The three countries under the spotlight in this month’s geographical focus – France, Belgium and Luxembourg – have long been pivotal players in Europe’s professional installation business.

More prominent on the world stage than at any time in the past 20 years – thanks in no small part to the publicity-attracting president, Nicolas Sarkozy – France (population 61.6 million) appears to be riding out the economic storm with more aplomb than many of its European neighbours. While the country’s recent financial statistics are nothing to get excited about – growth of just 0.14% was reported for the third quarter of 2008 – there is general relief that the economy isn’t actually shrinking.

France arguably has a more problematic relationship with the European Union following the public’s rejection of the proposed EU Constitution in a 2005 referendum, although the union remains at the heart of European social and political life. The country continues to enjoy creditable export levels, while there is little sign of the depressing large-scale job losses now afflicting many other Western European nations.

The outlook for Belgium (population 10.5 million) is more confused. The country’s economy continues to grow – albeit at unspectacular rates of 1-2% per year – but in political terms, the future has rarely been less certain. The sense of a divide between the primarily Dutch-speaking north and the mainly French-speaking south continues to grow, and was one of the factors contributing to an extended political impasse that followed the 2007 elections. A new administration finally took shape in March 2008, although that was not the end of the difficulties, with Prime Minister Yves Leterme stepping down just nine months later. His replacement was Belgian political mainstay Herman Van Rompuy.

Despite the present sense of stability, there are genuine fears that Belgium could ultimately splinter. In the shorter term, Van Rompuy and his colleagues are confronted with the unwelcome challenge of minimising the impact on the country of the global financial crisis and the recent bail-out of Belgian-Dutch bank Fortis.

Our triumvirate of nations is completed by Luxembourg. Possessing a population of only 467,000, the country is a compact dynamo at the heart of Europe and the EU – indeed, it is home to the European Parliament’s administrative offices, known as the General Secretariat. Politically, Luxembourg is very stable – Prime Minister Jean-Claude Juncker has been in the job since 1995 – and the economy continues to advance steadily. The fact that many of its people speak French, German and Luxembourgish (a dialect of German) underlines why the country is frequently perceived as a symbol of the wider European ‘project’ of greater integration.

Rewarding applications

As befits three countries whose business communities are often inextricably linked, it makes sense to take a collective approach to their installation markets – starting with the applications that are driving growth.

Control rooms, transport infrastructure, petrol stations, digital cinemas, simulation facilities, conference centres, health and fitness centres, supermarkets, restaurants, bars, clubs, arenas and stadia are among the high-performing applications cited by our featured interviewees, who run the gamut from lighting or audio suppliers to all-round integration and service providers.

Encouragingly, there is a general feeling that despite the worsening economic conditions (more of which anon), standards are continuing to rise across fixed install. For example, Luc Vandenbroucke, senior executive vice president of professional display and visualisation solutions provider Barco, depicts a market characterised by the increasing dominance of networking technologies, greater convergence of video and lighting, and a continuing trend in favour of digitisation.

Focusing in particular on Belgium and Luxembourg, Cédric Montrézor, head of installation support at France-based audio manufacturer L-Acoustics, points to growing demand for complete turnkey systems and “digital innovations such as system control and monitoring. We are responding to these market requests by designing and manufacturing complete systems rather than just being a loudspeaker manufacturer.”

Kris Vermuyten, operational, sales & marketing director of Belgium-based manufacturer Audioprof – best known for the APart brand – highlights the increasing number of requests for localised system control, multi-room audio and more compact loudspeaker designs. “Even though the fixed install audio market is a slow-changing [one], change is certainly going on,” he says.

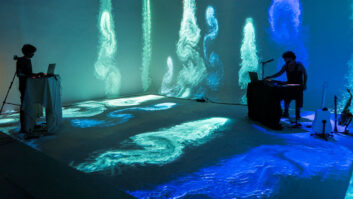

Benjamin Saint Girons, sales manager at show and media control technology company Medialon, suggests that “the most rapidly increasing market is for small to medium-sized projects, both in these countries and in Europe in general. That is the reason why we have designed an embedded low-cost show controller unit called SHOWMASTER.”

Merging Technologies is hoping to capitalise on the burgeoning replacement market with its forthcoming Ovation Media Server and Sequencer. “The overwhelming response from our current distributors has been that the replacement market for ageing audio/video media player equipment could have really good growth potential,” explains Dominique Brulhart, Merging’s head of software engineering. “This is where we step in with networkable, HD-capable, multi-format audio solutions, typically for integration in large installations currently standardising to new formats like MXF (Material Exchange Format) or AFF (Advanced Forensic Format).”

France-based loudspeaker manufacturer Nexo, meanwhile, is enjoying considerable success with its fourth-generation GEO array system, and in particular the GEO S12 series, which has been installed in a number of stadia, theatres and multipurpose venues. “For many of these installations we have been receiving very encouraging feedback as the final users quickly identified that by installing such a system they can now offer a wider scope of events in their venues then they had originally envisioned,” says Nexo’s marketing director, Joe White.

