 2022.

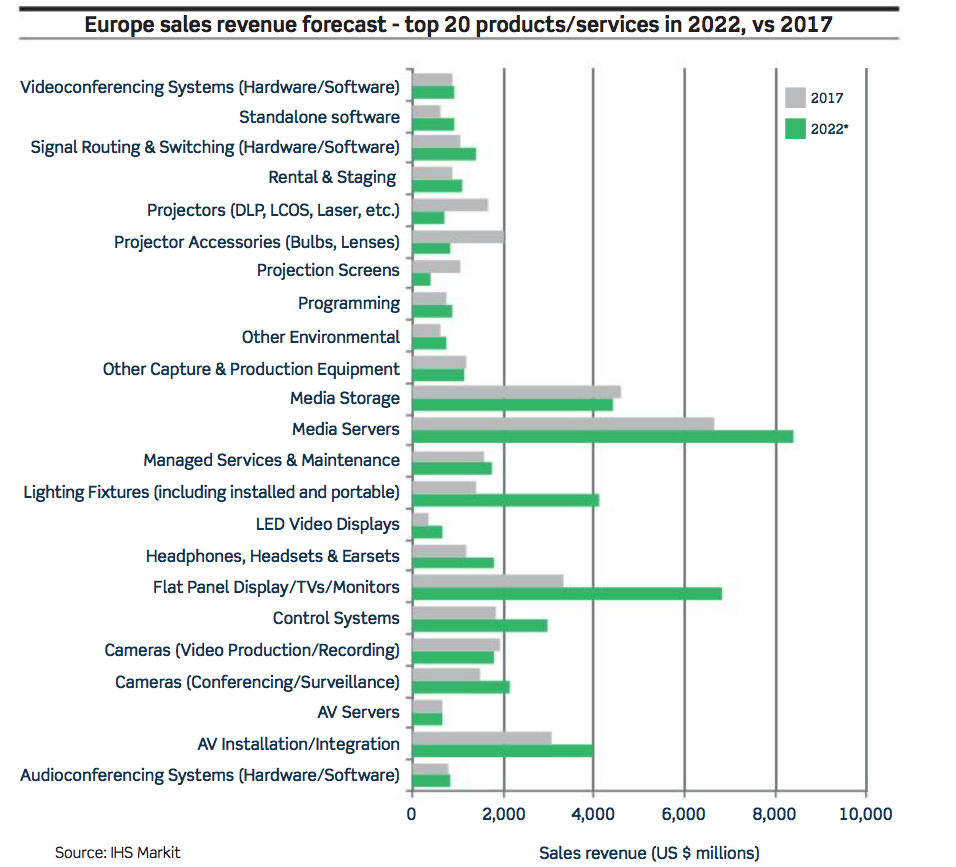

Looking at the individual European product/service segments, SMSD is the largest segment in the industry; this is set to continue right through to 2022. At $11.4 billion in 2016, SMSD represents around 28% of the revenues in the European pro AV market. In 2022 this proportion is going to reduce to 26% of the European pro AV market’s predicted $53.5 billion value.

Still in the non-hardware areas, general pro AV services will remain the second largest market sector. The long-established move away from selling boxes to supplying integrated solutions into industrial, commercial, entertainment and top-end domestic markets has kept the value of design, integration and programming strong.

Digital storage/media server growth is likely to be capped at around 5% CAGR. While the demand for storage is always increasing, this has become a commoditised market with the decreasing cost of storage having a greater impact than the increased demand.

Service trends

IOTA says that the increased integration of pro AV as a service (aaS), using both physical and cloud media servers and storage, will keep the media storage and server markets busy. Compared to buying and installing hardware, cloud-based servers and services offer lower costs as well as scalability. The decrease in the cost of storage means that the overall value of this sector will show a slight decline globally from $17.1 billion in 2016 to $15.9 billion in 2022. In trends that are paralleled for Europe, managed services will see an upturn from $3.9 billion (2016) globally to $4.3 billion in 2022, and it is a similar picture for the media server market: $26.3 billion globally in 2016, growing to $31.8 billion in 2022.

Display changes

The big changes are, predictably, in the area of visual displays. IOTA sees that the demand for digital display and signage throughout Europe in general shows no signs of abating for two reasons.

Bolstered by positive consumer confidence, the retail industry is happy to invest in areas that will help attract customers. The improvements in quality of displays and cost reductions have made flat screens a much easier sell.

InfoComm’s analysis says that this is coupled with a similar attitude towards digital out-of-home (DOOH) and using displays for branding, informing and, of course, advertising. This has created an ecosystem for the creation, supply and distribution of content, which helps to further feed the demand for the hardware.

