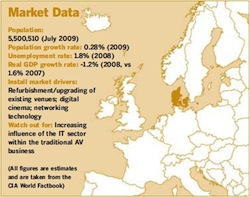

Many installations have been put on hold as Denmark confronts the effects of the global economic downturn. Despite this, general levels of business confidence remain high, as David Davies discovers.

Politically and economically, 2009 has been a highly eventful year for Denmark. After months of speculation, April saw the country’s Prime Minister of eight years – Anders Fogh Rasmussen – tender his resignation to seek the job of NATO Secretary-General, a position he assumed at the beginning of August.

Simultaneously, new PM Lars Lokke Rasmussen (no relation) has taken leadership of a coalition administration comprised of centreright- liberal party Venstre and the Conservative People’s Party. As a previous minister of finance, Rasmussen is surely as well prepared as anyone to deal with the challenges of an economy that has lost its shine during the past 18 months. Regularly said to host Europe’s most flexible workforce, Denmark has generally derived a significant portion of its wealth from international investment – a quantity that, for obvious reasons, has been in rather shorter supply of late. As the global markets have fluctuated, so have confidence levels across business communities – with the predictable result that many new construction projects or developments have tended to be the subject of delays or downsizing.

It certainly isn’t all bad news – in particular, unemployment remains very low in comparison to many other European nations – but, for now at least, the years of consistent 2-3% GDP growth seem to be a thing of the past.

IE’s survey of Danish installers, distributors, manufacturers and consultants captures some of the uncertainty inherent in the present climate, but nonetheless suggests that many of the foundations underlying the country’s installation business remain rock solid.

Market size

Survey participants were asked to assess the general level of confidence in Denmark’s professional installation sector on a scale of 1 to 5 (1 = very low, 5 = very high).

Encouragingly, the average score was 3.5, with 63.6% of respondents arguing that levels of confidence in 2009 are on a par with those last year; nobody felt that confidence was in decline.

Turning to contributors’ own professional installation interests, 63.6% expect their installation interests to increase in the current full-year. While not all were willing/able to suggest a precise percentage, the average among those who did was for a 17% increase. Only 27.3% predicted a decrease in activity levels, with the average drop coming in at 25%.

Next, IE documented a series of eight factors and asked participants to rank their relative importance in determining the health of the Danish professional installation business. In contrast to some recent surveys, this generated an impressive range of responses; for example, legal/ compliance issues received rankings all the way from 1 to 8 (1 being least or no importance, 8 being most importance). Ultimately, the three most important factors were judged to be national/international economic circumstances, government/spending taxation and technological developments.

Participants were then asked to rank a series of five factors in terms of the influence that they are likely to exert on installation customers during the next two to three years. Total cost of ownership and futureproofing tied for the position of most important factor, with maintenance contracts at the bottom of the table.

The final area of specific enquiry concerned the technologies that are set to experience the greatest rate of market adoption and acceptance in the near future. Following the emphatic endorsement of 3D by the Russian installation community (see IE Nov 09), their Danish peers voted overwhelmingly (80%) in favour of audio-video bridging over Ethernet, although it should be noted that one contributor declined to comment. Interestingly, several participants suggested that digital cinema should also be on the list.

Notable projects

As previously indicated, there has been a tendency towards the postponement or downsizing of many larger installations, and this is reflected in a rather limited list of specific projects nominated by our contributors (who may or may not have been involved in them).

“In the past 12 months, there haven’t been many major new building projects,” says Soren Jorgensen, product manager and part-owner of BICO Professional. “What has taken place is a great deal of modernisation and renovation.” By way of example, Jorgensen cites BICO Professional’s own involvement in a networking and dimming upgrade at the Aalborg Kongres & Kultur Center.

There was also a mention for Informationsteknik Scandinavia’s integration of a DIS conference system at the EU Committee Meeting Room inside the Danish Parliament building, while several respondents alluded to the DR Concert Hall in Copenhagen. MOTO Audio Sales and Informationsteknik Scandinavia were among the companies involved in the latter project, which featured a striking design by architect Jean Nouvel and was opened to the public in a flurry of acclaim at the start of this year. (An article focusing on MOTO’s installation of an L-Acoustics loudspeaker system at this venue appeared in the June 2009 issue of Installation Europe.)

IE concluded its Danish investigations by asking its contributors what, if any, measures could be taken by installers, manufacturers and official bodies/government to ensure the future growth of the installation business in Denmark. As ever with this section of the survey, an eclectic array of responses was forthcoming.

“There needs to be more focus on green technologies. That’s a very important factor for the future of the business,” suggested Jorgensen, while Neets’s Signe Vognsen de Vos called for “more investment in schools and the education sector”.

Informationsteknik Scandinavia’s Jesper Rosgaard, meanwhile, urged the established installation community to acknowledge the increasing influence of IT companies in the professional AV sector. “The traditional AV business will suffer from IT companies moving into this area,” he predicted. “AV companies must face this challenge and [ensure that they] benefit from the advantages of IP-addressable hardware. AV companies must also think about redesigning [existing products] and developing new ones.” Martin Professional’s sales manager for the Nordic region, Jonas Stenvinkel, said that there was a need for everyone “to provide solutions that can add value for the end customer.

For example, we are focusing a lot of our efforts on solutions for theme parks and shopping/retail.” VisionLine’s technical manager, John Norup, highlighted the need for both manufacturers and installers to ensure effective communication to customers. “There should be more focus on the advantages and benefits of systems – in other words, ‘What is in it for me? What do I get from this as a customer?’ It does concern me that sometimes customers won’t be able to understand the benefits of a particular system,” he said.

Summary

Like so many of the other countries to feature in recent market focus articles, Denmark is undergoing a degree of turbulence unparalleled in its recent history. In truth, no one can be quite sure when the installation sector will begin to regain its former lustre, although several interviewees did indicate their belief that (as of November 2009) the market is beginning to pick up.

Whatever timescale ultimately comes to pass, the country’s broadly based installation community and history of large-scale public and private projects – not to mention its stakeholders’ evident levels of confidence and determination – must bode well for the long-term future.