The global market for video surveillance equipment is set to grow overall in the next few years, with IP-based systems taking an increasing share, writes Steve Montgomery.

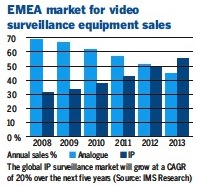

A recent report from IMS Research analyses the global market for video surveillance equipment. Of particular importance to those in the system integration world is that, in terms of revenue, the IP surveillance market will grow at a compound annual growth rate (CAGR) of 20% globally over the next five years.

In EMEA, the market share of IP systems is expected to grow from 31% in 2008 to 55% in 2013. Growth is forecast to stay above 20% in the long term, opening up a wealth of opportunities for vendors, distributors, installers and integrators.

Alastair Hayfield, research manager at IMS Research, says: “The video surveillance industry is undergoing a turbulent period of transformation. Technological trends, such as the transition from analogue CCTV to network video surveillance and the introduction of open standards, will be compounded by the global economic downturn, which has significantly lowered growth expectations in the short term. Globally there is an inherent need for video surveillance, with investment in security equipment across a range of industries remaining strong. In many countries, security spending has been buoyed by economic recovery plans.”

Mixed outlook

World Market for CCTV and Video Surveillance Equipment – 2009 focuses on key factors relating to market conditions, recovery and types of surveillance equipment in use. While the world market is expected to grow by 3% in 2009, more mature markets in Western Europe will be affected by the economic downturn, with video surveillance equipment revenues expected to decline by nearly 7%. The UK and Ireland was estimated to be the largest market for video surveillance equipment in EMEA in 2008. However, it is forecast to be the slowest growing this year as the market is approaching saturation. The Middle East is expected to be the fastest-growing region, with the majority of projects utilising IP surveillance technology.

In the US video surveillance equipment market, investment in verticals such as education and transportation will continue in 2009-10. Growth of over four times the rate of EMEA is forecast throughout 2009.

Hayfield says: “At a basic level, many of the skills needed to install surveillance equipment should be familiar to companies installing AV equipment: running cables, positioning equipment, working with video and audio feeds. As surveillance moves onto the network, it can be allied with other systems. For many installers and integrators, offering IP video surveillance equipment has added an important revenue stream. Rapid growth has induced many of the leading IP surveillance companies to offer extensive training programmes to attract new installers and integrators, ranging from basic system introduction, through to IT networking courses.” In summary, while relatively modest global growth is forecast for 2009, IMS projects that the global video surveillance market will begin to recover in the later stages of 2010. Improving economies, the transition to IP and emerging markets are all vital to the recovery.