The installation markets of Eastern Europe have been seriously affected by the economic downturn, with a clear slowdown in large projects. However, most stakeholders are upbeat about the prospect of a slow-motion recovery in the later stages of 2010. David Davies reports.

The manufacturer, distributor, integrator or, indeed, AV technology journalist seeking to comprehend the markets of Eastern Europe has one important obstacle to overcome before any progress can be made. Simply: what exactly do we mean when we use the term ‘Eastern Europe’? At the risk of making a colossal understatement, the region is the subject of varying definitions. Some highlight a mere five or six countries as constituting Eastern Europe, while others identify 10 or more nations.

Without embarking on an extended history lesson, it would be fair to say that numerous social, political and economic factors have shaped these contrasting definitions. Ultimately, it is hard not to concur with the Global Perspectives site run by the Center for Educational Technologies when it asserts that “there are almost as many definitions of Eastern Europe as there are scholars of the region”.

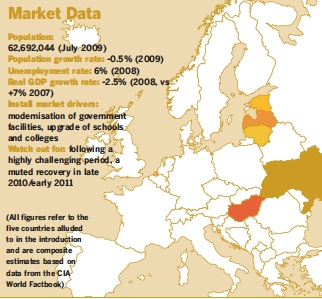

In lieu of a concrete definition, IE opted to focus on five countries that have generally dominated installation sector headlines in the region, and which have otherwise been absent from our recent market overviews, namely: Estonia, Hungary, Latvia, Lithuania and Ukraine. Despite longterm problems (not least high unemployment and debt levels), all five have attracted extensive analysis of their pro-AV potential in recent years. Given the generally challenging economic conditions, this should be an interesting time to take stock.

Market influences

On a scale of 1 to 5 (1 = very low, 5 = very high), the general level of confidence in the region’s overall installation business at this time averaged out at 3. Half of respondents felt that confidence levels were unchanging, while 30% suggested that they were currently falling.

Focusing more firmly on their own interests, 80% of respondents expected their activity levels in the installation sector to decrease in calendar year 2009. Among this group (excepting one respondent who did not offer a percentage), the average predicted decline was 33.3%.

Elsewhere, only 10% forecasted an increase in their installation interests prior to 2010.

IE then put a series of eight factors to its interviewees and asked them to assess on a scale of 1 to 8 (1 = little or no importance, 8 = very significant) their relative impact on the installation business per se.

Not surprisingly given the arduous financial situation in many Eastern European countries of late, economic circumstances was the clear-cut leader on an average of 6.5. The important contribution made by governmentinitiated installation projects was reflected by an average score for this factor of 6.2, while technological developments completed the top trio on 4.9. Green issues proved to be the least significant factor overall, registering an average of just 2.4.

Future days

Participants were then asked to rank the relative importance of five factors in terms of the effect they are likely to have on installation customers’ requests over the next couple of years.

Once again, the prevailing economic conditions mean that the identities of the two factors judged to be most important on a scale of 1 to 5 (1 = little or no impact, 5 = very significant impact) – total cost of ownership and keener pricing – are unlikely to be greeted with amazement. Perhaps indicating that networked solutions have yet to reach a tipping point in the Eastern European markets, networking capability trailed the field on an average of 2.5.

IE then asked its interviewees to consider four up-and-coming technologies and determine which one is likely to enjoy the greatest success in the short- to mid-term future. Unlike previous surveys, there was at least one vote for each of the four technologies, but ultimately there was another emphatic winner: audio-video bridging over Ethernet garnered a robust 60% of the vote.

Defining projects

IE rounded out the survey by asking participants to nominate the project areas and even specific projects (not necessarily ones in which they have been involved) that have defined the market during the past 12 months.

The sprawling nature of the region means that this is easier said than done, although even on a country-bycountry basis it is no mean feat. As Uldis Jaudzems, director of Latviabased AV integrator and supplier BIROTEH, observed: “In our country, the installation project market is rather fragmented and therefore it is difficult to speak about key/headline projects.”

Nonetheless, our participants did suggest a raft of general install types • including interactive whiteboards in schools, conference facilities, sports arenas, meeting rooms, residential properties and government facilities – that are helping to shape the market.

A number of more specific examples were also offered, among them a 60- plus speed camera installation in Lithuania, the reconstruction of the Liszt Ferenc Music Academy in Hungary, and more development work at the Lithuanian Exhibition and Convention Centre (LITEXPO).

In gratifying news for Integrated Systems Events, a number of participants who responded to a question about the key events that had shaped the past 12 months alluded to Integrated Systems Europe the next edition of which, of course, takes place at the Amsterdam RAI on 2-4 February.

IE concluded the survey by asking interviewees to consider whether there were any measures that could be taken by installers, manufacturers and official bodies/governments to ensure the future growth of the installation business in Eastern Europe.

A flurry of responses was forthcoming. “Investments in the building industry,” suggested Algirdas Sidiskis from Lithuania’s Audiotonas, while Jaudzems said that “installers and manufacturers should educate the market, while official bodies/government should place more emphasis on integrated AV technologies.” The general area of training and education was also picked up on by Serge Philippo, sales manager Eastern Europe & Russia at control technology giant Crestron.

“Integrators will be able to realise more projects if they have welltrained staff with technical and product knowledge,” he said.

In what may prove to be a rather more difficult request, there were also several calls for greater political stability. For example, Thomas Csernus from audio distributor Bluesound observed: “From a Hungarian point of view, we need a stable government with less politics getting in the way. That will help to ensure the future growth of the market.”

Last but certainly not least, there was a call to address problems pertaining to perceived corruption. “This is a huge problem in Eastern Europe,” said Einars Cintins from Latvian AV services provider Skatuves Sistemu Serviss. “The way that some tenders are organised needs to be changed. This would help to prevent, for example, a building company putting 50% on top of the list price! We also need a new kind of association to implement new regulations that would ensure only certified and educated people could create and supervise installation projects.”

Summary

As the estimated real GDP growth total cited in the Market Data box indicates, Eastern Europe has undergone profound economic turbulence during the past 20 months. Inevitably, this has dampened market confidence and put the brakes on many large-scale projects. Despite this, most participants alluded to a string of ongoing, future or possible projects, and appear to have confidence in the underlying fundamentals of the regional business. Ultimately, as with so many other territories at present, 2010 is likely to be a year for continued hard work and – to put it bluntly – hoping for the best.