According to the latest research by Futuresource Consulting, worldwide shipments of front projectors in the fourth quarter of 2013 grew by 6% over the corresponding fourth quarter of 2012, to a total of 2.12 million units. This represents $2.63 billion in value. The report reviews the quarterly performance of the market and provides a sales and product development strategy outlook to 2019.

The Americas reported strongest regional growth with an 8% increase. This was due to exceptional performance in North America with year-on-year growth of 12% counteracting a poor performance in Latin America, which showed a corresponding decline of 20%, despite strong rallying in Brazil. The education sector declined drastically while the corporate market remained stagnant with no compelling incentive to trade up to more featured, higher value products.

Asia-Pacific enjoyed a 5% year-on-year increase in projector shipments during the last quarter of 2013, during which time 835,000 units were shipped. However annual totals contracted 0.2% with 3.17 million units shipped compared to 3.18 million units in 2012.

[social]

China performed particularly well: continuing its return to growth with sales reaching 496,000 units, an 8% increase. This contributed to full year growth of 3%. The easing of political tensions between China and Japan towards the end of 2012 and latent demand built up during the brief dip in early 2013 played a part in this increase.

India’s poor economic position and delays in its education budget stifled demand, with a decline of 21% and just 41,000 units shipped. Korea’s investment in projectors for recreation and entertainment continues with sales in the 4,000-5,999 lumen segment growing by 38%, which assisted in the total market’s 8% full year growth.

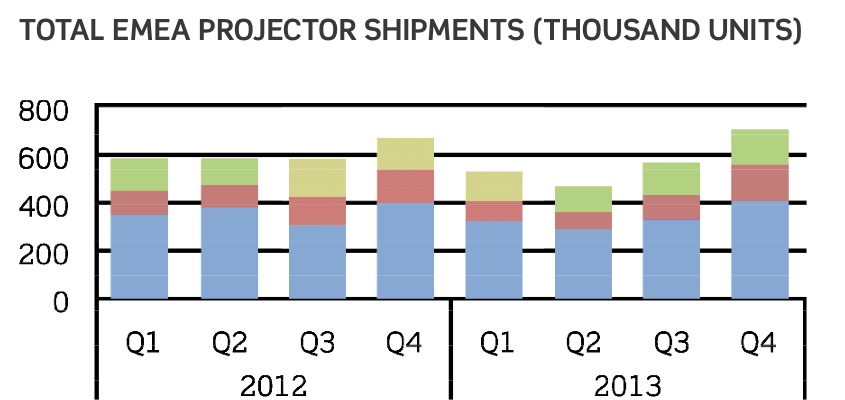

Despite a 4% quarterly increase, the shipment of 702,000 units was insufficient to offset the full-year decline in sales of 6% in EMEA. Eastern Europe enjoyed the greatest growth with shipment of 151,000 units, a 12% increase from the year before. The end of a temporary diversion of government funding for the 2014 Winter Olympics allowed Russia to resume its high volumes, with 780,300 units shipped, up by 10%. Most went into the education sector which is expected to continue in the short term. EU member states in Eastern Europe contributed to the growth as they used up the remainder of their 2007-13

EU budget.

With 412,000 units shipped in the quarter, Western Europe enjoyed growth of 3%, largely due to strong retail sales in France and Germany. Spain also had its best sales performance since 2011 with 33,900 projectors shipped during the last quarter of 2013. A decline in the UK’s under-represented retail market for projectors saw the country experience a 5% year-on-year decline in total sales in the final quarter.

The Middle East and Africa experienced modest 1% growth with 139,000 units shipped, due to education projects in Saudi Arabia and UAE failing to come to fruition. However, the MEA region remains a strong opportunity long term due to its low penetration.