The convenience and quality of video displays has an inevitable impact on the video projector market. Paralleling the global market trends, while the European demand for display digital imaging increases, the video projector market shows significant decline. At $7.8 billion, projectors accounted for 17% of the European pro AV market in 2014 and by 2016 it was already down to 13%. CAGR for projectors is expected to be -17% through to 2022, resulting in a value of around $1.93 billion in 2022 – which is less than a quarter of its 2014 value.

Audio in step

Looking at that other letter in ‘AV’, audio in all its forms is less volatile. Audio will show a value growth that is in step with the increase in the size of the market, so maintaining its 8% European market share in 2017 through to 2022. As audio systems are used in a wide set of applications from conferencing, entertainment and corporate, to production and media, variations in the audio submarkets and product areas will tend to counteract each other.

Lighting fixtures is the other smaller market sector that IOTA predicts will show significant growth, 24% a year globally. Driven by installations in retail, high-end consumer smart homes, education and care environments.

This growth, says IOTA, is being driven by traditional pro AV overlapping with smart building control, and also the general transition to LED lighting, which is generating a whole new set of opportunities in control, programming and integration. From a level of around $6.3 billion globally each for control and lighting fixtures this year, control is expected to grow to $10.6 billion globally and lighting to $18.8 billion in 2022 globally, with Europe following the same trend.

New buyers

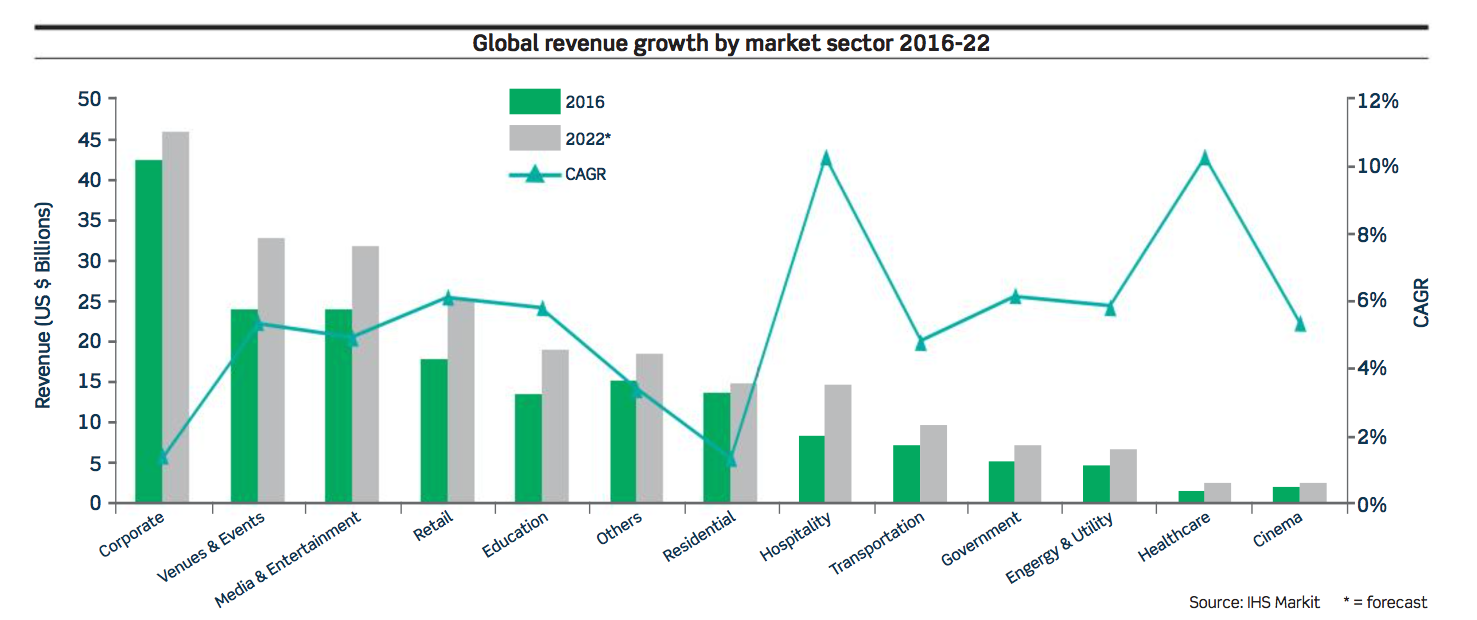

Highlighted in IOTA, a significant part of the pro AV market growth will be driven by new buyers in the marketplace, with pro AV technology integrating and spreading into ever-wider markets. At an expected global value of $46 billion in 2022, the traditional corporate market will remain the biggest single buyer segment, but it will have only expanded by just over 8% from 2016. Taken together, the next four largest sectors – venues/events, media/entertainment, retail and education – will grow by 37% in the same period, to a combined global market size of $108.9 billion in 2022.