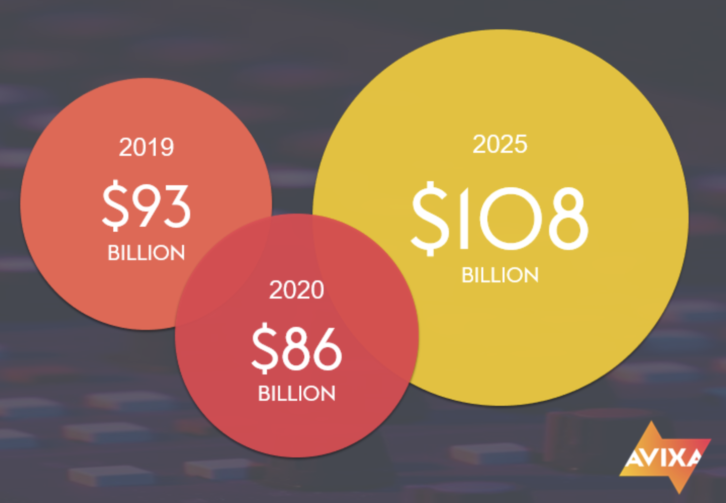

After reaching $93 billion in 2019, the Americas pro AV market is set to drop eight per cent to $86 billion in 2020 due to the COVID-19 pandemic, according to the new 2020 AV Industry Outlook and Trends Analysis (IOTA) Americas Summary produced by AVIXA.

The report also predicts a strong recovery, with growth resuming in 2021 and reaching $95 billion in 2022. A target of $108 billion is expected in 2025.

“AVIXA’s latest forecast was formulated in the first half of 2020 and is based on the assumption that market growth would return in the second half of the year as businesses reopened and resumed purchases of pro AV products,” said Sean Wargo, senior director of market intelligence, AVIXA. “Our forecasts show that a lot of the pro AV products and services that were already trending upward – servers, digital signage, security, conferencing, and collaboration – will pick up more steam because of the pandemic’s impact.”

The eight per cent drop in Americas pro AV revenue in 2020 is in line with the global decline of 7.7 per cent in 2020. However, the Americas is expected to perform better than the Europe, Middle East, and Africa (EMEA) region, which is set for an 8.9 per cent decline. In contrast, the Americas will underperform Asia-Pacific, which will decline by 6.4 per cent.

North America accounts for a 87 per cent of Americas regional revenue in 2020 – a share that is expected to hold steady through to 2025. While comparitively much smaller, the South America market will see stronger growth, with a compound annual growth rate (CAGR) of 5.6 per cent from 2020 through 2025 – compared to 4.5 per cent for North America. Central America and the Caribbean will attain region-leading growth with a 5.8 per cent CAGR.

Not only is the energy and utility market the fastest growing in North America, it’s also the fastest across the entire Americas region with an 8.5 per cent CAGR for 2020-2025. Due to the pandemic’s impact on decreasing travel, demand for oil has dropped. However, the market is expected to rise rapidly as economic conditions improve. This will drive investments in smart-city, smart-grid, with heavy digital signage and control room solutions, translating into considerable demand for LED video displays, which will enjoy a 25.6 per cent CAGR.

The fastest-growing industry in Central America and the Caribbean is transportation, with revenue rising at a CAGR of 10.4 per cent to reach $331 million in 2025, up from $201.7 million in 2020. Transportation also drives the pro AV industry in South America – the market will grow at an 11 per cent CAGR from 2020-2025, growing from $511.1 million to $863.1 million. This growth is driven by transportation hubs’ investments in pro AV solutions to increase health and safety measures.

You may also be interested in:

- INFOGRAPHIC: How many jobs does the live events biz provide per performance

- AVIXA confirms mass redundancies, says it doesn’t know when trade shows will return

- Free AV industry recruitment site launches in response to COVID-19 redundancies

- ISE 2021 at ‘low risk’ of COVID-19 says WHO

- ‘A statement of perseverance’: AVIXA reflects on InfoComm Connected

In the Americas, education will suffer only limited fallout from COVID-19 in 2020, with pro AV revenue declining by 2.7 per cent – and a four per cent rebound expected for 2021. Given the uncertainty regarding COVID-19 and the timing of a vaccine, schools and colleges will continue to invest in remote learning solutions including updates to classrooms in support of livestreaming. This will not only drive software as a service (SaaS)-based distance-learning solutions but investment in remote teaching aid software, connectivity, and cloud and managed services as well.

Media and entertainment is another market that stands out with a moderate 5.7 per cent decline in 2020, followed by a 7.4 per cent rebound in 2021. In the COVID era when people are staying at home, the consumption of digital content from mobile apps to TV and gaming has risen significantly, driving demand for associated equipment. The demand for digital entertainment and business content is expected to increase substantially during the forecast years, giving rise to production, storage, and distribution equipment, software, and services.

Although it will generate only a mild CAGR of 2.3 per cent from 2020-2025, conferencing and collaboration will remain the top solution bundle in the Americas. Increased remote working in 2020, along with limited access for installation, will reduce the need for on-premise conferencing in the near term. However, as employees return to work in a limited capacity, AVIXA predicts that there will be more need for collaboration among on-premise and remote workers. This is expected to push installations in the second half of 2020. Over the long term, workspace trends moving toward smaller, more flexible spaces and more remote working will help to sustain growth and keep the conferencing solution in the top spot.

The IOTA report is produced by AVIXA in conjunction with Omdia (formerly IHS Markit), a global research firm with specialty across a number of underlying supply chain markets, many of which overlap with the principal components of the pro AV industry.

Yesterday it was confirmed that AVIXA had made a significant number of redundancies across its workforce on account of the pandemic.

The IOTA Industry Overview, which explores the global trends within the pro AV industry, is available now for purchase.