No one disputes the centrality of this region to European install, and indeed for many of our featured companies it is one that continues to have a fundamental influence on their overall business. For Barco, France, Belgium and Luxembourg constitute one of the most significant regions in Europe. Audioprof also derives an “important” part of its turnover from Belgium/Luxembourg but, says Vermuyten, “even more important is the feedback from this home market. It is this kind of feedback that helps us to develop new APart products that perfectly meet the demands of the customers and the people in the field. After all, they need to install the product!” The company says that it is also doing well in the French market, where it is represented by exclusive distributor Sennheiser France.

Public or private

It stands to reason that the health of any installation market is determined by the levels of both public and private investment. The past year has seen the credit river reduced to a stream, and with less assurance than at any time in the recent past about a return on new investment, it is unsurprising that an increasing number of privately funded projects are subject to delay.

Despite an impressive roll-call of recent installations – including an ongoing railway signalling centre project in Belgium, which entails a long-term collaboration with Siemens – Barco is among those companies bracing itself for a more challenging period.

“Instead of a growth we are expecting a decrease in 2009,” admits Vandenbroucke. “This applies particularly to the events market, where decisions are being delayed, and to the digital signage market, which is experiencing a decrease in advertising budgets. Having said that, control room and publicly funded projects seem to be less hampered.”

French console manufacturer Innovason currently has more leads and projects in the installation market than at any time since 2004. The recently launched Eclipse console is helping to drive this expansion, with sales & marketing director Xavier Pion characterising the overall situation for the company as “very encouraging”. Nonetheless, there is a recognition that both public and private institutions will need to hold their nerve and keep pushing forward with new projects if the installation market is to remain vibrant.

“In order to maintain growth within this sector, or indeed any business sector, the financial institutions will have to take the (calculated) risk of continuing to finance these projects,” counsels Pion.

Vermuyten predicts that the public sector will step up to help plug the investment gap. “Some companies will hesitate to invest in new AV equipment, but local governments will do everything possible to turn this situation around and will invest [more than ever] in public buildings, schools and infrastructure,” he says.

In terms of the private sector, Vermuyten hopes that the increased focus on price could bring more business for Audioprof’s APart brand. “People will compare [products] more often and brand name will be less important than value for money,” he says.

Future projects

While plenty of interviewees identify possible new opportunities arising from the current economic predicament, a lot of readers will no doubt be asking the question ‘Quite how bad might this get, then?’ It’s a tough one to answer, not least because substantial system purchases – for example, a sophisticated new lighting rig or audio console – are likely to have been mapped out months or even years in advance of installation. Consequently, activity levels in France, Belgium and Luxembourg show no signs of dipping for many suppliers and installers.

“The systems we deliver today were specified between one and three years ago, and the final purchase decision was made at least 12 months ago,” says Innovason’s Pion. “[Hence] we do not feel any impact of the economic situation… yet. However, the economy is not doing well and it will very probably affect the business to some degree, although it is very difficult to make any accurate forecasts.”

Merging’s Brulhart also suggests that it is too early to assess the potential impact of the economic downturn. “In both the broadcast and large-scale installation markets, most business decisions are taken with a longer-term perspective, and budgets don’t change radically from one day to the next,” he says. “To date, we haven’t noticed any dramatic decrease in our overall business due to the worldwide economic downturn – quite the opposite, in fact. However, like any other professional manufacturer in our industry, we are closely monitoring the market evolution and potential changes in market trends and needs to be prepared for possible future scenarios.”

L-Acoustics’ Montrézor, too, has concerns. Focusing specifically on Belgium and Luxembourg, he says that the company has “not yet perceived a downturn in the fixed installation market. However, there’s a worrying possibility that difficult access to financing for both private and public projects might delay projects or reduce budgets in the second half of 2009 and early 2010.”

Stéphane Guidetti, videowall project manager at French control room and display systems manufacturer/installer Lanetco, places current developments in a wider international context. “It is true that the global economic situation has frozen some projects in all countries,” he says, “although I think that companies are [confronting] this situation.”

Indeed, Guidetti sounds rather enthusiastic about the future, not least with regards to Lanetco’s plan to place a greater emphasis on security applications. “We definitely want to develop our business in the security market through our new IP processor, IPVision,” he confirms.

Other companies make similarly confident predictions, underlying the obvious but frequently overlooked truth that a surprising number of businesses continue to prosper in the most adverse of circumstances.

“For the industry this is an interesting period,” says Gerben van den Berg, sales manager Belgium, Netherlands & Luxembourg for Norwegian projector manufacturer projectiondesign. “If you don’t have the right added value for your customers, the chances [that] you will not survive in this slow market are huge. If, however, you are able to offer next to best product in the market, [as well as] good pre-sales and after-sales, you will find many new customers. It is all about keeping your focus on your core business and giving the customers the right attention.”

Nexo’s White says that there could be a downturn in the number of installations being completed in the later quarters of this year. However, he notes: “For 2010 we are seeing a [considerable] amount of medium and large projects where Nexo will have a very high chance of being specified for providing the sound reinforcement solution.”

There is no doubt that the installation business is set to pass through a more problematic period, and France, Belgium and Luxembourg will not be immune to this process. However, the combination of investment-friendly public sectors and a raft of experienced suppliers, distributors and installers suggests that the impact could be considerably less pronounced than in some other European markets.