As the digital signage market matures and the technology becomes more accepted, growth is expected – but it’s not all good news. Steve Montgomery finds out more.

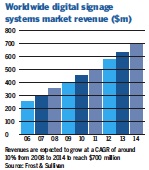

The world digital signage market has expanded rapidly in the past few years to become one of the major market sectors for display technologies. A new report from Frost & Sullivan considers this growth from 2005 to the present day and forecasts future activity to 2014. It offers detailed market trend analysis including drivers and restraints for each of the main geographic regions.

An analysis of market evolution indicates that phase one, that of unclear market opportunity and inconsistent implementations, lasted up to 2007; the sector is currently at the end of phase two in which media conglomerates have entered the market and are establishing their market position. Phase three will yield universal standards, as digital signage evolves into a mainstream advertising medium and market consolidation occurs.

In total, the market for digital signage systems had annual revenues in excess of $350 million worldwide in 2008. Revenues are expected to grow annually at a compound annual growth rate (CAGR) of around 10% from 2008 to 2014. Digital signage software is a major element of that total revenue, accounting for in excess of $120 million worldwide in 2008, and expected to grow annually at a CAGR of around 12% from 2008 to 2014.

Sales trends

More than 110,000 displays were sold worldwide in 2008. Shipments are expected to grow annually at a CAGR of about 15% from 2008 to 2014. The report finds that LCD and LED displays are rapidly gaining ground over plasma displays as users exhibit a preference for LCD. In addition, LCD displays are experiencing a faster relative price drop – falling 20% annually compared with only 10% for plasma technology.

Media players are becoming integrated within displays to conceal them from view or, in many cases, players are being run from a secure remote location over AV extenders.

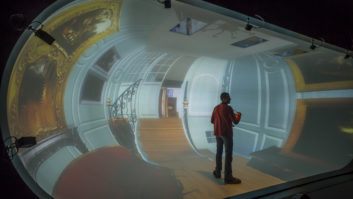

Digital signage software now usually includes content and device management and media player software with content delivery through dial-up, LAN/WAN, WiFi, Ethernet, and satellite networks. They can typically display a range of media types at high resolutions, select media files using smart tag options, control play lists, and are scalable to accommodate network expansion. There is a convergence of various technologies, including broadband, kiosks, digital signage and mobile phones within retail stores, all of which helps to facilitate the uptake of systems. The concept of interactive signs is also gaining in acceptance.

The report also considers key market drivers and restraints. Key positive indications are technology convergence, an emphasis on content creation and management, standards and software as a service. On the negative side, the report cites the economic crisis, consolidation within the industry, low prioritisation and lack of interest and commitment by advertising agencies