There’s much to admire in the Danish economy, including a high credit rating and low levels of income inequality. How does its installed AV business stack up? Our latest survey finds out.

There’s a strong sense of optimism coming from our latest survey of national installed AV markets. A strong majority of respondents to our survey from Denmark felt that market confidence was stronger there than six months ago. There was also a similar sentiment when it came to predicting their own companies’ financial performance: the most popular response selected from those offered was a growth figure of more than 5%, with a smaller amount of growth being the next most popular answer.

That’s not to say that our survey revealed no concerns in the market. The issue causing concern to the greatest number of respondents was ‘falling margins’, with ‘poorly qualified newcomers distorting the market’ and ‘clients going for lowest price rather than best value’ also being mentioned. On the last point, Peter Maier, product and solution manager at distributor DTK Audio and Visual, commented: “Even if there are a few companies going for quality, it is the lowest price that counts.”

Anders Jørgensen, a projects executive at integrator Stouenborg, mentioned another issue that causes worry, centred around skills shortages. “We are in a success period where we need to say no to jobs in order for us to maintain quality. There are not enough skilled technical persons to hire in Denmark,” he said.

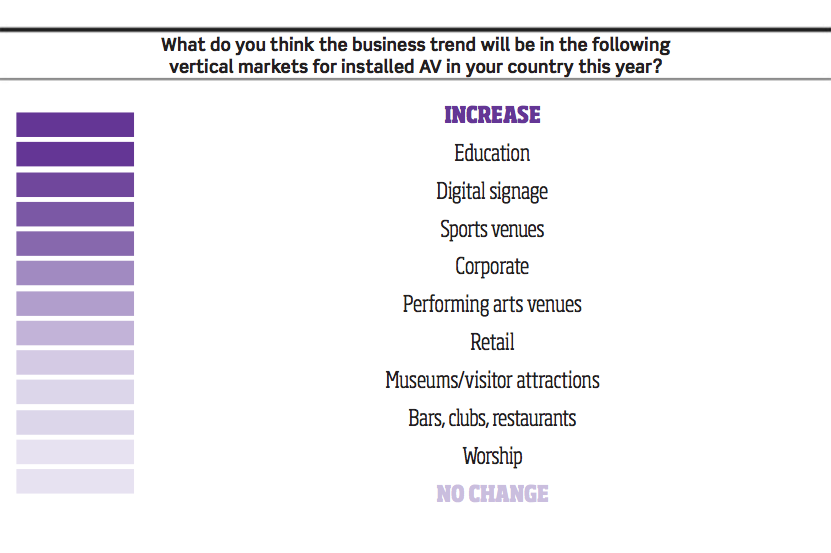

When we asked our respondents to predict growth trends across various sectors, a pattern emerged that was broadly similar to that in other surveys: education and digital signage led the field (although, unusually, sports venues edged corporate into fourth place); at the other end of the scale, worship and bars, clubs & restaurants were felt to be static as far as growth was concerned.

Turning now to the size of the market, our survey was roughly equally divided between those who felt the number of active companies was falling and those who thought it was growing. Electrical contractors broadening their offering was one reason cited by some in the latter camp.

We also asked our respondents about what they would like to change about their country’s installation market, if they could. Government spending is often mentioned as an answer to this question, and so it was here, with some wishing that budgets could be increased. Another comment was the desire for education programmes targeted specifically at the audiovisual sector.