In an era when it often seems that our entire existence revolves around the screens of our laptops and mobile devices, one could be forgiven for expecting the museum sector to have been in decline before the pandemic. But in reality, attendance figures in many countries have remain relatively unchanged over the past decade; for example, Statista has routinely reported a 50%+ attendance at a museum or gallery in the past year by three of its five age groups. (1)

Of course, that was before Covid-19 hit and huge numbers of museums faced extended closures in line with lockdown restrictions. Even where museums were able to reopen, visitor numbers were down dramatically from their previous levels. For instance, half of the 600 museums across 48 countries surveyed by the Network of European Museum Organisations (NEMO) reported a drop of between 25% and 75, while two in 10 said visits had declined by more than 75%. (2)

In a sector that is especially reliant on visitor attendance fees and donations, this raises troubling implications for its future investment in pro-AV. Prior to the pandemic, many museums were moving in the direction of becoming ‘smart’ venues with greater deployment of interactivity, virtualisation, augmented reality (AR) and other immersive technologies. With government subsidies also likely to be reduced in many territories as they grapple to balance the books post-pandemic, it seems inevitable that many sites will have to scale back their investment plans.

NEW OPPORTUNITIES

But lest this seem like a catalogue of potential woe, the pandemic has actually heralded a few new opportunities for pro AV vendors and integrators. The acute need to avoid viral transmission has – for now at least – meant a shift away from touch-based interactivity in museums and exhibition spaces. Suddenly, there is a strong demand for touch-free, voice-oriented and motion sensor-controlled technologies, and it’s one that is already proving profitable for those companies who have solutions ready to go. In addition, it is likely that some museums will be keen to capitalise on the new audiences reached during recent virtual/streaming events.

Moreover, as people feel more confident about venturing out, there is good reason to expect that they will want to escape their screens and participate in collective non-virtual experiences once again. At that point, there is no reason to think that museums won’t benefit from an uplift comparable to those anticipated for other venues such as theme parks, cinemas and concert halls.

VARYING OPINIONS

From a pro-AV perspective, opinions vary about quite how dynamic the museum market was prior to Covid-19. In general, though, it seems to have been the countries in which government support and private sector sponsorship remained relatively buoyant where there was the most activity, with high-resolution display and projection technology among the popular targets for investment.

Jonathan Cooper, sales consultant EMEA – leisure and museums at Sharp NEC Display Solutions Europe GmbH, comments on the pre-pandemic period: “Across the globe the outlook was very positive, projects were growing in number, and investment commitments for refreshes and new initiatives were occurring.” On a geographical level, he adds, “in EMEA – the regional focus area I am most familiar with – the opportunities were strong, especially in countries such as the Middle East, Turkey and parts of Central Europe, where government support to improve and establish attractive cultural experiences was popular.”

Toby Keenan, technical sales and support at AV systems design, consultancy and installation company Crossover, offers a more variable account in which access to finance tends to play a crucial role. “I would say that budgets have always been a big concern in this sector, and even more so during the pandemic,” he says. “In our experience costs are largely prohibitive for utilising technology like VR [virtual reality] to reach a remote audience, or to spend money creating highly immersive experiences with custom content. As far as our experience goes, the sales/marketing budgets that large corporations and multi-nationals would be able to spend on such AV set-ups aren’t seen in the museum sector.”

Also based in the UK, Tony Crossley – special projects director at AV supply and integration company Pure AV – depicts a sector that “pre-pandemic had gone really quiet and almost fallen off our radar. Previous to that quite a few projects had taken place in the sector, especially when there was heritage lottery funding available to museums. That had enabled them to go ahead with some big capital projects. But more recently, I had the impression that some were struggling [with access to funding], so it’s not surprising that it had gone a bit quiet. And I know from speaking to other companies and contractors that they had had the same experience.”

