Martijn van der Woude, director business management at Philips Professional Display Solutions, speaks exclusively to Installation about the company’s strategy for taking on the highly competitive LED display market…

It’s taken a while for Philips Professional Display Solutions to truly announce itself in the LED market, why is that?

At Philips Professional Display Solutions, we have a history of product innovation but that’s not to say we design novel displays that no one really needs. Instead, we concentrate our efforts on bringing products to market that are right for our customers at the right times and at competitive price points. This was the case with LED. We have been analysing both the marketplace and the quality of LED components and products over the course of a few years, and now the time is right for the Philips LED solutions that our customers need.

In such an already very competitive marketplace, what do you offer that would encourage others to take notice?

As is the case with all of our products, with LED we focus on bringing full solutions to integrators and their customers, making installation, set up and ongoing use as hassle free and straightforward as possible.

So, as well as offering LED as custom solutions and kits, we also have bundled packages that include all the components required, our competitive warranties and support with installation and after service. We bring into our LED offering the consistency in technical service and support that we know our customers value us for in LCD.

How would you describe your strategy for the LED market currently and over the coming months?

This is a market that we’ll continue to grow into, bring new and exciting variants, both in terms of pixel pitch, brightness and form factor, allowing our partners and customers to sell into new verticals and environments as LED grows in demand.

You may also be interested in:

- A moment to process: Exploring advances in LED tech

- Seismic changes: Charting the transition from LCD to LED

- The move to LED: Who’s leading the way and who’s playing catch-up?

- ‘There is significant business to be won’: What Samsung DID’s LCD exit means for the biz

How about price points? Where does Philips Professional Display Solutions sit in this space for LED?

We’ve entered the marketplace with a well-featured, quality product range that will deliver long term benefits and at a price point that competes effectively against our peers. We’re exciting by the enquiries we have coming in and the projects that we’re already working on with our partners throughout EMEA.

As stated before, the market is extremely competitive and prices points vary significantly between manufacturers – both known and less known ones. Whilst many (or all) will offer comparable qualities, what are some of the risks of being led simply by price?

Clearly there are LED products out there that are incredibly cheap in comparison to the solutions offered by both Philips Professional Display Solutions and our peers. There’s always a reason for an incredibly low cost, though, and we’d always urge caution when buying on price alone. It’s important to compare like for like and to look out for the components with quality guarantees, such as European TUV certification, that will deliver into the long term. Lower cost components are likely to last for a shorter life span, meaning cost of ownership will be higher in the long term.

Believing in bringing optimum quality solutions to our customers, Philips LED displays have EMC Class-B (best-in-class) low radiation emission levels and gold wiring for a longer lifetime. There’s always a reason for an incredibly low cost, and some LED manufacturers are not that transparent in the origin of their components and their manufacturing and quality processes as in other segments in the display industry.

What do you consider to be the biggest opportunities in the LED market?

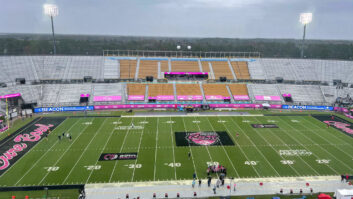

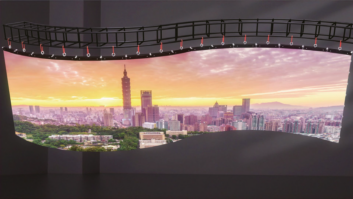

Advertising spaces in retail environments, public venues and stadia continue to dominate when it comes to fast growing demand for LED. They’re set to grow in double digits over the next three years. Retailers are upgrading their shop formulas with digital signage and LED as they compete with online buying patterns. Public Venues are interested in enhancing the experience of visitors and at the same time want to be able to cast vital information to the public in an instant. The corporate sector is a growing area and we’ve been incredibly pleased to complete a number of projects in this arena already.

With the rise in LED, what does that mean for LCD? Philips Professional Display Solutions offers both, could this change or will/can they coexist?

