Our survey of the Swedish installed AV market finds fewer reasons for optimism than the corresponding Danish survey last month.

In contrast to the mood of optimism in our survey of the Danish market last month, the overall sentiment of our Swedish installed AV market survey is rather more subdued.

The vast majority felt that general levels of confidence in the country’s installation sector were the same as six months ago – with the small minority split roughly equally between ‘higher’ and ‘lower’. As we often find in these surveys, though, the mood was more positive when we asked our respondents about their own prospects – how their company’s revenue would change over the next 12 months. ‘No change’ was the most popular single answer, but only a slightly smaller number were predicting growth.

When we asked our respondents to choose, from a list, the business issues causing them most concern, the clear leader – as we find so often – was ‘clients going for lowest price rather than best value’.

“An increasing number of manufacturers are concentrating on web sales,” said one respondent. Another laid the blame squarely at the door of those who deal with public tenders: “Government business only goes on price, and they usually purchase a system in poor working condition. This is mainly due to incompetence in the evaluation of tenders.”

There was less unanimity when we asked whether the total number of players in the Swedish installed AV market was increasing or decreasing. Just under half felt that numbers were rising: “It’s an attractive area to work in,” said one integrator. However, a few felt that the trend was in the other direction: “Too many companies have got too big,” was one comment offered here.

We also asked what our respondents would like to change about the installed AV market in Sweden. “Increase competence,” was the blunt wish of one respondent. Another wanted to see “more knowledgeable consultants, and purchasers asking for qualified AV integrators”.

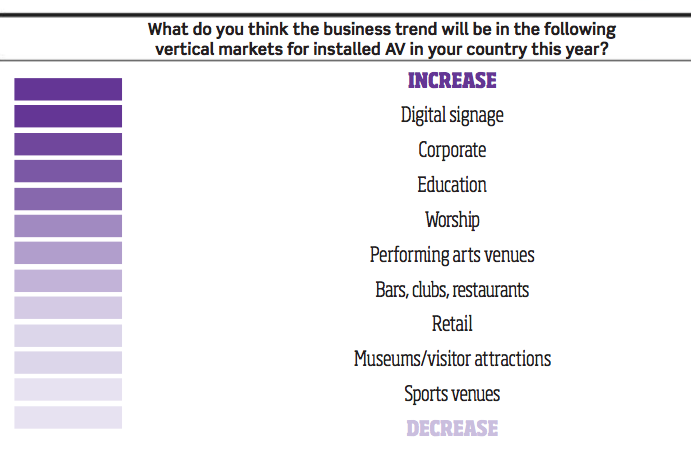

If those answers were perhaps a little familiar, the same can’t be said for the predicted business trends in various vertical sectors. Overall, there was a greater degree of pessimism than in our Danish survey last month, with more verticals predicted to be static or falling than predicted to rise. But there were some surprises in the expected performance of certain sectors: retail, and sports venues polled surprisingly low compared with most countries we’ve surveyed recently, while worship did well.