OPENING DOORS

Over the last few months as conditions have begun to improve, many museums have reopened – or started preparing to reopen – their doors. For a sector whose continued existence owes so much to visitor donations, this is obviously welcome news. However, there isn’t much expectation that attendance levels will be quickly restored to their former glory. Citing NEMO once more, some 40% of those surveyed thought it could take until after summer 2022 for visitor numbers to fully recover. Simultaneously, many are also facing a protracted funding crisis: while 45% of museums received no emergency support from national, regional or local government, a troubling 70% are expecting budget cuts in the next two years. (3)

Understandably, Keenan senses a prevailing mood of caution. “As we come out of the lockdowns, the museum sector seems to be taking stock,” he remarks. The tendency is for museums to be “looking at their inventories and seeing where the priorities are for maintaining AV functionality – rather than being ambitious with new AV installation projects. ‘Mend and make do’ is perhaps the attitude of the current day.”

TARGETED INVESTMENTS

One consequence of present circumstances is that where investments in new technology do take place, they are likely to be smaller and more targeted. Moreover, with sanitation and the need to minimise the risk of viral transmission still on everyone’s minds, it’s likely to be companies who can provide alternatives to touch-based interactivity who pick up the most work in the short- to medium-term.

US-based directional audio company Holosonics is a prime example, having witnessed “a really significant” increase in demand for its ‘touchless’ products over the past 12 months. Items in its Audio Spotlight range – which utilises an innovative directional audio technology that creates sound in a narrow beam – have proven to be especially popular, according to technical sales manager Cristofer Osden.

The inclusion of no-touch sound beaming device with Bluetooth and motion sensor options eliminates the need for physical interaction by the public. “The touchless aspect is resonating strongly with exhibit customers these days, especially in the early wake of the Covid-19 pandemic,” says Osden. “It allows museums, galleries and other public venues to reopen safely to their guests by replacing unsanitary tactile methods like headphones, handsets and listening wands with touch-free focused sound beams instead.”

Deutsches-Hygiene Museum in Dresden, where the recent 4th Saxson State exhibition was held, is a case in point. The project, says Osden, was “one of the earliest adopters in terms of capitalising on the touchless aspects during the (active) pandemic landscape late last year. The designers selected our technology because it would allow them to add audio at specific positions, intentionally spaced out to respect and encourage safe social distancing. The sonically activated areas were designated by complementary floor decals, and more than two dozen speakers were used in the project throughout most of the exhibits on the ‘F.I.T. for Future – Research. Innovation. Technology’ floor.”

With projects references elsewhere in Germany, the UK, US and other countries, Osden says the company is anticipating continued demand as more museums “find they need to rework their approach to interactivity in light of Covid-19”.

ADDITIONAL TRACTION

Tim Matthews, B2B product manager at Vestel, also anticipates further traction in another area of audio – voice. “We expect voice to continue to grow – not just due to the pandemic, but also as a result of its popularity across the consumer technology landscape more broadly,” he says. “We deliver voice solutions through collaboration with our partner Sodaclick, which offers a cloud-based digital signage content platform that can be integrated into hardware. Leveraging – and building upon – Google’s infrastructure, such platforms bring accurate, AI-driven, and multilingual voice recognition to users, with the ability to even recognise patterns of stress and intonation within spoken language. With museums playing a central role in tourism, this multi-language functionality offers a major benefit in enabling visitors from across the world to engage with exhibits or information points within the venue.”

Referring to a current project involving a multi-channel audio installation designed to evoke a military flypast – located at the Spitfire Gallery in the PM&AG (The Potteries Museum and Art Gallery in Stoke-on-Trent – Tony Crossley agrees with the suggestion that more emphasis is being given to audio quality these days. “People are more conscious of having very good audio to go along with the visuals,” he says, adding that targeted sound has long been a priority: “It’s always been very important to get audio to the audience and not have it spread into areas where it’s not required.”

VIRTUAL DEVELOPMENTS

There could also be further developments around the virtualisation experiments that some museums have undertaken during the pandemic. As Cooper remarks: “It is interesting, with the digitalisation of artefacts and objects during the lockdown periods, to see some organisations looking at new ways to engage with their audiences.”

Tim Matthews, B2B product manager at Vestel, expects museums to use ongoing digitalisation as a way of conveying more information and insight to visitors. “Through the combination of AV and cloud technologies, museums can store and provide access to a wealth of information via their displays where previously they may have been limited to a physical, non-digital signage,” he says. “Through touch or voice interaction, visitors can dive further into a particular piece of art or artefact, while museums can also integrate quizzes and games into the displays for a more engaging and entertaining two-way learning experience.”

