Now that Prime Minister Theresa May has triggered Article 50, our UK country survey asks some questions about the effect of Brexit on the installation sector.

There’s one issue affecting the installation market in the UK that is unique among those we survey: the country has officially handed in its notice to quit the EU. So we decided to ask our selected group of readers about Brexit and their business.

First, though, let’s look at a couple of broad-brush measures for the sector. A significant majority of respondents felt that confidence levels were the same as six months ago – with ‘higher’ being the next most popular answer. Around two-thirds of our sample expected their company’s revenue to grow over the next 12 months.

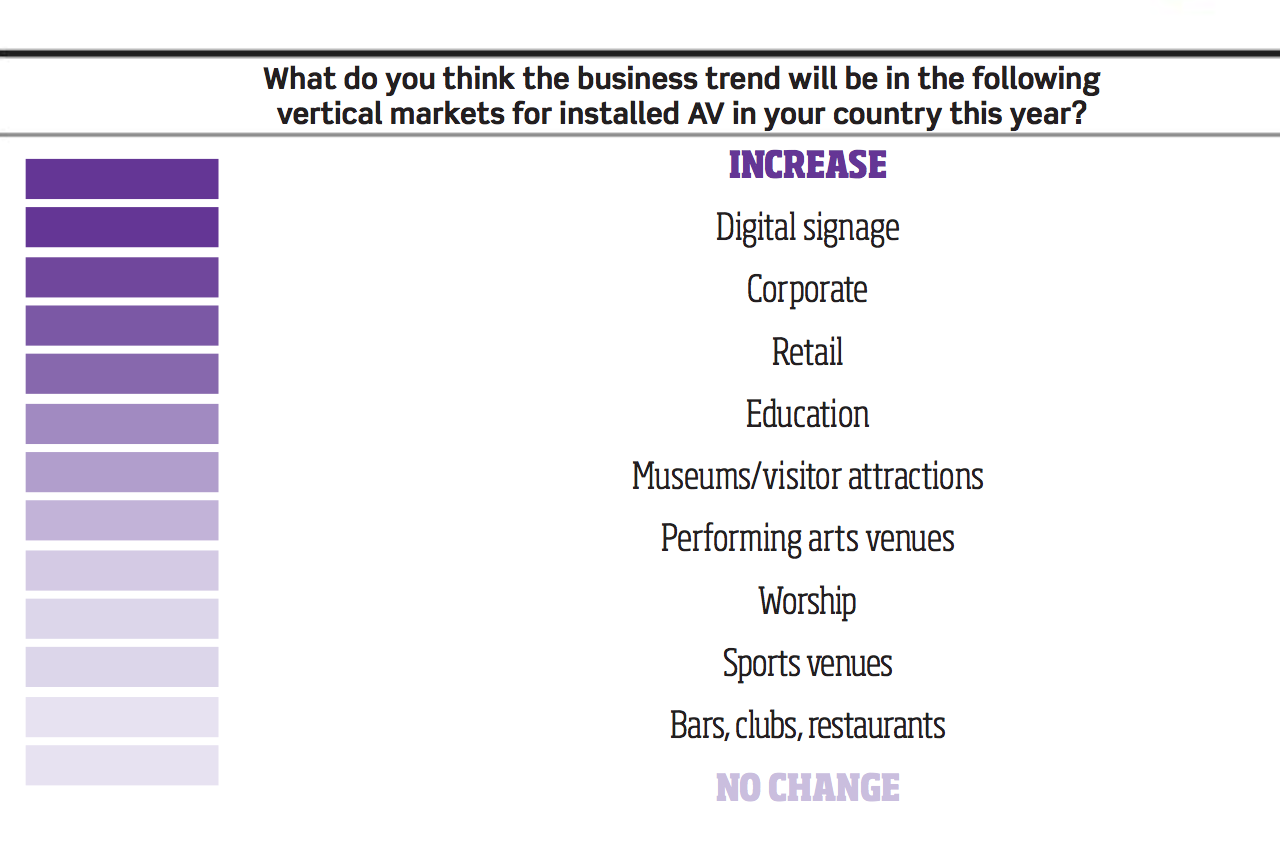

We also asked our respondents about what they thought the business trend would be this year across a number of key verticals. The results yielded no surprises: digital signage, corporate and retail headed the list, while growth expectations were muted for hospitality, sports venues and houses of worship.

Now, Brexit. Around two-thirds agreed, or strongly agreed, with these two statements: ‘Many product prices have risen as a direct result of the weaker pound since the Brexit vote’, and ‘Overall project costs are increasing as integrators pass on product price rises to their clients’. (For both of these, ‘neither agree or disagree’ was the next most popular response.)

We wondered if this pressure on prices was having an effect on the equipment specified in projects, so our next statement was ‘Rising product costs have led to more affordable brands being specified in installation projects’. Responses were more varied here – in fact they were split roughly equally three ways between ‘agree’ or ‘agree strongly’, ‘disagree’, and ‘neither agree nor disagree’. So it seems fair to conclude that higher-end brands are suffering, to a limited extent, in the UK currently.

Other thoughts about Brexit were about the present situation and the recent past, rather than speculation about the future. “Our biggest concern as an integrator is sterling weakness and steep inflation in the products that we provide,” said Graham Cording, MD of Smart Presentations. Another respondent said that, following a period of indecisiveness over projects after the referendum result last June, “the market seems to have recovered somewhat, but project costs have increase due to sterling devaluation hitting imported equipment.”

So at this stage, it seems that the UK installation market craves a strong currency and clarity about the future, so that decisions can be taken with confidence. However, with a general election in the offing, and the two-year Brexit negotiation period just starting, it remains to be seen if the market will get its wish.