As with radio and television, there’s space for both LCD and LED in the AV marketplace. While there are obviously cross overs in applications for these two display options, each offers a unique set of benefits that will see them both serve our customers for many years to come.

As price points for both display types continue to fall, LCD will remain the lower cost option, while image quality when viewed up close will continue to improve. Meanwhile the brightness of LEDs, together with their versatility for sizing up and their flexibility for uniquely shaped installations will continue to open new opportunities.

What do you make of the decision from Samsung and LG to cease LCD production this year? Did this surprise you?

This topic has to be seen multi angled. There is, of course, a shift in LCD production from other Asian countries to China in recent years. And LG and Samsung follow this trend as the scale of investment in LCD manufacturing on one hand, and the size of the local market in China on the other hand, are both massive.

As well as this, other display technologies, like direct view SMD LED and Micro LED, that are emerging will replace part of the LCD technologies market. The Korean companies are simply shifting investments in that direction to remove themselves from price competition with Chinese manufacturers.

The decisions from Samsung and LG will deliver opportunities for those manufacturers that continue to deliver premium quality LCD at a reasonable price. While there’s a possibility that one day deep into the future LED will dominate over LCD to the point where it squashes its rival out of the market, that’s not likely to happen any time soon.

Do you think this decision will accelerate the transition to LED across the market?

The decisions from Samsung and LG are based much more on economy rather than technology. LED will grow faster, but LCD markets continue to grow. At Philips Professional Display Solutions, we are launching LFD touch displays for the Education and Corporate sectors this year, and large format collaboration displays will bring new growth to the LCD markets.

The manufacturing process of LCD is industrial and fully matured, the SMD LED manufacturing is not. Once Micro LED production is fully matured, which is still years away, the display technologies for small to very large displays will merge into one technology. This is predicted to last 5-7 years.

Would Philips Professional Display Solutions consider ceasing LCD production in the near future?

Certainly we continue with strong sales in the LCD arena and our aim will be to continue with production of these cornerstone displays while they meet the demands of our customers. From our set of products launched this year – from the new C-Line Corporate collaboration touchscreen, the T-Line interactive display for Education and the new X-Line videowall with Pure Colour Pro offering precise white balance and accurate colour consistency, we think it’s fair to say that our product managers are dedicated to bring display solutions in a range of sizes and options across LCD as well.

We believe that our LCD and LED product line up is perfect in balance for all the applications and markets we serve. The two technologies each still have very distinct applications for us to continue to expand both technologies.

In which verticals are you seeing sustained or an increasing appetite for LED?

Retail, public venues, stadiums and hospitality all work well when it comes to demand for LED. The use of LED in corporate environments is growing and we’ve been incredibly pleased to complete a number of projects in this arena already.

And in which are you still seeing strong demand for LCD displays?

Demand for large format LCD displays sits across all verticals. We have seen appetite for larger screen sizes increase because prices for these have dropped and this widens the applications of displays for corporate, retail, public venue and hospitality use. Collaboration displays in education and corporate have more use cases due increased software availability for collaboration from companies such as Microsoft and Google.

And the wide availability of screen sharing options like Chromecast and Clickshare has improved usability of displays in huddle spaces, meeting rooms and classrooms. Access to software is made even easier with the embedded Android platforms across our LCD display range and access to the Google Play store adds, on a daily basis, more software options for content management, collaboration, digital lessons, games and more.

This year, we’ve launched a series of new product ranges to strengthen our position in the Corporate, Education and Hospitality environments across EMEA and beyond and the demand for these products is already seeing exciting growth potential for Philips Professional Display Solutions.

Which of your LED lines are proving most popular at the moment?

This is hard to say, because some products are made for high volume, and others are made for lower volumes, so popularity is a relative measurement of success. In terms of LCD, though, our large size (from 55 -inch) Q and D line are our fast runners because of their rich feature list and smart pricing.