Audinate has offered just over 17 million shares in an IPO (initial public offering), which was floated on the ASX (Australian Securities Exchange) on Friday morning.

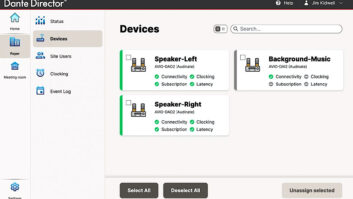

Coincidentally, the offer went public a few hours after Audinate collected the Grand Prix at the InstallAwards last night (pictured left to right are: Kieran Walsh and Joshua Rush of Audinate, and Roland Hemming of RH Consulting who presented the award).

The company has raised A$21 million ($16.1 million) from the offering, which values the company at A$72.6 million ($55.4 million). The shares were floated at A$1.22 each, rose to A$1.53 after the first day’s trading.

Documents posted by Audinate ahead of the offer revealed that over 20% of its revenue in the 2016 financial year came from its largest, customer Yamaha Corporation. Yamaha now owns approximately 10.2% of the company’s issued capital, making it the third largest shareholder.

The two biggest shareholders are venture capital firms Starfish Ventures and Innovation Capital Partners, owning 25% and 15.6% respectively. Audinate senior management including CEO Lee Ellison, CTO Aidan Williams and COO David Myers also have stakes ranging from 3.8% to 2.4%.

It was reported in the Australian Financial Review that Audinate’s workforce is expected to increase by 50% over the next year. Additionally there will be research and development investment for new software allowing authenticated security and control over audio networks.