Vestel itself has brought a number of new products to the market over the past 12 months that are suitable for use in museums, including the next-generation IFX Series of 4K interactive displays. “These displays support the display of 4K HDR content from within an ultra-slim bezel design, enabling everything on-screen to be seen in exceptional colour and definition,” says Matthews. “With two powerful 20W front-firing speakers and twenty-point IR touch technology, the displays deliver all-encompassing audio and give multiple users the opportunity to work on screen simultaneously. These interactive displays offer museums the opportunity to facilitate collaboration and maximise engagement to educate their visitors in creative and dynamic ways.”

The company has also recently introduced a new digital signage range, the Q Series, that is said to address a “real gap in the market” for high-resolution picture quality and high-brightness within a slender E-LED design. Matthews notes: “Available in a range of sizes, from 49” to 65”, the Q Series has been specifically designed and tested for 24/7 usage and offers an abundance of connectivity and CMS options available to simplify operations for the end user – enabling museums to easily showcase different content across the venue whenever and wherever they want to. The Q Series offers a vibrant and cost-effective solution within areas of high ambient lighting, and is built to captivate audiences.”

UTILISED EVOLUTION

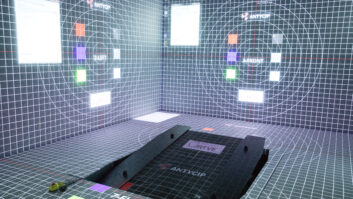

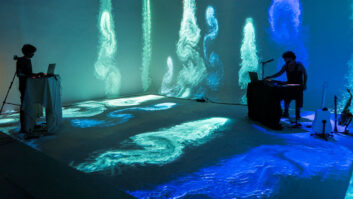

For Sharp NEC, Cooper also anticipates the further evolution of the ways in which displays are utilised within museums. In addition, he indicates that the longer-term shift towards creating more immersive environments – distinguished by trends such as the use of the latest display technology to create large and versatile canvases – will continue.

He predicts: “The role displays play in museum AV will become more hybrid, and important assets in the attraction of visitors to ensure multiple return visits. They will be the window into exploring the topics which museums wish to open up and could be a means to capture views and opinions utilising touch technology. [In addition] large surface displays – dvLED, projection, video-wall and single large LCD – will become more relevant in an age where social distancing is maintained.” He also expects further growth for interactivity, which could be “gesture-based – moving the head or arms/hands – and [via] touchscreens, which will again become more acceptable as our adaptation to living with Covid-19 evolves.”

Underlining its confidence in the long-term outlook for the sector, Cooper notes that Sharp NEC has recently launched a number of new products that are “very relevant” to museums. These include a range of ‘bundle HD and UHD packages’ involving fine pitch LED technology, as well as the WD551 Teams certified collaborative display, which is suitable for use “in conferencing sessions internally and with other external organisations”. In projection, the ‘super-silent’ P Series has “proven to be a very popular choice, while the PA (LCD) and PX (Single Chip DLP) projector ranges with a mix of lenses including UST have been utilised in edge-blended applications.”

DIGITAL TRANSFORMATION

For Crossover AV, Keenan also voices a few predictions about how digital transformation might develop as museum funds allow. “As life returns to normal, and there are fewer financial worries, we would expect to see the museums sector looking to invest a greater percentage of development budget in digital platforms,” he says. For example, he thinks there will be “more hybrid events, meaning that online audiences will be much better catered for now that people are used to hosting and participating in video-conferencing and streaming. We also expect there to be greater use of custom mobile apps to interact with museum exhibits – possibly using AR to enhance physical exhibits – and more virtual tours. The cost of creating custom virtual environments will decrease as more specialist companies work in this area.”

In short, whilst there is good reason to expect a bit of a lull in demand, it’s likely that museums will ultimately continue to be a robust market for pro AV. An innate receptiveness to new technologies and approaches, coupled with a need to engage audiences in new and contemporary ways means that the museum market will always be ‘one to watch’.

Sources:

(1) https://www.statista.com/statistics/418323/museum-galery-attendance-uk-england-by-age/

(2) and (3) https://www.ne-mo.org/fileadmin/Dateien/public/NEMO_documents/NEMO_COVID19_FollowUpReport_11.1.2021.pdf