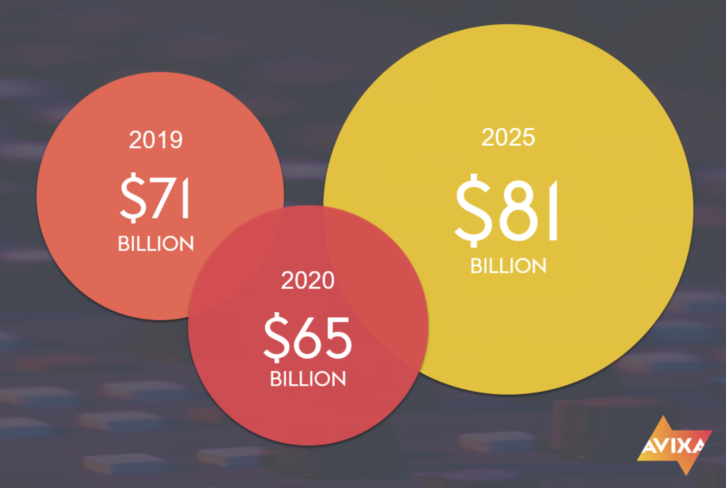

The EMEA pro AV industry is set to fall by nine per cent in 2020, declining to $65 billion from $71 billion in 2019, according to new forecasts from trade organisation AVIXA.

The report, entitled 2020 AV Industry Outlook and Trends Analysis (OTA) EMEA Summary, forecasts recovery for the region in 2021, with revenue set to return to its 2019 level in 2022, hitting $71.5 billion. This growth is expected to continue, growing to $81 billion in 2025.

“The pro AV industry and economies at large are reeling from the effects of COVID-19. The pandemic has broadly impacted the near-term and longer-term outlooks for economic growth and business activity in the EMEA region, spurring reductions in our forecast,” said Sean Wargo, senior director of market intelligence, AVIXA. “But recovery is in sight. Growth for pro AV in EMEA will far exceed the expansion of the regional economy, with the industry growing in the range of 5.1 per cent to 4.8 per cent in the coming years.”

Western Europe leads pro AV revenue for EMEA, with 39 per cent of the regional revenue – a share that will largely hold steady through 2025. Western Europe is forecast to hit $25.3 billion in 2020 and reach $30.6 in 2025. The smaller Sub-Saharan Africa market will generate the strongest growth in the region, with a six per cent CAGR from 2020-2025, growing from $1.7 billion to $2.2 billion during that time. The Central European pro AV market is set to expand to $12.5 billion in 2025, rising at a CAGR of 5.8 per cent from $9.4 billion in 2020.

In EMEA, the media and entertainment market stands out among the pro AV industries for its relatively strong performance during the COVID-19 crisis, with revenue declining by only 5.6 per cent in 2020 and rising by 8.5 per cent in 2021. The consumption of digital content from mobile apps to TV and gaming has sharply increased during the pandemic. This gives rise to production, storage, and distribution equipment, software, and services.

You may also be interested in:

- AVIXA: Americas pro AV biz to drop to $86bn in 2020, rising to $95bn in 2022

- INFOGRAPHIC: How many jobs does the live events biz provide per performance

- AVIXA confirms mass redundancies, says it doesn’t know when trade shows will return

- Free AV industry recruitment site launches in response to COVID-19 redundancies

- ISE 2021 at ‘low risk’ of COVID-19 says WHO

In the era of increased cyberthreats and nationalistic outlooks, the military and defense industry is expected to invest heavily in pro AV technology in the mid-to-long-term, driving growth from $3.6 billion in 2020 to $4.4 billion in 2025. Government and military, education, and corporate will generate the most demand for security, surveillance, and life safety solutions during the short and long terms as they seek to update their infrastructure to handle the needs of monitoring and responding to the pandemic.

Digital signage growth will be driven by an increased need for on-premise and out-of-home (OOH) communications, especially for security and new health protocols. The functionalities of digital signage merge with those of surveillance and security. This is applicable to both employee-facing and customer-facing situations. For example, surveillance cameras already in place will be augmented by AI, software, and displays and used for business analytics for assessing customer journey, tracking, and heat-mapping.

Looking at the ranking of pro AV solutions in EMEA from 2020 to 2025, conferencing and collaboration leads the region thanks to the prevalence of work from home. Revenue will increase at a CAGR of 2.6 per cent during this time. Spending will continue to increase in this area as legacy infrastructure gives way to the cloud. Cloud traits such as flexibility, scalability, ease of use, and cost effectiveness will help drive collaboration in the short- and long-terms.

The IOTA report is produced by AVIXA in conjunction with Omdia (formerly IHS Markit), a global research firm with expertise across a number of underlying supply chain markets, many of which overlap with the principal components of the pro AV industry. This specialisation provides connections with manufacturers, distributors, integrators, and larger end user firms that provide and consume pro AV products and solutions. This translates into sources of data that are modeled in conjunction with key macroeconomic data to generate the forecasts shown.

To learn more about the 2020 AV Industry Outlook and Trends Analysis (IOTA) EMEA Summary, visit www.avixa.org/IOTA.