A 2017 World Bank survey found Norway to be the eighth easiest country in the world to do business with – one place behind the UK. But is its AV installation market similarly smooth-running? Our latest country survey finds out.

The majority of respondents to our survey into the Norwegian installed AV market were either optimistic or equivocal on most of the questions we asked them; unusually, there were very few signs of pessimism in the answers we received.

A little under half of our survey thought that general levels of confidence in the country’s industry were on a par with what they were six months ago, while a slightly smaller proportion believed them to be higher. There was a similarly bright outlook when we asked them how they felt their own companies were faring: around two-thirds believed that their revenues would rise by up to 5% over the next 12 months.

Asked to choose from a list of issues the one that was of most concern to their businesses, the most popular choice – as it tends to be in most of our country surveys – was ‘clients going for lowest price rather than best value’. “The trend today – being compliant with the spec – is that just price counts,” said one respondent. ‘Poorly qualified newcomers distorting the market’ was the second most popular choice from our list of six issues, which cover matters financial, technological and competition-related.

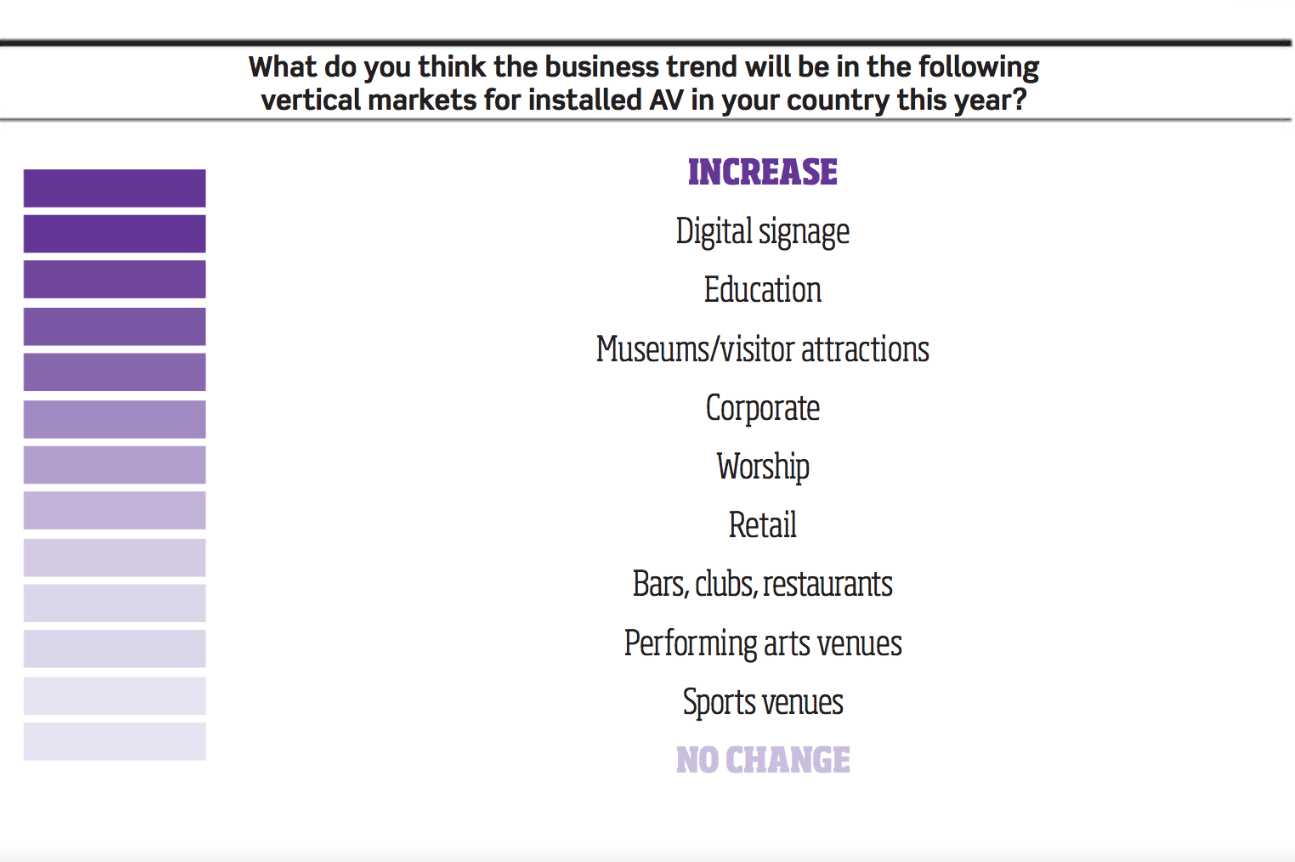

Nothing too unusual so far, but we had some less predictable answers when we asked about vertical market trends. Digital signage often tops the list in these national polls; but houses of worship and museums and visitor attractions both performed more strongly than is often the case (see below). Conversely, sports venues, which generally do well, came in at the bottom of the list; however, it should be noted that despite this low placing, the sentiments expressed for this vertical averaged out fairly close to ‘no change’.

Turning now to the number of players active in the market: the majority of respondents thought this was not changing. One of the minority who thought the numbers might be decreasing gave their reasoning as follows: “We might be looking at fewer and bigger companies. The key factor will be IT competence and involvement of the client’s IT personnel.”

We had a range of responses when we asked respondents about the one thing they would change about how the Norwegian install market works. A consultant hoped for an end to “building and electrical contractors cutting corners”. And finally, a distributor suggested that “the specifier should also carry out post-installation testing!”