The economic conditions may not be ideal, but Swedish installers and distributors are generally upbeat about the market they serve. David Davies finds out more.

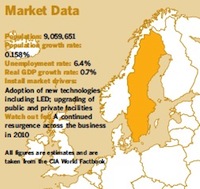

Home to 9 million people, Sweden has long supported a robust and diverse installation community. Projects involving highprofile auditoria, academic facilities, office complexes, nightclubs and more have made the trade press headlines on a regular basis during the past few years, attesting to the vibrancy of the country’s installation sector.

IE conducted its survey of companies active in the Swedish installation market in late August 2009. As the results analysed below will demonstrate, the sector is experiencing the effects of the global economic downturn. However, many report encouraging levels of business as well as an underlying confidence about the wider market.

In a comment that was far from untypical, Peter Liljegren from Canseda – the exclusive distributor of NuVo Technologies in Sweden – remarked: “As with most industries, the CI market in Sweden has felt the impact of the global recession. [But] things are improving and people are regaining confidence and starting to build again, which is great news for our sector.” With many of the underlying fundamentals remaining sound, there is plenty of reason to feel optimistic about the year ahead.

The basics

Participants were first asked to rate the general level of confidence at present in the Swedish professional installation sector on a scale of 1-5 (1 = very low, 5 = very high).

In an early indication of enduring confidence in the Swedish market, the average rating was 3.7. An overwhelming majority of respondents (82%) indicated that the current level of confidence is comparable to that felt 12 months ago – a time, of course, when the extent of the global economic crisis and its implications on a regional level had yet to become clear.

Interviewees were then invited to consider the position of their businesses in the installation sector. Specifically, IE wanted to know whether they expect their install-related business to increase or decrease this year, and by what percentage. Only 55% of respondents felt able to report a specific figure, and among those who did the average was for a modest increase of 1.4%. A slim majority of participants expect their levels of installation business to stay the same or increase, although the high percentage of participants (46%) predicting a decrease provides some cause for concern.

The next part of the survey explored the impact that a range of key factors are having on participants’ business in the installation sector.

On a scale of 1 to 8 (1 = least or of no importance, 8 = most important), a quartet of factors registered an average of 5 or more: national/international economic circumstances, competition within the local/national market, the advent of more affordable technology and technological developments. Interestingly given the prevailing ‘regulation culture’ in various parts of Europe, legal/compliance issues was felt to be the least important factor.

Next, respondents were asked to rate the likely importance of five factors to their installation customers in the next 2-3 years. In what appears to be a reflection of current market realities, total cost of ownership was declared to be the most important, followed by keener pricing, futureproofing, maintenance contracts and networking capability.

Participants also suggested a number of other aspects that they think will become increasingly important. Integration capability with IT infrastructure and/or EVAC/ fire alarm systems was highlighted by more than one respondent. Other proposed factors included the need for customers to feel safe with their suppliers and the ability to provide a customised service and round-the-clock maintenance cover.

IE closed out this part of the survey by inviting respondents to select the new technology from a field of four that they think will rise most rapidly in the Swedish installation sector over the next couple of years. As with last month’s UK/Ireland survey, one of the technologies received no votes whatsoever, only this time it was 3D rather than gesture-recognition technology. Once again, however, audio-video bridging over Ethernet led the field, with 64% of respondents believing this to be the technology that will gain the greatest ground in the next few years. Ultra-thin OLED displays and gesture recognition tied for second place, with 18% of the votes apiece.

High-profile projects

In a bid to produce a rounded portrait of the market at this time, IE invited participants to name some of the major projects – not necessarily ones in which they have been involved – that have helped to define the Swedish installation sector in the past 12 months. The nominated projects encompassed major auditoria, houses of worship, nightclubs and more. There isn’t space to detail all of them here, but the more obviously high-profile examples include a forthcoming Malmš complex incorporating concert halls, conference facilities and a hotel; the new Stockholm Swedbank Arena, which will provide a home for Sweden’s national football team; and the upgrading of the Swedish court system.

Interviewees were also asked to nominate major events or developments that have helped to shape the install market in the past year or two. A number of respondents said that they couldn’t think of anything specific, but many did voice their suggestions. Poor levels of investment and currency fluctuation were highlighted, as was the trend towards company mergers and acquisitions. “There are fewer players in the market these days,” said Lasse Enstršm, the owner of installer MixArt AB.

“There is also less in the way of personal contact as people tend to move around more than they used to.” To conclude, IE wanted to find out whether there were any measures that installers, manufacturers, trade organisations and government bodies could be taking to help ensure the continued vitality of the Swedish installation business.

Not surprisingly, this section of the survey elicited a flurry of interesting responses. Several respondents highlighted the need for a more fulsome explanation of the possibilities afforded by new technologies such as LED, while the desirability of greater interoperability between different manufacturers’ platforms was also singled out.

The most consistent theme, however, was the need to ensure that standards across the installation sector continue to rise. “As there are so few rules to follow in our market, many installers can get away with doing a poor job without getting blamed for it,” said Jan Setterberg from communications systems developer Soliflex Svenska AB. “Most of the inspectors in Sweden are oriented towards electrical installations and have very poor knowledge of our business. The new EN54 [regulation on fire detection and fire alarm systems] will help our business to be more respected, but there is still a lot to be done.”

Summary

This last comment about the need to keep enhancing standards across the installation sector bodes well for the future of the business in Sweden. The increasing emphasis on new technologies is also encouraging, with installers and consultants working to specify the most flexible, reliable systems for the job at hand. For sure, the economic circumstances are likely to have an effect for some months to come, but they are not diminishing the high levels of confidence felt by many stakeholders in the Swedish business.